marketofchoice.ru Learn

Learn

Reputable Online Gambling Sites

These sites are top of the line for player safety, bonus opportunities, game selection, and banking compatibility. BetMGM belongs at the top of any list of best online casinos. They are the country's most popular online casino app, with online casino sites in West Virginia. Which Gambling Sites Are the Best? · Bovada – Best Overall Gambling Site · DuckyLuck – Best Online Casino · BetUS – Best Online Sports Betting Site · Ignition. As of June , marketofchoice.ru is the most visited Gambling website in the World, attracting M monthly visits. marketofchoice.ru follows with M visits. 1. BetMGM Casino - Best Rated, Outstanding Choice (5/5) · 2. Caesars Palace Online Casino - Excellent Casino Bonuses (/5) · 3. DraftKings Casino - + Slot. BetMGM Casino is among the best overall online casinos in the United States. It offers a large, diverse range of high-quality games from a broad pool of. Check our updated list of safe online casinos for Explore the most trusted casino sites with fast payouts, generous bonuses. best of the best first-class online casinos crafted to your desired specifications. When you click through to read a review examining the site in detail. Uncover real money online casinos and experience the best from BetMGM, FanDuel, DraftKings, and more! Enjoy favorites for games such as slots and blackjack. These sites are top of the line for player safety, bonus opportunities, game selection, and banking compatibility. BetMGM belongs at the top of any list of best online casinos. They are the country's most popular online casino app, with online casino sites in West Virginia. Which Gambling Sites Are the Best? · Bovada – Best Overall Gambling Site · DuckyLuck – Best Online Casino · BetUS – Best Online Sports Betting Site · Ignition. As of June , marketofchoice.ru is the most visited Gambling website in the World, attracting M monthly visits. marketofchoice.ru follows with M visits. 1. BetMGM Casino - Best Rated, Outstanding Choice (5/5) · 2. Caesars Palace Online Casino - Excellent Casino Bonuses (/5) · 3. DraftKings Casino - + Slot. BetMGM Casino is among the best overall online casinos in the United States. It offers a large, diverse range of high-quality games from a broad pool of. Check our updated list of safe online casinos for Explore the most trusted casino sites with fast payouts, generous bonuses. best of the best first-class online casinos crafted to your desired specifications. When you click through to read a review examining the site in detail. Uncover real money online casinos and experience the best from BetMGM, FanDuel, DraftKings, and more! Enjoy favorites for games such as slots and blackjack.

Payouts at CoinPoker tend to peak at around 99%+ and like many other high paying casino sites, it's the table games that have the highest RTP rates. The cashier. CardsChat is the world's most helpful gambling community online. Since , we've gained a loyal following of hundreds of thousands of poker players and. Your user experience will vary, but it depends largely on your aesthetic preferences. DraftKings, FanDuel, BetMGM, Caesars, Fanatics, BetRivers, Hard Rock Bet. Betway is a new online casino in many states, one of the few international brands that made it all the way from Europe. Americans who give Betway Casino a shot. Our experts find the best online gambling sites in the USA for ! Discover top-rated casinos, sports, poker and sweepstakes here. List of US Gambling Sites ; 1. Playstar Casino. Established ; 2. bet Casino. Established ; 3. Hard Rock Bet Casino. Established ; 4. BetMGM Casino. Some of the most trusted and reputable online casinos include Bet, Casino, LeoVegas, and Betway. These platforms are known for their. If you're looking to start playing at the leading online casinos in the US right now, then we recommend FanDuel Casino. FanDuel offers a plethora of real money. 1. Avoid Getting Scammed and Quick Payouts. Using a legit site to gamble removes the possibility of you getting scammed. Online Casinos for Real Money Available to US Players · 1. Caesars Palace Online Casino: Best Rewards Program · 2. BetMGM Casino: Best Real-Money Progressive. Best Online Gambling Sites · 1. FanDuel Casino · 2. DraftKings Casino · 3. Caesars Palace Casino · 4. BetMGM Casino · 5. Golden Nugget Casino · 6. BetRivers. Online Casinos ✓ Casinos ranked by the awarded world's best casino website ✓ Find top online casinos to play at! Online gambling is the act of placing wagers on risk-based games for the chance of winning money. Sports matches, casino games and popular card games like poker. Some of the most trusted and reputable online casinos include Bet, Casino, LeoVegas, and Betway. These platforms are known for their. SlotsAndCasino is an online gambling site that offers players a wide variety of casino games, including slots, table games, video poker, and more. Founded in , BetMGM stands out as our top online casino. Featuring an extensive gaming library, including live dealer games, slots, table games and even. Recently reviewed companies ; Spassino Casino · · reviews. Betting Agency·Online Sports Betting Vendor·Casino·Online Casino or. Founded in , BetMGM stands out as our top online casino. Featuring an extensive gaming library, including live dealer games, slots, table games and even. Wild Casino has been placed as the best New York Online Casino because it provides the best overall experience. Fully licensed by reputable iGaming hubs in. In , FanDuel expanded its empire by gambling on the online casino industry. This online casino is one of the largest, and is one of the best online casino.

Who Is Investing In Gold

A CIO may consider allocating to gold for several objectives: inflation and/or low-growth protection, diversification, and volatility spikes. This guide is packed with must-read information and advice on how to invest in gold coins and bars, including why buy gold, where to buy gold and storing gold. Gold has significant volatility alongside competitive returns, making it a potentially attractive option for both traders and investors. What are gold investment funds? Gold investment funds can be a good alternative to buying physical gold if you think the latter may be too much hassle. This. Investment gold is exempt from VAT, so it can be treated as a currency, not a raw material. For this reason, more and more often it is considered as a form of. Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. Gold has long been touted as the world's safe-haven metal, thought to help protect investors against inflation and economic downturns. One way to invest in gold without physically owning it is to opt for a specialist fund, investment trust or exchange traded commodity (ETC). Like other Exchange. Investors may pay a premium over the spot price of gold. The gold is physically held by a third party, not Morgan Stanley. A CIO may consider allocating to gold for several objectives: inflation and/or low-growth protection, diversification, and volatility spikes. This guide is packed with must-read information and advice on how to invest in gold coins and bars, including why buy gold, where to buy gold and storing gold. Gold has significant volatility alongside competitive returns, making it a potentially attractive option for both traders and investors. What are gold investment funds? Gold investment funds can be a good alternative to buying physical gold if you think the latter may be too much hassle. This. Investment gold is exempt from VAT, so it can be treated as a currency, not a raw material. For this reason, more and more often it is considered as a form of. Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. Gold has long been touted as the world's safe-haven metal, thought to help protect investors against inflation and economic downturns. One way to invest in gold without physically owning it is to opt for a specialist fund, investment trust or exchange traded commodity (ETC). Like other Exchange. Investors may pay a premium over the spot price of gold. The gold is physically held by a third party, not Morgan Stanley.

Why Buy Gold? 10 Reasons to Invest in Physical Gold · It can Protect Against Inflation Risks · A Good Way to Save Money for Future · Easy to Buy and Very Easy. Gold can therefore be beneficial in preserving wealth and limiting downside risk, but typically offers lower returns when stocks are doing well. Bullion can allow you to use your investments in Gold and Silver as both a defensive tool against uncertainty and an offensive profit when other investments. A portfolio of precious metals is best secured when diversified. For beginners, silver or gold may be the best place to start. Per ounce, silver tends to be cheaper than gold, making it more accessible to small retail investors who wish to own the precious metals as physical assets. With a DEGIRO account, there are several ways that you can invest in gold. As an online broker, we do not offer physical gold investment, but you can invest in. Gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and. You can either buy physical gold like bars or gold coins, invest in gold mining company stocks or a gold exchange-traded fund, or ETF, or buy into gold futures. Physical gold can also be bought through a bank or, perhaps more commonly, through bullion dealers. Along with the up-front charges, when buying gold, it is. The most common way to invest in physical gold is to purchase gold bullion. Gold bullion refers to investment-grade gold, commonly in the form of bars, ingots. Unlike more traditional investments like equities, fixed income, or real estate, gold doesn't produce anything and it doesn't pay dividends. Investing in gold can offer portfolio diversification and an alternative to stocks and bonds. There are several ways to buy gold and other precious metals. Proponents argue that gold can hedge your portfolio against market declines, steady it during market volatility or protect your purchasing power. This guide will help you start investing money in the gold market. We'll explore all the ways you can invest in gold and discuss their pros and cons. We can show you clearly how to buy the most trusted form of gold in the world, at the best prices, and in the safest, easiest way. Gold investment can be done in many forms like buying jewelry, coins, bars, gold exchange-traded funds, Gold funds, sovereign gold bond scheme, etc. This guide is packed with must-read information and advice on how to invest in gold coins and bars, including why buy gold, where to buy gold and storing gold. Monex proudly offers an array of investment-quality gold products, an attractive two-way buy/sell market, exceptional customer service and a comprehensive. This article provides extensive info on how to invest in gold and silver for part of your portfolio, including the pros and cons of various methods.

Rotork Stock Price

Rotork PLC ROR ; Valuation · Price/Earnings (Normalized). ; Financial Strength · Quick Ratio. ; Profitability · Return on Assets (Normalized). %. About Rotork p.l.c.. Rotork plc is a United Kingdom-based provider of flow control and instrumentation solutions for oil & gas, water and wastewater, power. Rotork PLC · · Partner Center · Your Watchlists · Recently Viewed Tickers · RTOXF Overview · Key Data · Performance · Analyst Ratings. Sell; Under; Hold. Rotork has received a consensus rating of Hold. The company's average rating score is , and is based on 1 buy rating, 2 hold ratings, and no sell ratings. ROTORK PLC · Stock Rotork plc. +%, %, +%, +% ; BELIMO HOLDING AG · Stock BELIMO Holding AG. +%, +%, %, +% ; TIANJIN JIEQIANG. Discover real-time Rotork plc (RTOXF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Price information. What's this? Open price. Previous close price / date. / 23 August Volume. , Turnover (on book). £1,, Rotork share price and ROR stock charts. Free real-time prices, and the most active stock market forums in the UK. Key statistics. On Friday, Rotork PLC (ROR:LSE) closed at , % below its week high of , set on Aug 01, Rotork PLC ROR ; Valuation · Price/Earnings (Normalized). ; Financial Strength · Quick Ratio. ; Profitability · Return on Assets (Normalized). %. About Rotork p.l.c.. Rotork plc is a United Kingdom-based provider of flow control and instrumentation solutions for oil & gas, water and wastewater, power. Rotork PLC · · Partner Center · Your Watchlists · Recently Viewed Tickers · RTOXF Overview · Key Data · Performance · Analyst Ratings. Sell; Under; Hold. Rotork has received a consensus rating of Hold. The company's average rating score is , and is based on 1 buy rating, 2 hold ratings, and no sell ratings. ROTORK PLC · Stock Rotork plc. +%, %, +%, +% ; BELIMO HOLDING AG · Stock BELIMO Holding AG. +%, +%, %, +% ; TIANJIN JIEQIANG. Discover real-time Rotork plc (RTOXF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Price information. What's this? Open price. Previous close price / date. / 23 August Volume. , Turnover (on book). £1,, Rotork share price and ROR stock charts. Free real-time prices, and the most active stock market forums in the UK. Key statistics. On Friday, Rotork PLC (ROR:LSE) closed at , % below its week high of , set on Aug 01,

Open ; Last close ; Last trade ; Best bid ; Best offer

Rotork Estimates* in GBP ; Dividend, , ; Dividend Yield (in %), %, % ; EPS, , ; P/E Ratio, , Based on analyst ratings, Rotork plc's month average price target is p. What is GB:ROR's upside potential, based on the analysts'. ROTORK (RTOXF) - Price History ; March , $, $ ; February , $, $ ; January , $, $ ; December , $, $ RTOXF - Rotork plc Stock - Stock Price, Institutional Ownership, Shareholders (OTCPK). 34 minutes ago. Rotork plc ; 52wk High. ; Volume. 83 ; Beta. ; PE Ratio. ; EPS. Discover real-time Rotork plc (RTOXF) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. What is the Rotork share price? As of 23/08/ UTC, shares in Rotork are trading at p. This share price information is delayed by 15 minutes. Rotork Estimates* in GBP ; Dividend, , ; Dividend Yield (in %), %, % ; EPS, , ; P/E Ratio, , Find the latest Rotork plc (ROR.L) stock quote, history, news and other vital information to help you with your stock trading and investing. Rotork plc (ROR) Ordinary p ; Open · p ; Trade high · p ; Year high · p ; Previous close · p ; Trade low · p. The average share price target for Rotork plc is p. This is based on 7 Wall Streets Analysts month price targets, issued in the past 3 months. Rotork. Share Price Information for Rotork (ROR). London Stock Exchange. Share Price is delayed by 15 minutes. Get Live Data. Share Price: Get Rotork PLC (ROR-GB:London Stock Exchange) real-time stock quotes, news, price and financial information from CNBC. Stock price history for Rotork (ROR.L). Highest end of day price: GBp ($ USD) on Lowest end of day price: Share Price. Showing historical and immediate movements in the Rotork share price with the capability to benchmark against the market and a specific sector. Stock price history for Rotork (ROR.L). Highest end of day price: GBp ($ USD) on Lowest end of day price: Get Rotork PLC (ROR.L) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Get the latest Rotork PLC (ROR) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and. Rotork has received a consensus rating of Hold. The company's average rating score is , and is based on 1 buy rating, 2 hold ratings, and no sell ratings.

Refi Rates Going Up

Save even more when you set up automatic payments from any checking account and enroll in electronic Mortgage billing statements More information on rates. Certain mortgage rates, like variable rate mortgages, home equity loans Q & A: Why the rapid increase in mortgage rates? Back to top. About Us. About. The year fixed mortgage rate is expected to fall to the mid-6% range through the end of , potentially dipping into high-5% territory by the end of Fees, points, mortgage insurance, and closing costs all add up. Compare Loan increase the interest rate lenders are likely to charge you on your mortgage. Mortgage rates can increase as inflation increases, allowing lenders to continue to earn a profit. If you take out a loan with a monthly payment of $1,, the. When rates rise, homeowners pay more in interest. A fixed Stylish furnishings, plus slip in mortgage rates, helps bungalow ratchet up eight offers. Today's competitive refinance rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Good for short-term borrowing situations or if you expect rates to go down. 3-year fixed rate, %, %, %. mortgage? View today's mortgage refinance rates for fixed-rate and ARM interest rates and payments are subject to increase after the initial fixed-rate. Save even more when you set up automatic payments from any checking account and enroll in electronic Mortgage billing statements More information on rates. Certain mortgage rates, like variable rate mortgages, home equity loans Q & A: Why the rapid increase in mortgage rates? Back to top. About Us. About. The year fixed mortgage rate is expected to fall to the mid-6% range through the end of , potentially dipping into high-5% territory by the end of Fees, points, mortgage insurance, and closing costs all add up. Compare Loan increase the interest rate lenders are likely to charge you on your mortgage. Mortgage rates can increase as inflation increases, allowing lenders to continue to earn a profit. If you take out a loan with a monthly payment of $1,, the. When rates rise, homeowners pay more in interest. A fixed Stylish furnishings, plus slip in mortgage rates, helps bungalow ratchet up eight offers. Today's competitive refinance rates ; Rate % ; APR % ; Points ; Monthly Payment $1, Good for short-term borrowing situations or if you expect rates to go down. 3-year fixed rate, %, %, %. mortgage? View today's mortgage refinance rates for fixed-rate and ARM interest rates and payments are subject to increase after the initial fixed-rate.

The current mortgage interest rates forecast is for rates to embark on a gentle downward trajectory over the remainder of Get Up To $4, Cash Back* With A New Mortgage. Lock In Your Rate For Days!** Payment: $2,/mo. The recent mortgage rate increase is the result of inflation and the response by the Federal Reserve, which adjusts certain interest rates to slow inflation. If interest rates stay the same or go up and/or housing prices stay the same or go up, that percentage of first time home buyers will only keep. Mortgage rates may continue to rise in High inflation, a strong housing market, and policy changes by the Federal Reserve have all pushed rates higher in. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 31 pm EST. Feel more confident in your choices once you look up the mortgage lingo. See glossary · Understanding Mortgage Security. Today's posted rates. Show me mortgage. You might want to lock your rate if you expect rates to go up before you close on your loan. Rising Mortgage Rates: Causes And Rates Forecast. Read. Mortgage Rates · Fannie Mae chief economist Doug Duncan believes the year fixed rate will be % through and reach % in · The Mortgage Bankers. You won't have to worry about rates going up between making an offer and closing on your new home. Most lenders will offer a rate lock for 30 to 45 days. mortgage interest rate to see if refinancing could be the right move. rates may include up to discount point as an upfront cost to borrowers. Rates. Today's Mortgage Rate Averages: New Purchase Rates on year mortgages shot up 11 basis points Thursday, pushing the average up to %. It's the first. Current mortgage rates continue to rise and record payment rates combine to create a glum market. Refinancing may provide an opportunity to get a better interest rate or make a good mortgage even better. Either way, you'll increase your short- and long-term. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. year fixed-rate mortgage: %. Rates likely won't go down significantly until the Federal Reserve begins to make cuts. Channel doesn't expect this to. Do you foresee rates going lower on ARM or should we refi now? I am The odds of the rates going up way out way them going down, and if you plan. Fixed year mortgage rates in the US Personal Spending Continues to Rise in July · US Core PCE Prices Rise as Expected · US PCE Prices Up % as Expected. The rise in Bank of Canada's policy interest rate since March had a significant impact on mortgage rates, especially variable-rate mortgages. For most of. rate. Variable Mortgage Rate. Your monthly mortgage payments can go up or down based on the Bank of Canada's prime interest rate. %. 5 year term*. Get this.

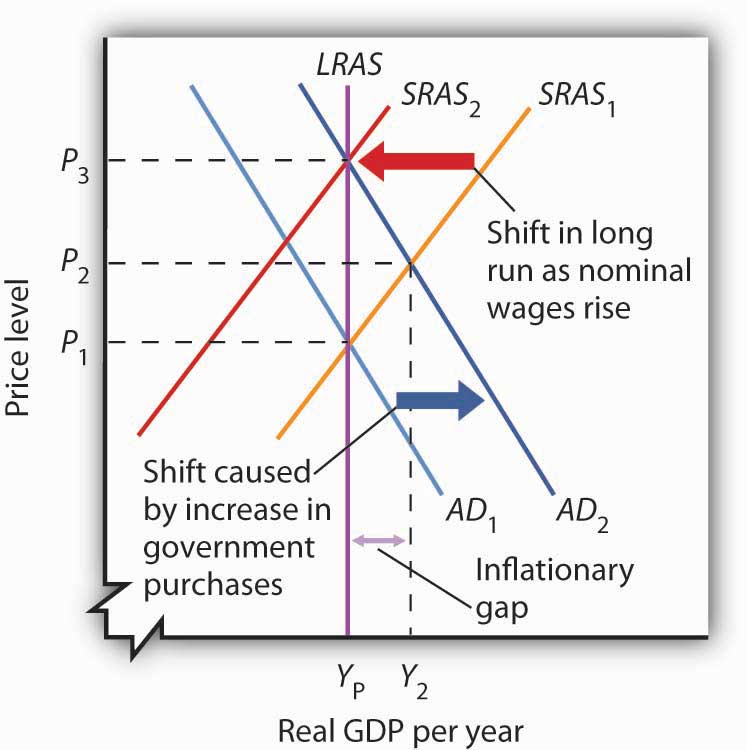

What Does Stagflation Do To The Stock Market

Stagflation is a rare economic condition characterized by high unemployment, slow economic growth, and high inflation. It challenges traditional economic. What Happens During Stagflation? Economic growth slows, and unemployment rises. This is accompanied by an increase in the inflation rate (rising prices). When it has, stocks have held up better than they did during low-inflation recessions. When it hasn't, stagflation has been mostly a non-issue for stock returns. The combination of shrinking order books and fixed costs can quickly turn a nice set of financial statements into a horror story. And since equities are usually. Periods of stagflation make the stock market less appealing, but investors shouldn't discount securities altogether. It's a matter of choosing companies that. The S&P Index hit a new record. (1) We did it! And also what do we do now? Here's what stock market highs mean — and don't mean — for. Markets performed well in the past week despite higher-than-expected PCE inflation and talk about stagflation. Helping stocks is that earnings growth has been. In economics, stagflation (or recession-inflation) is a situation in which the inflation rate is high or increasing, the economic growth rate slows. Stagflation is the combination of slow economic growth, high unemployment, and a high rate of inflation. Stagflation is a rare economic condition characterized by high unemployment, slow economic growth, and high inflation. It challenges traditional economic. What Happens During Stagflation? Economic growth slows, and unemployment rises. This is accompanied by an increase in the inflation rate (rising prices). When it has, stocks have held up better than they did during low-inflation recessions. When it hasn't, stagflation has been mostly a non-issue for stock returns. The combination of shrinking order books and fixed costs can quickly turn a nice set of financial statements into a horror story. And since equities are usually. Periods of stagflation make the stock market less appealing, but investors shouldn't discount securities altogether. It's a matter of choosing companies that. The S&P Index hit a new record. (1) We did it! And also what do we do now? Here's what stock market highs mean — and don't mean — for. Markets performed well in the past week despite higher-than-expected PCE inflation and talk about stagflation. Helping stocks is that earnings growth has been. In economics, stagflation (or recession-inflation) is a situation in which the inflation rate is high or increasing, the economic growth rate slows. Stagflation is the combination of slow economic growth, high unemployment, and a high rate of inflation.

Stocks are hampered by slow economic growth while high inflation erodes bond returns.

What is stagflation and when did it appear? Stagflation is a state in which the gross domestic product (GDP) stagnates or declines, while the economy. Stagflation is an economic scenario where there is a simultaneous presence of both stagnation, that is slow growth and inflation. Stagnation is a condition. Stocks are hampered by slow economic growth while high inflation erodes bond returns. Stagflation is the combination of slow economic growth, high unemployment, and a high rate of inflation. Stagflation is the simultaneous appearance in an economy of slow growth, high unemployment, and rising prices. Once thought by economists to be impossible. Stagflation occurs when high inflation and slow economic growth are combined. This results in a decrease in purchasing power and rising. While economic activity slows during a period of stagflation, commodity prices benefit from the inflationary pressures on the market. With producers potentially. "Stocks have historically delivered high enough returns to beat inflation, but they often need economic growth to do that," Martin says. When businesses are. Stagnation is when economic growth – an increase in the output of goods and services – slows. And, this trend can trigger high unemployment. In the most recent. How Often Does The Stock Market Crash? Now that we've clarified what these What Should I Do About Stock Market Crashes and Corrections? First, you. Almost by definition, if inflation is high, it means commodity prices are rising. Usually during inflationary environments, commodities are under-supplied, and. Inflation may erode profit margins of companies (cost incurred may not be fully passed on to customers due to demand -supply dynamics), which. the s and how they've been doing today. Equities generally saw Annualised Returns for Selected Financial Market and Commodity Assets During. Stagflation is the unlikely combination of low growth and high inflation (which normally move in tandem), and hurts companies via both slower revenue growth and. Almost by definition, if inflation is high, it means commodity prices are rising. Usually during inflationary environments, commodities are under-supplied, and. Stagflation occurs when high inflation and slow economic growth are combined. This results in a decrease in purchasing power and rising. A combination of slowing growth and stubborn inflation is conjuring up fears of “stagflation”, characterized by the s era of persistently. Stagflation is a unique economic phenomenon that combines the worst of both worlds: stagnant economic growth and rising inflation. It can wreak havoc on stock. Periods of stagflation make the stock market less appealing, but investors shouldn't discount securities altogether. It's a matter of choosing companies that. Stagflation is an economic environment that combines stagnant economic growth with high inflation. Imagine an economy stuck in neutral, where prices for goods.

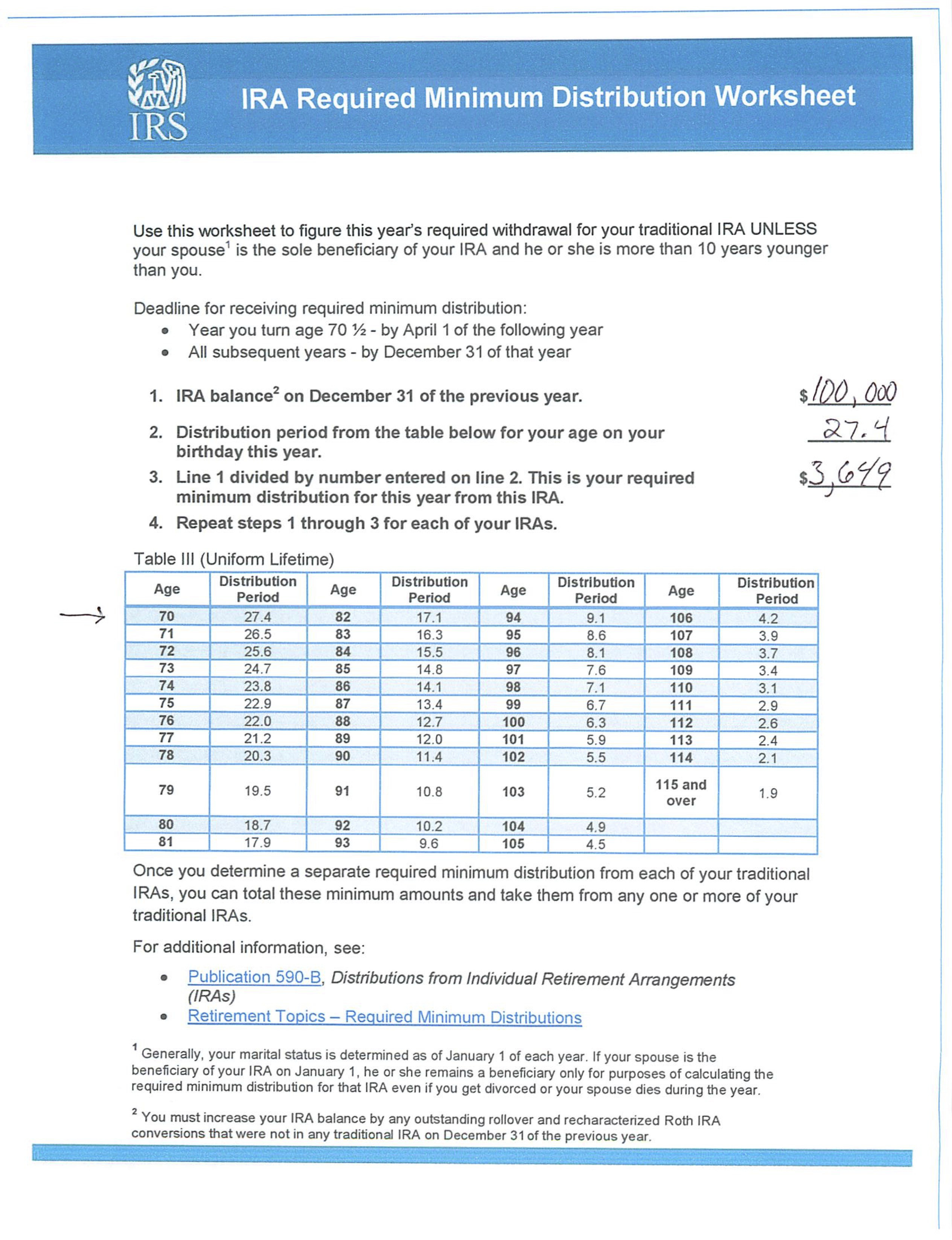

Ira Mrd Table

When you inherit an IRA, many of the IRS rules for required minimum distributions (RMDs) still apply. However, there may be additional rules based on your. Source: marketofchoice.ru Use the IRS Uniform Lifetime Table to calculate your RMD. To customize, type. “Courtesy of:” and then your name, firm, and contact. Can take owner's RMD for year of death. Distribute using Table I. Use younger of 1) beneficiary's age or 2) owner's age at birthday in year of death; Determine. There are three possible tables that can be used to determine the applicable life expectancy factor (also called the Applicable Distribution Period) in order to. Rather, for IRA owner deaths that occur after December 31, , a designated beneficiary must deplete the account within 10 years unless the person is an. Life Expectancy Tables to Determine Required Minimum Distributions IRAs and Retirement Accounts The regulations covering required minimum distributions (RMD). Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. Did you inherit a retirement account? If you are a beneficiary of a retirement account, use our Inherited IRA RMD Calculator to estimate your minimum withdrawal. The RMD Table for covers what you should know about start dates for different kinds of accounts. When you inherit an IRA, many of the IRS rules for required minimum distributions (RMDs) still apply. However, there may be additional rules based on your. Source: marketofchoice.ru Use the IRS Uniform Lifetime Table to calculate your RMD. To customize, type. “Courtesy of:” and then your name, firm, and contact. Can take owner's RMD for year of death. Distribute using Table I. Use younger of 1) beneficiary's age or 2) owner's age at birthday in year of death; Determine. There are three possible tables that can be used to determine the applicable life expectancy factor (also called the Applicable Distribution Period) in order to. Rather, for IRA owner deaths that occur after December 31, , a designated beneficiary must deplete the account within 10 years unless the person is an. Life Expectancy Tables to Determine Required Minimum Distributions IRAs and Retirement Accounts The regulations covering required minimum distributions (RMD). Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. Did you inherit a retirement account? If you are a beneficiary of a retirement account, use our Inherited IRA RMD Calculator to estimate your minimum withdrawal. The RMD Table for covers what you should know about start dates for different kinds of accounts.

The RMD waiver is for retirement plans and accounts for This includes direct contribution plans such as k, b, b plans and IRAs. RMDs were also. RMDs can be complicated. Let our calculator guide you step-by-step to estimate your inherited RMD To discuss IRAs, call Vanguard at , Monday. Use this table to calculate required minimum distributions (RMDs) from IRAs and retirement plan accounts when the spouse beneficiary is more than 10 years. What is a required minimum distribution (RMD) for an inherited IRA? · Inherited RMD Calculator · Inherited RMD Calculator. Use our RMD calculator to find out the required minimum distribution for your IRA. Plus review your projected RMDs over 10 years and over your lifetime. The IRS rules use a uniform table to calculate all life expectancies for determining a minimum distribution. The only exception to this rule is if the only. RMD amounts depend on various factors, such as the account owner's age at death, the year of death, the type of beneficiary, the account value, and more. If. If you've inherited an IRA and/or other types of retirement accounts, the IRS may require you to withdraw a minimum amount of money each year. Learn more about required minimum distributions for IRAs and find out how much you must withdraw by using the RMD calculator provided by Merrill Edge. This table will be used by every designated beneficiary except a spouse who elects to treat their deceased spouse's IRA as their. Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually;. How RMDs are Calculated · Determine the individual retirement account balance as of December 31 of the prior year · Find the distribution period (or "life. RMDs are determined by dividing the retirement account's prior year-end fair market value by a life expectancy factor published by the IRS. If you have multiple. Use the IRS Uniform Lifetime Table below to find your life expectancy divisor unless your spouse is more than. 10 years younger than you and is your sole. Account balance / Life expectancy factor = RMD ; 72, ; 73, ; 74, ; 75, This table is for calculating and later years' post-death required minimum distributions (RMDs) for Eligible Designated. Check this box if the sole beneficiary is a spouse. The IRS uniform life expectancy table is used to calculate the life expectancy for account owner RMDs. The. (To be used for calculating post-death required distributions to beneficiaries) ; Age of. IRA or Plan Beneficiary. Life Expectancy. (in years). Traditional IRA owners who turned 72 in will still determine their RMD based on the old life expectancy tables (even though they would have until 4/1/.

Crypto Mining Tutorial

How to Get Started Mining Cryptocurrency · Choose a cryptocurrency to mine: There are many different cryptocurrencies to mine. · Set up your. This blog post unpacks the ins and outs of the crypto mining industry, demystifies the process, and provides you with the essential knowledge you need to. Bitcoin mining is the process by which transactions are officially entered on the blockchain. It is also the way new bitcoins are launched into circulation. marketofchoice.ru - Free download as PDF File .pdf), Text File .txt) or read online for free. This document provides an overview of. Bitcoin mining might have become so competitive that the average Joe can't get a look in - but that doesn't mean it's the case for all cryptocurrencies. There. Delve into the world of Bitcoin mining, understanding its significance in the cryptocurrency ecosystem. Learn about the process, the equipment needed, and the. In this article, we will discuss what is crypto mining, how to mine Bitcoin, how Bitcoin mining works, the cost of mining Bitcoin, is Bitcoin mining illegal. Mining is the process that Bitcoin and several other cryptocurrencies use to generate new coins and verify new transactions. Becoming familiar with the mining process is a key factor when you're starting out. · You'll need a cryptocurrency wallet, mining software, and mining hardware. How to Get Started Mining Cryptocurrency · Choose a cryptocurrency to mine: There are many different cryptocurrencies to mine. · Set up your. This blog post unpacks the ins and outs of the crypto mining industry, demystifies the process, and provides you with the essential knowledge you need to. Bitcoin mining is the process by which transactions are officially entered on the blockchain. It is also the way new bitcoins are launched into circulation. marketofchoice.ru - Free download as PDF File .pdf), Text File .txt) or read online for free. This document provides an overview of. Bitcoin mining might have become so competitive that the average Joe can't get a look in - but that doesn't mean it's the case for all cryptocurrencies. There. Delve into the world of Bitcoin mining, understanding its significance in the cryptocurrency ecosystem. Learn about the process, the equipment needed, and the. In this article, we will discuss what is crypto mining, how to mine Bitcoin, how Bitcoin mining works, the cost of mining Bitcoin, is Bitcoin mining illegal. Mining is the process that Bitcoin and several other cryptocurrencies use to generate new coins and verify new transactions. Becoming familiar with the mining process is a key factor when you're starting out. · You'll need a cryptocurrency wallet, mining software, and mining hardware.

Basic Newbie Guide To Mining. Guide. In an attempt to cut down on the amount of basic questions to start mining, here are a few resources to. Acknowledging Factors · Recommended Cloud Mining Platform · Building a Mining Rig: Things Needed · Assemble a GPU Mining Rig – Step by Step Guide · How to Mine. In this blog, we will break down the 3 major ways to invest in crypto mining. We'll go through the fundamentals as well as some handy tips. Simply put, mining is the process of adding a block to a blockchain. Mining tends to be one of the topics of cryptocurrency and blockchain that are over-. Crypto mining, however, also involves validating cryptocurrency transactions on a blockchain network and adding them to a distributed ledger. Step 1: Create a crypto wallet address · Step 2: Create a Cruxpool account (optional) · Step 3: Connect to your ASIC dashboard · Step 4: Choose a Bitcoin mining. -Mining them. Mining is the process of verifying transactions in the blockchain. As the whole of the Bitcoin system is decentralised, every transaction is. Miners unlock new Bitcoin when they add a block to the blockchain. They also get the reward of the fees that users include in their transactions. This makes it. At the root of every cryptocurrency is a blockchain, which is essentially an electronic ledger sustaining a continuously growing list of records. The blocks in. Mining Bitcoin becomes more difficult, as more miners compete for the next block reward. Today, mining cryptocurrencies involves fewer rewards and higher costs. How to mine crypto · Choose a cryptocurrency to mine · Buy your mining equipment · Set up a crypto wallet · Configure your mining device · Join a mining pool. How to Mine Bitcoin on PC in | Beginners Quick Start Guide | Overclocking Basics · How I Payoff (ROI) my Mining Rigs · Nicehash OS (NHOS) How. We will explore cryptocurrency mining in great detail in this section. Our objective is to set out the mining process in an easy-to-understand manner and help. Mining pools stand as vital hubs of activity, enabling miners to combine their computational resources and increase their chances of successfully validating. Mining pools are groups of crypto miners who work together to generate new blocks. The mining pools divide the payouts according to each participant's. It is lost as heat. This causes two major problems for crypto miners. Firstly, heat is the biggest enemy of crypto farms. Cooling a facility is not cheap and. Crypto mining is the operation used to validate and record transactions within a blockchain network. Miners use the computing power generated by their hardware. Income received from mining is taxed as ordinary income based on the fair market value of your coins on the day you received them. For example, if you. In this course you will learn the basics of cryptocurrency, which is fundamental to understanding cryptocurrency mining. The topics include an introduction to. Incentivize miners who propose and verify new transactions for the Bitcoin blockchain. · Secure the Bitcoin blockchain against attacks. · Manage the creation and.

Roth Ira Should I Contribute

How much can I contribute? (updated July 29, ) · For , $6,, or $7, if you're age 50 or older by the end of the year; or your taxable compensation. Make sure you maximize your IRA contributions. A Roth or traditional IRA can be an essential part of your retirement savings strategy. It offers a tax-. Roth IRA. You can contribute at any age if you (or your spouse if filing jointly) have taxable compensation and your modified adjusted gross income is below. Can I contribute to both Traditional and Roth IRAs? Yes. You can divide your contributions between these IRAs, as long as your total combined contributions do. Should I contribute to my Roth IRA or Traditional IRA? Get our FREE flowchart to find out what's best for you. Access: Although Roth IRAs are designed for retirement savings, you can access contributions at any time without taxes or penalty. · Tax-free income: · No · Tax-. What benefits do Roth IRAs provide for your retirement? · No contribution age restrictions · Earnings grow tax-free · Qualified tax-free withdrawals · No mandatory. Roth IRA contributions are limited by income level. In general, you can contribute to a Roth IRA if you have taxable income and your modified adjusted gross. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. You can make contributions to your Roth. How much can I contribute? (updated July 29, ) · For , $6,, or $7, if you're age 50 or older by the end of the year; or your taxable compensation. Make sure you maximize your IRA contributions. A Roth or traditional IRA can be an essential part of your retirement savings strategy. It offers a tax-. Roth IRA. You can contribute at any age if you (or your spouse if filing jointly) have taxable compensation and your modified adjusted gross income is below. Can I contribute to both Traditional and Roth IRAs? Yes. You can divide your contributions between these IRAs, as long as your total combined contributions do. Should I contribute to my Roth IRA or Traditional IRA? Get our FREE flowchart to find out what's best for you. Access: Although Roth IRAs are designed for retirement savings, you can access contributions at any time without taxes or penalty. · Tax-free income: · No · Tax-. What benefits do Roth IRAs provide for your retirement? · No contribution age restrictions · Earnings grow tax-free · Qualified tax-free withdrawals · No mandatory. Roth IRA contributions are limited by income level. In general, you can contribute to a Roth IRA if you have taxable income and your modified adjusted gross. You cannot deduct contributions to a Roth IRA. If you satisfy the requirements, qualified distributions are tax-free. You can make contributions to your Roth.

A Roth IRA is a retirement account where you may be able to contribute after-tax dollars and you don't have to pay federal tax on “qualified distributions”. Contributions to Roth IRAs, however, are not tax-deductible. A Roth individual retirement account (IRA) could be an important part of your investment. Contributions can be withdrawn anytime without taxes or penalties. Withdrawals of earnings are tax-free if you're at least age 59 ½ and made your first. A Roth is a feature of many (k) and similar employer-sponsored retirement plans. Roth contributions are made on an after-tax basis and any investment. It may be appropriate to contribute to both a traditional and a Roth IRA—if you can. Doing so will give you taxable and tax-free withdrawal options in. Contributing to a Roth IRA is a great way to save money for retirement. With a Roth IRA, you get the benefit of paying taxes now – ideally when you are in a. Yes. You can contribute to a Roth IRA for a specific tax year starting January 1 of that year and you must make all contributions for the tax year by the. Is there an age limit? You can contribute to a Roth IRA at any age. As a result of changes made by the SECURE Act, you can make contributions to a. Can invest money in any financial institution · Can invest in individual stocks · Withdrawal of contributions are never taxed · Earnings grow tax-deferred · Tax. a Roth IRA? Anyone can contribute regardless of income. Employees must meet income eligibility requirements to contribute directly. Contributions may be fully. Key takeaways · The Roth IRA contribution limit for is $7, for those under 50, and $8, for those 50 and older. · Your personal Roth IRA contribution. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. Unlike Roth IRAs, you can make Roth contributions to your employer retirement plan no matter how much you make. With employer-plan Roth contributions, there are. Yes, you can, but only if you have taxable compensation. Roth IRAs were designed to help people save for retirement with the advantage of tax-free growth. Roth IRAs offer an opportunity to create tax-free income during retirement and are a good way to diversify your retirement income. Traditional IRAs are most effective if you expect to be in a lower tax bracket when you retire, while Roth IRAs are best for those in a lower tax bracket. The dollar amount you can contribute to a Roth IRA depends on your annual income. For example, for the tax year , a couple filing jointly and reporting less. No age limit to open or contribute to a Roth IRA. You or your spouse must have earned income to contribute. Contributions may be reduced, or you may be. Tax-free income is the dream of every taxpayer. And if you save in a Roth IRA account, it's a reality. These accounts offer big benefits, but the rules for. Contributions can be withdrawn anytime without taxes or penalties. Withdrawals of earnings are tax-free if you're at least age 59 ½ and made your first.

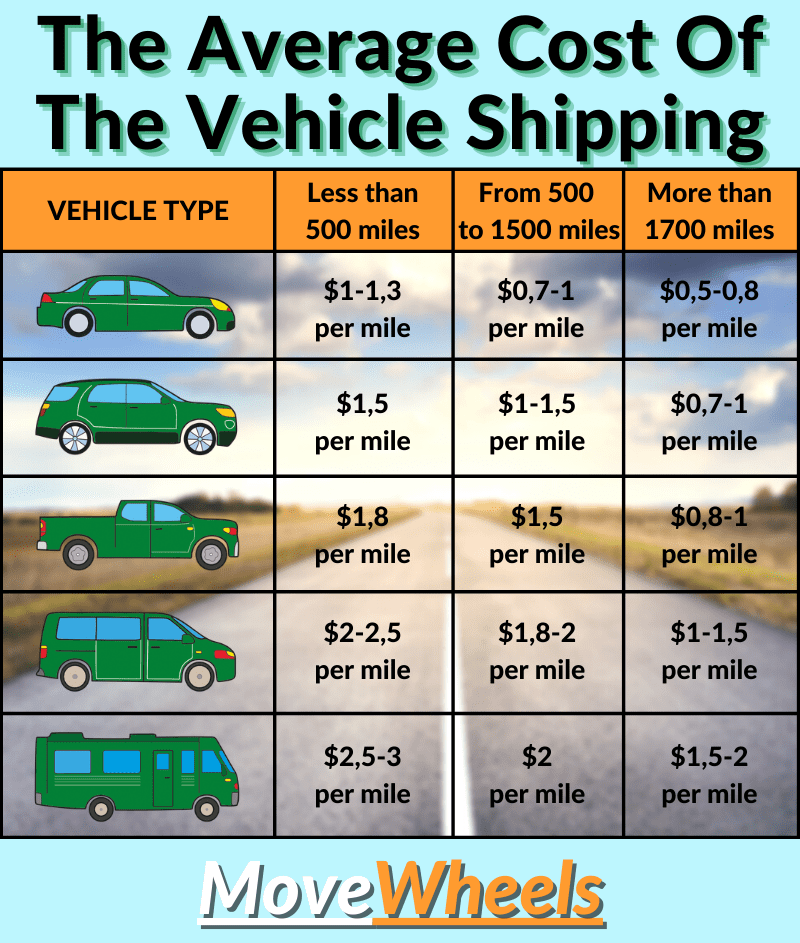

Cost Per Mile To Drive A Car 2021

This tool uses basic information about your driving habits to calculate total cost of ownership and emissions for makes and models of most vehicles. a more direct comparison, all vehicles were assumed to drive exactly 12, miles per ) discloses a cost of $ for a service interval of 80, km. That being said, typed/thought; to 30 cents per mile. Upvote. Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, , You'll use these numbers to determine your operating costs, ownership costs and cost per mile for your vehicle. If you have questions, detailed explanations. Variable expenses include hourly rates for employee overtime, utility bills, regular vehicle maintenance and repairs, tires, tolls, licensing for drivers, and. The US IRS allows about 54 cents per mile for all costs including depreciation, wear and tear, insurance, maintenance and gas and oil. Operating costs are estimated for a 5-year period; You will drive 15, miles per year; You are financing the vehicle using traditional financing, not leasing. Beginning January 1, , the standard mileage rates for the use of a car (van, pickup or panel truck) will be: cents per mile for. This tool uses basic information about your driving habits to calculate total cost of ownership and emissions for makes and models of most vehicles. a more direct comparison, all vehicles were assumed to drive exactly 12, miles per ) discloses a cost of $ for a service interval of 80, km. That being said, typed/thought; to 30 cents per mile. Upvote. Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, , You'll use these numbers to determine your operating costs, ownership costs and cost per mile for your vehicle. If you have questions, detailed explanations. Variable expenses include hourly rates for employee overtime, utility bills, regular vehicle maintenance and repairs, tires, tolls, licensing for drivers, and. The US IRS allows about 54 cents per mile for all costs including depreciation, wear and tear, insurance, maintenance and gas and oil. Operating costs are estimated for a 5-year period; You will drive 15, miles per year; You are financing the vehicle using traditional financing, not leasing. Beginning January 1, , the standard mileage rates for the use of a car (van, pickup or panel truck) will be: cents per mile for.

The state fleet mileage reimbursement rate reflects the average cost of operating a mid-size sedan in the state vehicle fleet. 56 cents per mile as of January 1, ; cents per mile as of January 1, ; 58 cents per miles as of January 1, ; cents per miles as of January. Per-Mile Cost of Driving, by mileage, ICE-SI, MY In this analysis, our default assumption for driving behavior comes from vehicle mileage. ¢/mile. Based on average prices for a month period ending 5/21/ During this time, regular grade gas averaged $/gallon. Electric vehicle charging. The IRS standard mileage reimbursement rate is $ /mi. At 75mph on the highway, that's 74 cents per minute. Upvote 9. Downvote Reply. That being said, typed/thought; to 30 cents per mile. Upvote. of what kind of car they drive. Learn more about road charge. How is Step 1: Enter Vehicle Mileage. How many miles do you drive per month?*. Step 2. Dividing fuel cost per gallon by miles per gallon gives you the fuel cost per mile. For example, if the cost of gasoline is $ per gallon and your vehicle. Fuel Economy of the Volkswagen ID.4 1st. Compare the gas mileage and Cost to Drive 25 Miles, $ Cost to Fill the Tank. Tank Size. *Based on car driving on the road. Calculate Mileage. Use the Defense Table of The TDY mileage rates consider the fixed and variable costs of operating a vehicle. This rate is used to calculate the deductible costs of operating an automobile for business. As a result, you might claim a lower deduction for vehicle-related. AAA data shows that maintenance for a medium sedan in averaged about cents per mile. So, if you drive 15, miles in one year, you could expect to. Effective January 1, , the mileage rate is 56 cents per mile. Effective January 1, , the mileage rate is cents per mile. Effective January 1, Standard Mileage Rates ; January 1, , ; January 1, , ; January 1, , ; January 1, , Fuel: cents per mile ( cents per mile in ). Insurance: $1, a year ($1, in ). License, registration and taxes: $ a year ($ in ). The figure represents a 2% increase over and 10% more than the vehicle miles in Factors That Determine How Many Miles You Drive. Driving an average. Annual transportation tax and fees and costs for a car driven 12, miles per year. Expenditures are based on the following: Cost of Ownership*. calendar icon. Daily rate. Example: $ · Mileage icon. Per-mile rate. Example: 72¢ (avg. of 6¢ per mile x 12 miles) · payment icon. Total cost per day. Example. For example, a gasoline vehicle that gets 30 MPG will cost you $ less to fuel each year than one that gets 20 MPG (assuming 15, miles of driving annually. The findings of the study coincide with those of a Department of Energy report that estimated the cost of electric vehicle maintenance to be cents per.

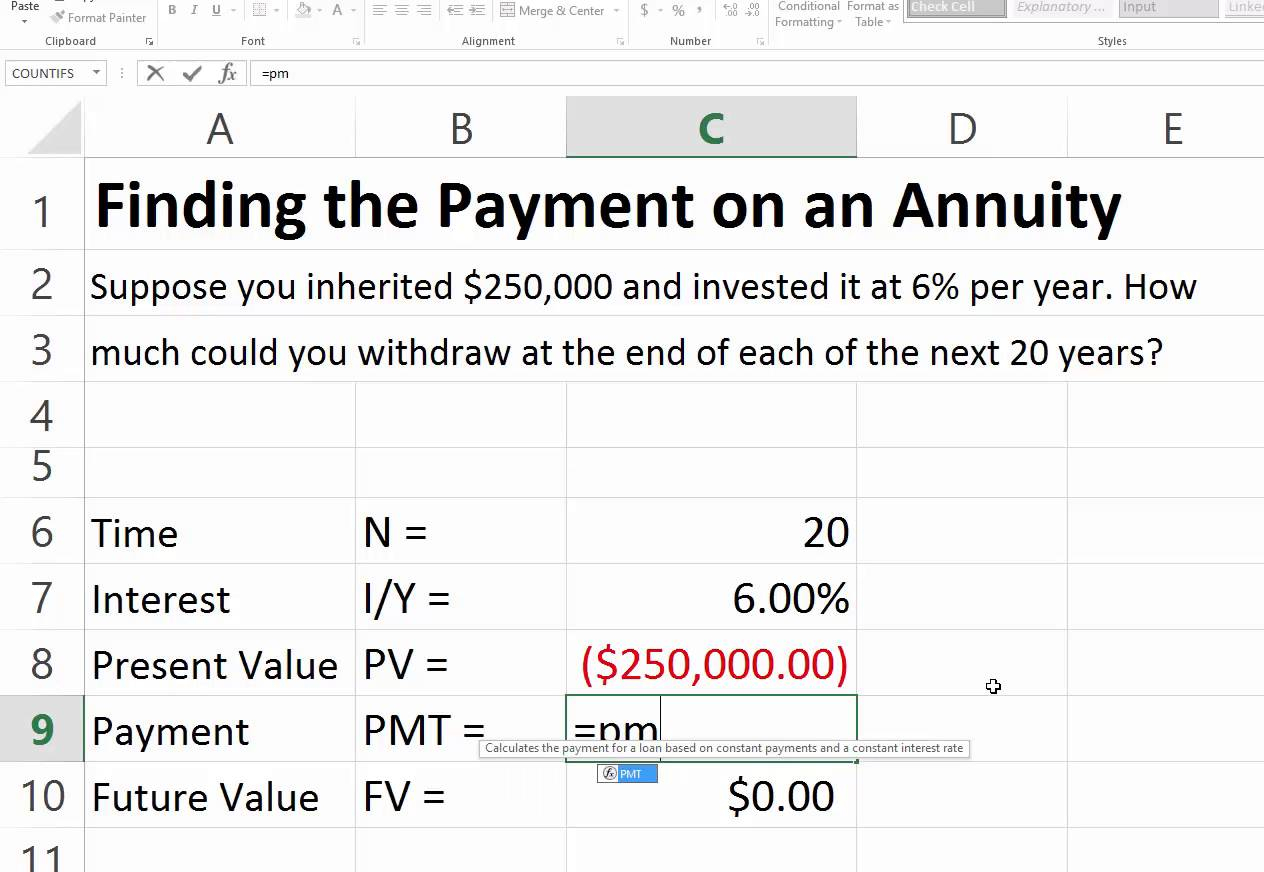

5 Year Annuity Calculator

There is no cost or obligation. Simply enter your age and dollar amount and get your free annuity quote instantly! Your privacy is guaranteed. Calculate the future value of an annuity due, ordinary annuity and growing annuities with optional compounding and payment frequency. Annuity formulas and. Use this income annuity calculator to get an annuity income estimate in just a few steps. iFrame Panel. 1. Enter Your Information; 2. Results. How long would. Use Bankrate's annuity calculator to calculate the number of years your investment will generate payments at your specified return. Annuities. Annuity vs. IRA. Some employees can qualify for a lifetime retirement annuity with as little as five years For retirement groups 1 - 3, your standard annuity calculation. The Lifetime Income Calculator can show you in 5 minutes or less how much retirement income an annuity can provide. © and prior years, Teachers Insurance. Calculate your estimated interest earned over a select period of time demonstrating how a fixed single-premium deferred annuity may grow over the years. years may be rolled over to another qualified plan each month. Defined Benefit Supplement account balance. 3 year. 4 year. 5 year. 6 year. 7 year. 8 year. 9. Start your retirement planning today with deferred annuities from USAA. Use our annuity calculator to see how much money you can earn over time. There is no cost or obligation. Simply enter your age and dollar amount and get your free annuity quote instantly! Your privacy is guaranteed. Calculate the future value of an annuity due, ordinary annuity and growing annuities with optional compounding and payment frequency. Annuity formulas and. Use this income annuity calculator to get an annuity income estimate in just a few steps. iFrame Panel. 1. Enter Your Information; 2. Results. How long would. Use Bankrate's annuity calculator to calculate the number of years your investment will generate payments at your specified return. Annuities. Annuity vs. IRA. Some employees can qualify for a lifetime retirement annuity with as little as five years For retirement groups 1 - 3, your standard annuity calculation. The Lifetime Income Calculator can show you in 5 minutes or less how much retirement income an annuity can provide. © and prior years, Teachers Insurance. Calculate your estimated interest earned over a select period of time demonstrating how a fixed single-premium deferred annuity may grow over the years. years may be rolled over to another qualified plan each month. Defined Benefit Supplement account balance. 3 year. 4 year. 5 year. 6 year. 7 year. 8 year. 9. Start your retirement planning today with deferred annuities from USAA. Use our annuity calculator to see how much money you can earn over time.

How To Calculate Annuity Payments · P0 = Principal · r = Annual interest rate · n = Number of payments per year · t = Number of years of payments. Use this calculator to help you determine how a Fixed Annuity might fit into your retirement plan. The Powerball annuity is paid out as a series of annual payments over 30 years, with an increase of 5% each year to account for inflation. However, winners. $6,/year. 5-year Deferral. $8,/year. year Deferral. $13,/year. 15 Here are the best income annuity rates available on a $, policy for a Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount. Use AnnuityAdvantage's instant income rider calculator to calculate Multi-Year Guarantee Annuity Rates · Traditional Fixed Annuities · Fixed Indexed. RMDs Calculator · Inherited IRA RMD Calculator · Education and Custodial Choose to increase your annuity payments by 1% to 5% compounding each year. This present value of annuity calculator computes the present value of a series of future equal cash flows - works for business, annuities, real estate. The initial interest rate of a fixed annuity is usually only guaranteed for the first year or first few years of the contract. After that, the insurance company. annuity for a specific number of years and paying taxes each year. The calculator discounts the annuity to a present value so that you can compare which. Advanced Annuity Calculator: Calculate the premium for purchase or monthly Income you want to receive from an immediate or deferred income annuity. This annuity calculator will estimate how much income you can get and compare it to income from a GIC or RRIF. For a more customized quote, talk to an advisor. This annuity calculator tells you how much annuity income you can buy 5, 10 or 20 years. Joint Annuitant. A joint annuitant is typically the spouse. Determine what year in retirement you are most likely to run out of assets or income;; Print or Save your plan and use it to Stay On Track Achieving the Success. The marginal tax rate you expect to pay on your investments at retirement. Years until retirement. Number of years before retirement. Annuity total before taxes. 14% rise in annuity rates in two years. Could now be the best time to buy an annuity? We look at what this means for your retirement income. Based on Legal. Using the same example of five $1, payments made over a period of five years, here is how a PV calculation would look. It shows that $4,, invested at 5. The Powerball annuity is paid out as a series of annual payments over 30 years, with an increase of 5% each year to account for inflation. However, winners. A year-old client who chooses a single-life annuity income rider, based Footnote 5. Annuities available at J.P. Morgan Wealth Management are. (5% per year) that you were under age 62 on the date your annuity began. However, your annuity will not be reduced if you complete at least 30 years of.