marketofchoice.ru Learn

Learn

How Much Is Auto Insurance In Florida

Although Florida requires some minimum insurance coverages, it is often not enough to cover all your damages in the event of a major accident with injuries. Minimum Insurance Requirements in Florida · $10, for personal injury protection (PIP) · $10, for property damage liability (PDL). Nearly full coverage, 6 year old vehicle, no accidents or tickets, mid 30s, Tampa suburbs, drive 20k+ miles per year. $49/mo. The minimum insurance coverages that are required to register most personal motor vehicles in Florida is $10, in Personal Injury Protection (PIP) and $10, Nearly full coverage, 6 year old vehicle, no accidents or tickets, mid 30s, Tampa suburbs, drive 20k+ miles per year. $49/mo. According to our review of dozens of car insurance companies operating in Florida, Geico, State Farm, Travelers and USAA offer some of the best service coupled. In (State) the average rate for liability only coverage is around $ per month compared to Full coverage which will cost you about $ per month. According to the Florida Department of Highway Safety and Motor Vehicles (DHSMV), all drivers in the state must have auto insurance coverage. If you are pulled. Based on proprietary rate data provided by Quadrant Information Services, the average annual premium for a minimum coverage policy in Florida is $1, Drivers. Although Florida requires some minimum insurance coverages, it is often not enough to cover all your damages in the event of a major accident with injuries. Minimum Insurance Requirements in Florida · $10, for personal injury protection (PIP) · $10, for property damage liability (PDL). Nearly full coverage, 6 year old vehicle, no accidents or tickets, mid 30s, Tampa suburbs, drive 20k+ miles per year. $49/mo. The minimum insurance coverages that are required to register most personal motor vehicles in Florida is $10, in Personal Injury Protection (PIP) and $10, Nearly full coverage, 6 year old vehicle, no accidents or tickets, mid 30s, Tampa suburbs, drive 20k+ miles per year. $49/mo. According to our review of dozens of car insurance companies operating in Florida, Geico, State Farm, Travelers and USAA offer some of the best service coupled. In (State) the average rate for liability only coverage is around $ per month compared to Full coverage which will cost you about $ per month. According to the Florida Department of Highway Safety and Motor Vehicles (DHSMV), all drivers in the state must have auto insurance coverage. If you are pulled. Based on proprietary rate data provided by Quadrant Information Services, the average annual premium for a minimum coverage policy in Florida is $1, Drivers.

The minimum insurance coverages that are required to register most personal motor vehicles in Florida is $10, in Personal Injury Protection (PIP) and $10, According to our review of dozens of car insurance companies operating in Florida, Geico, State Farm, Travelers and USAA offer some of the best service coupled. The average cost of car insurance in Florida is around $2,, but don't let this amount guide you when shopping for your own policy! The best way to find out. Do I Have Enough Auto Insurance? · Bodily Injury Liability Coverage ("BI Coverage”). · Recommended Coverage Limits: We suggest that you buy Bodily Injury. In Florida, car insurance costs an average of $2, annually, according to our data, more than $1, higher than the national average rate of $1, State. The average cost for car insurance in Florida is $1, Average costs range from $1, with Travelers to $1, with Direct General Insurance. Florida car insurance coverage requirements · $10, of personal injury protection · $10, of property damage liability · Save up to 30% for being a safe driver. What is the best car insurance in Florida? · Allstate customers who switch and save with Progressive save $ on average · GEICO customers who switch and save. On average, full coverage car insurance in Florida costs $ per month, which is significantly higher than the national average of $ In Florida, you can expect to pay approximately $6, per year for full coverage car insurance or $2, per year for minimum coverage. Car insurance in. What is the average cost of car insurance in Florida? Florida drivers paid an average of $1, a year for full coverage (liability, collision and. For full coverage insurance, the average annual cost is $3, Some factors that impact your car insurance rates in Florida. In. Get Cheap Car Insurance In Florida ; $ a month · $ a month · $ a month · $ a month · $ a month ; $ a month · $ a month · $ a month · $ a. State Farm offers some of the cheapest car insurance rates in Florida, at $67 per month for liability only and $84 for full coverage. Anna Baluch. Written by. Florida car insurance coverage requirements · $10, of personal injury protection · $10, of property damage liability · Save up to 30% for being a safe driver. On average, commercial car insurance in Florida costs about $ per month, according to Insureon statistics. This translates to approximately $1, per year. According to Autolist, Florida ranks third in the United States for its high car insurance rates, with an annual average of $, a 52 percent increase over. Yes, to register your car in the Sunshine State, Florida law requires an auto insurance policy that provides at least the state minimum coverage limits, which. What Coverages Are Required in the State of Florida? · $10, bodily injury per person per accident · $20, bodily injury for all persons per accident · $10, Get a free Florida car insurance quote today. Nationwide offers personalized coverage options, discounts, and auto insurance you can rely on.

Why Should I Buy Tesla Stock

Tesla is able to produce cars at a much lower cost than its competitors, giving it room to cut prices to stoke demand in a way others can't. Tesla stock is a. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. The financial health and growth prospects of TSLA, demonstrate its potential to underperform the market. It currently has a Growth Score of D. Recent price. Firstly, they can buy shares in companies on the exchanges where they are listed. For instance, you can buy Tesla stock on the NASDAQ exchange, so you own a. The consensus recommendation from analysts surveyed by MarketBeat sat at 'hold' as of 2 March. Even though 21 out of 36 analysts have rated the stock a buy. The company issued million shares of common stock at a price of $17 per share, raising $ million. In October , Tesla opened the Tesla Factory to. How to buy Tesla shares (TSLA) · Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4. Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. The company operates. Tesla has created massive wealth for shareholders since its IPO, and might have game-changing upside potential, according to this Wall Street investor. Tesla is able to produce cars at a much lower cost than its competitors, giving it room to cut prices to stoke demand in a way others can't. Tesla stock is a. Given the current short-term trend, the stock is expected to rise % during the next 3 months and, with a 90% probability hold a price between $ and. The financial health and growth prospects of TSLA, demonstrate its potential to underperform the market. It currently has a Growth Score of D. Recent price. Firstly, they can buy shares in companies on the exchanges where they are listed. For instance, you can buy Tesla stock on the NASDAQ exchange, so you own a. The consensus recommendation from analysts surveyed by MarketBeat sat at 'hold' as of 2 March. Even though 21 out of 36 analysts have rated the stock a buy. The company issued million shares of common stock at a price of $17 per share, raising $ million. In October , Tesla opened the Tesla Factory to. How to buy Tesla shares (TSLA) · Step 1: Choose a broker · Step 2: Decide how much to invest · Step 3: Review TSLA stock performance and potential · Step 4. Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. The company operates. Tesla has created massive wealth for shareholders since its IPO, and might have game-changing upside potential, according to this Wall Street investor.

It's also a growth company with specific advantages that lead investors to think it may dominate the global auto industry in the next decade and. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tesla stock shows the buy. TeslaSkip to main content. Menu. Vehicles; Energy; Charging; Discover; Shop With steer-by-wire and rear steering, you get the handling of a sports car. The company issued million shares of common stock at a price of $17 per share, raising $ million. In October , Tesla opened the Tesla Factory to. It's also a growth company with specific advantages that lead investors to think it may dominate the global auto industry in the next decade and. Tesla's mission is to accelerate the world's transition to sustainable energy. Today, Tesla builds not only all-electric vehicles but also infinitely. Key Takeaways · Tesla designs, builds, and sells electric vehicles, as well as energy generation and storage systems. · Tesla's rivals include major automakers. If you do not have a brokerage account, you will need to open one. At this time, Tesla does not have a direct stock purchase program. Can Tesla comment on a. TeslaSkip to main content. Menu. Vehicles; Energy; Charging; Discover; Shop Stealth Grey and Ultra Red are designed to change with the light and viewing angle. Get the LIVE share price of Tesla Inc(TSLA) and stock performance in one place to strengthen your trading strategy in US stocks How to Buy Tesla Inc Shares in. The reality is that Tesla “got federal subsidies” when other companies “didn't give a shit”. They were leading because they had no competition. Based on 31 Wall Street analysts offering 12 month price targets for Tesla in the last 3 months. The average price target is $ with a high forecast of. You can buy Tesla stock through an investment account, or a brokerage account. You have to add money to the account and then purchase purchase Tesla stock. All vehicles built for the North American market now use our camera-based Tesla Vision to deliver Autopilot features, rather than radar. How do I purchase an. Why Tesla Is Splitting its Shares? Many experts assume the Tesla split will make the company's stock more affordable to retail investors. But even after. Tesla, Inc. engages in the design, development, manufacture, and sale of electric vehicles and energy generation and storage systems. TeslaSkip to main content. Menu. Vehicles; Energy; Charging; Discover; Shop Stealth Grey and Ultra Red are designed to change with the light and viewing angle. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Tesla stock shows the buy. Investors should watch Tesla's quarterly production and delivery report, set to release on Tuesday, for more insights. Despite this, around 40% of analysts. Buy Now Pay Later (BNPL) Apps · Best Debt Relief. SELECT. All Small Business to its products. The Company's segments include automotive, and energy.

Best Companies For Small Business Loans

OnDeck is an online lender specializing in small business loans. Its products include term loans and business lines of credit, which are available in 49 states. The Small Business Administration (SBA) offers loan programs to small businesses in Pennsylvania. SBA Loans are the best Pennsylvania business loans simply. Banks that offer small business loans. Banks that offer business loans include: Chase; Wells Fargo; U.S. Bank; Capital One; Bank of America; American Express. CDC Small Business Finance is the nation's top SBA lender, offering many small business loan products. Similar products and services offered by different companies will have best supports your business. Potential for business expansion: Financing can. Once approved, a small business loan advisor will reach out to you with the options you qualify for and help you choose the best business loan or financing. Guaranteed by the government, the Canada Small Business Financing Loan (CSBFL) provides financing to start a business or grow an existing one. Best for SBA loans: Fundera · Best for poor credit: BlueVine · Best for microloans: Kiva · Best for quick disbursement: TD Bank · Best all-rounder: Kabbage · We can. Best for multiple types of loans: Biz2Credit · Best for same-day funding: OnDeck · Best for no prepayment fees: Funding Circle · Best for microloans: Kiva. OnDeck is an online lender specializing in small business loans. Its products include term loans and business lines of credit, which are available in 49 states. The Small Business Administration (SBA) offers loan programs to small businesses in Pennsylvania. SBA Loans are the best Pennsylvania business loans simply. Banks that offer small business loans. Banks that offer business loans include: Chase; Wells Fargo; U.S. Bank; Capital One; Bank of America; American Express. CDC Small Business Finance is the nation's top SBA lender, offering many small business loan products. Similar products and services offered by different companies will have best supports your business. Potential for business expansion: Financing can. Once approved, a small business loan advisor will reach out to you with the options you qualify for and help you choose the best business loan or financing. Guaranteed by the government, the Canada Small Business Financing Loan (CSBFL) provides financing to start a business or grow an existing one. Best for SBA loans: Fundera · Best for poor credit: BlueVine · Best for microloans: Kiva · Best for quick disbursement: TD Bank · Best all-rounder: Kabbage · We can. Best for multiple types of loans: Biz2Credit · Best for same-day funding: OnDeck · Best for no prepayment fees: Funding Circle · Best for microloans: Kiva.

It's worth it to consider local financial institutions, like credit unions — which often not only award business loans to smaller companies and startups, but. Some of these loans may be applied for through the U.S. Small Business Administration (SBA), however, you can also apply for small business loans through. Here are some of the recommended lenders for small business loans for individuals with bad or no credit scores ¹ ²: · - Lendio: Best overall. Buying Guides. Small Business Loans · Startup Business Loans ; Credit Score. No-Credit Check Business Loans · Business Loans For Bad Credit ; Business Grants. Below, compare the best small-business loans, including bank and SBA loans, business lines of credit, term loans and equipment financing. Broad eligibility requirements: Companies unable to secure traditional financing might have better luck qualifying for an SBA loan. Capped interest rates: The. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. Lendio is our top choice because this marketplace connects you with a wide range of lenders. If you're looking for a microloan, consider applying through Kiva. Big banking corporations like Bank of America and the U.S. Bank also provide loans to small businesses. Banks and SBA are considered to be traditional lenders. The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses and is the most widely used loan program of the Small. Best Lender Comparison Site: Lendio ; Best Revolving Line of Credit: Fundbox ; Best for Microloans: Kiva ; Best for SBA Loans: Fundera ; Best for Same-Day Funding. Best business loans · Credibly business loan: Best for poor credit. · OnDeck business loan: Best for customer experience. · American Express® Business Line of. It's worth it to consider local financial institutions, like credit unions — which often not only award business loans to smaller companies and startups, but. Here are some of the recommended lenders for small business loans for individuals with bad or no credit scores ¹ ²: · - Lendio: Best overall. OnDeck supports small businesses with a variety of loan options for any business need. Learn why OnDeck is the right lender with loan amounts up to $K. Why Biz2Credit is the Best Marketplace Lender. Biz2Credit is our choice for the best marketplace lender because its platform connects small business owners. Get fast, affordable business loans online through Funding Circle. SBA 7A, PPP, Term Loans & more - we'll help you find the right loan for your small. Assess loan offers and accept the one that's best for your business. Some lenders may provide you with several offers with varying repayment terms, interest. A business loan marketplace like Lendio allows you to compare term loan offers from multiple lenders. Lines of credit. A business line of credit gives your. 1 Quick Comparison · 2 Bluevine: Best Overall Small Business Line of Credit · 3 Chase: Best CRE Multifamily Lender, Business Checking & Credit Cards · 4 U.S. Bank.

Quick Easy Personal Loans

Borrow up to $45, with flexible terms through our fast, % online, award-winning personal loans. Easy funding. Laurel Road offers personal loans with low. Need a little extra cash? Check out this quick, $, no credit check loan for qualifying members. Just a few minutes and you're ready to dive into fun! Get low-interest personal loans quickly with Best Egg. Apply online in minutes & receive funds fast. Start your journey to financial stability now! From debt consolidation to home improvement and more, our fast and easy personal loans could help you get the funds you need. Quick Online Loans: Get Paid In 60 mins* ⏱ Cash Loans $$2k, Personal Loans $2k-$5k Over Million Loans Approved. MoneyMe offers customers quick personal loans in just a matter of minutes, all online. We all live our lives online so why not apply this convenience to. Get an online personal loan through Avant with a simple, 3-step process. Apply online. Get a fast decision.† Receive your funds. Options from $ - $ Since CreditNinja online loans come with a fixed interest rate, borrowers can rely on consistent monthly payments that are predictable and easy to plan for. You. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral. Borrow up to $45, with flexible terms through our fast, % online, award-winning personal loans. Easy funding. Laurel Road offers personal loans with low. Need a little extra cash? Check out this quick, $, no credit check loan for qualifying members. Just a few minutes and you're ready to dive into fun! Get low-interest personal loans quickly with Best Egg. Apply online in minutes & receive funds fast. Start your journey to financial stability now! From debt consolidation to home improvement and more, our fast and easy personal loans could help you get the funds you need. Quick Online Loans: Get Paid In 60 mins* ⏱ Cash Loans $$2k, Personal Loans $2k-$5k Over Million Loans Approved. MoneyMe offers customers quick personal loans in just a matter of minutes, all online. We all live our lives online so why not apply this convenience to. Get an online personal loan through Avant with a simple, 3-step process. Apply online. Get a fast decision.† Receive your funds. Options from $ - $ Since CreditNinja online loans come with a fixed interest rate, borrowers can rely on consistent monthly payments that are predictable and easy to plan for. You. Through the personal loan program at Axos Bank, you can borrow money fast with great rates, flexible terms, fixed monthly payments, and no collateral.

A fast cash loan allows you to get the cash you need – quick. These loans typically have a shorter term than traditional bank loans. Get instant loans with our trusted lenders. We offer personal loans that you can apply for online and quickly receive the money in your bank account. OppLoans offers an easy personal loan application process. Use our online application to see rates, check eligibility, and apply for a loan up to $ Personal loans designed with you in mind ; Fast and easy. Quick and simple application with same day decision. ; No surprise fees. We charge an origination fee. Apply for an online loan, get approved in minutes, and get your deposit instantly. For lightning-fast same-day loans, apply at Minute Loan Center today. From debt consolidation to home improvement and more, our fast and easy personal loans could help you get the funds you need. CashPlease® is a fast, easy, and affordable alternative to payday loans, cash advances from credit cards, and finance companies offering quick access to cash. If you need extra cash fast, we've got you covered. With multiple personal loan options, we have what you need to apply easily, get a fast approval response. Sometimes unexpected costs occur, so trust OneMain to provide personal loans for home improvement, debt consolidation, car purchases, & more. Representative example of repayment terms for an unsecured personal loan: For $16, borrowed over 36 months at % Annual Percentage Rate (APR), the. Personal loans that put you in control. Customize your loan terms with Easy & quick process. Thanks Oportun! Leticia Yniguez. from Google. This is a. Best fast personal loans · SoFi: Best overall. · LendingClub: Best for co-borrowers. · LightStream: Best for low APR. · Prosper: Best for good credit. · LendingPoint. What can a personal loan be used for? Personal loans provide you fast, flexible access to funds that can be used for many major life events, expenses or. 3 quick steps to get your personal loans · 1. CHECK YOUR RATE. Safely share your basic income & expense information with us to see what interest rate you may. Apply for a Personal Loan online today with Simple Fast Loans. With our easy application process, you can have your personal loan fast with no hassles! Whether you have good credit, bad credit or something in between, FCU has personal loans designed for you¹. No collateral is required, applying is easy, and you. Easiest personal loans to get · Upgrade: Best for poor credit. · LendingPoint: Best for long repayment terms. · Prosper: Best for peer-to-peer lending. · Avant. Checking your rate will not affect your credit score. Get funds as soon as the same day you sign with our quick, easy application process. Finance almost any home improvement project on your list with fast, easy financing from LightStream. Use your funds for your whole project and tackle your. Apply anytime online or with mobile banking to get a quick & fast loan up to $ with U.S. Bank Simple Loan. Look inside for details.

Social Media Scorecard

Send us your social accounts. Schedule a 30 minute consult with us. And we will discuss your current strategy and give you practical steps for improvement. Yup! Social media management scorecard for brands, level 2 In an era of integrated brand management and network marketing, brand builders try to use methods and. The scorecard provides a unique insight into what marketers think of the tools on offer and where social media sites need to improve. Some key stats are. This sector scorecard provides a top-down, comprehensive outlook for the key players in the social media sector over the next two years, based on the key themes. Increase the visibility of your social media posts by appearing in more online searches and engaging in a wider audience. Social Media Assessment Scorecard. YOUR COMMENTS. TURNAROUND: Things aren't clicking on all levels - we need to schedule a call / meeting ASAP. Our social media KPI scorecard template is a spreadsheet to personalize for your brand's social media marketing program. With the Social Media Success Scorecard, there's no need to waste time spinning your wheels because it gives you a tangible look at what aspects of your. A template to document your objectives, initiatives, measures and targets for Social Media for the next months. Send us your social accounts. Schedule a 30 minute consult with us. And we will discuss your current strategy and give you practical steps for improvement. Yup! Social media management scorecard for brands, level 2 In an era of integrated brand management and network marketing, brand builders try to use methods and. The scorecard provides a unique insight into what marketers think of the tools on offer and where social media sites need to improve. Some key stats are. This sector scorecard provides a top-down, comprehensive outlook for the key players in the social media sector over the next two years, based on the key themes. Increase the visibility of your social media posts by appearing in more online searches and engaging in a wider audience. Social Media Assessment Scorecard. YOUR COMMENTS. TURNAROUND: Things aren't clicking on all levels - we need to schedule a call / meeting ASAP. Our social media KPI scorecard template is a spreadsheet to personalize for your brand's social media marketing program. With the Social Media Success Scorecard, there's no need to waste time spinning your wheels because it gives you a tangible look at what aspects of your. A template to document your objectives, initiatives, measures and targets for Social Media for the next months.

Social Media Scorecard. Edition. Sociality Squared is a full service social media marketing agency based out of New York City. S2 has worked with over The client required an overhaul and expansion of their current web-based Social Media Scorecard document in order to improve accuracy, timeliness. Influencer marketing is a crucial part of any brand's social media marketing strategy, but not every influencer is the right fit. Use this free scorecard to. A marketing scorecard takes your marketing goals, campaign metrics, and data. It puts data in an easily readable series of charts, widgets, and graphs. The Scorecard evaluates six major social media platforms: Facebook, Instagram, and Threads (whose parent company is Meta), TikTok (parent company: ByteDance); X. The scorecard explains how to compare the different social platforms when it comes to legacy and pre-planning tools and features (spoiler alert: nobody scores 5. It will give you complete control over the message being shared on social networks, integrate with both CRM's and e-commerce systems, and provide you with real-. With intellisense solutions, you can keep track of your social media performance and discover influencers in your industry. Easily monitor key metrics. A comprehensive social media analytics dashboard includes data about your influence score, keyword frequency, audience growth rate, engagement rate, conversion. A template to document your objectives, initiatives, measures and targets for Social Media for the next months. They're like scorecards for your online posts and interactions, showing how many people saw, liked, shared, or commented on your content. Social media metrics. Social Media Scorecard Want to know how you score on using Social Media to promote your business? Of course you do! Fill out and submit this form to receive. The Social Media Growth Scorecard is not just a tool; it's a comprehensive roadmap designed to navigate the complexities of social media marketing in the. Social Media Scorecard. SOCIAL MEDIA SCORECARD. Page 2. FACEBOOK CHART. 0. Jan. Feb. Mar. Apr. May. Jun. Jul. Aug. Sep. Social data is abundant, but presenting it in a way that captivates and informs your leadership team can be challenging. Equip your C-suite with. Our Community Marketing Manager Scorecard Checklist For Social Media Engagement are topically designed to provide an attractive backdrop to any subject. Social Media Scorecard: Web Strategy Brand ; Technorati rank: The lower the number the better, this is out of millions of blogs. For example, the most. Here's a look at how different platforms are handling the flood of videos, memes, and hashtags and what you can do to get the most out of social this election. Scorecard. A, B, C, D, E, F, G, H, I, J, K, L, M, N, O, P. 1, How to Use this Scorecard, For more information, read the full post. 2, Start.

Define Web Designer

Web design is the art of planning and arranging content on a website so that it can be shared and accessed online with the world. Web Designers combine graphics, fonts, images & more to create aesthetically pleasing websites. Website designers have tools like website builders & software to. A web designer is a creative professional who specializes in the aesthetic and functional aspects of website creation. They blend visual artistry with. A web designer is commonly referred to as a "web designer" or "web developer." These terms are often used interchangeably, although some. It's possible to land a great job as a self-taught web designer, but completing a college degree program arms a future designer with a comprehensive set of. The simple answer is that web developers build the core structure of a website, implementing the vision of the web designer with whom they closely collaborate. It's a web designer's responsibility to construct the overall look and feel of a website, using images, HTML, CSS, and JavaScript to do so. Designers are. Research: Being responsible for the look and feel of websites, a web designer must work to identify the goals of the website and strategize how the site's. Web design is the process of designing the visual look and feel of a website. As a web designer, you'll focus on planning the user experience of the website. Web design is the art of planning and arranging content on a website so that it can be shared and accessed online with the world. Web Designers combine graphics, fonts, images & more to create aesthetically pleasing websites. Website designers have tools like website builders & software to. A web designer is a creative professional who specializes in the aesthetic and functional aspects of website creation. They blend visual artistry with. A web designer is commonly referred to as a "web designer" or "web developer." These terms are often used interchangeably, although some. It's possible to land a great job as a self-taught web designer, but completing a college degree program arms a future designer with a comprehensive set of. The simple answer is that web developers build the core structure of a website, implementing the vision of the web designer with whom they closely collaborate. It's a web designer's responsibility to construct the overall look and feel of a website, using images, HTML, CSS, and JavaScript to do so. Designers are. Research: Being responsible for the look and feel of websites, a web designer must work to identify the goals of the website and strategize how the site's. Web design is the process of designing the visual look and feel of a website. As a web designer, you'll focus on planning the user experience of the website.

Web developing is a more specialist role, focusing on the back-end development of a website, using programming languages to make the web design a reality that. What does a web designer do? · Research · Wireframing · Graphic design · Information architecture · Responsive design · User experience design (interaction design). Web designers develop the visuals, layout and functionality of websites. Their role is to ensure that websites are easy to use and that the information is easy. Web developers work independently as freelancers or with company teams to create websites. These professionals may focus on front-end or back-end development. The term "web design" is normally used to describe the design process relating to the front-end (client side) design of a website including writing markup. What is web design? Web design involves creating attractive, user-friendly web pages and web-based apps. User experience design, user interface design, and. A brief web designer definition sounds like this: it is a person whose main task is to define the logic behind a website's structure and think of the ways to. Students who learn web design online develop creative and technological skills. Website designers must ensure their sites are engaging. Once they finish their. It's the process of planning and building the elements of your website, from structure and layout to images, colors, fonts and graphics. Web design has numerous. The skill set of a web designer, while based in different coding languages or design programs, is entirely focused on creating beautiful and engaging digital. Web designers are responsible for the visual elements, including the overall look, feel, and aesthetics of a website, while web developers handle the coding and. What is a Web Designer? Web Designers are creative, digital professionals who craft the overall vision and plan for a website. Web design is less about using. Web designers design the appearance and workings of a website. They use their understanding of both visual design and technical design principles to create. Web design is a profession where a person designs a web page or a web site. The web page can have graphics, music, animations, and many other things on it. A Web designer is a person who creates web sites. Web designers may use Web-authoring software or an HTML editor to create the actual pages. A front end developer takes the plans and layouts provided by web designers and uses coding languages (like HTML, CSS, and JavaScript) to turn them into live. Web designers work in tandem with others to figure out the goals and objectives of the website, giving their prototypes and wireframes to a web developer. Web. A web designer primarily focuses on the look and feel of a website. They are like the architects of web navigation, laying out a user-friendly blueprint with an. Google Web Designer is an advanced web application that lets you design and build HTML5 ads, images, videos, and other web content for your business. A website works the way you want it to because the front and back ends of a website are always communicating. A back-end developer is like the conductor. They.

Financially Independent Retire Early Fire

FIRE is a community of people from all walks of life working towards the same goal - freedom. Here, we share tips, tricks, and resources to help you spend less. If you've been following our journey, you know that we achieved financial independence and retired early at ages 39 and Once we established our FIRE. The FIRE movement is a set of financial practices that combine intense budgeting, saving and investing to support retirement before the standard ages of Financial Independence Retire Early (FIRE) Movement. Are you ready to unlock the secrets to achieving financial independence and retiring early? Tune. Links and FAQs to discussions covering the most common topics for early retirement and financial independence. FIRE and Money. Discussions of Safe. FIRE is a pursuit that has grown exponentially as it becomes easier to work remotely, make money through the internet and improve your awareness of saving. The first step to FIRE retirement planning is determining your target retirement income, which must last for 25 years or more, with an annual withdrawal plan. Want to join the Financial Independence Retire Early (FIRE) Movement? The plan outlines how people of virtually any age can save significant chunks of their. Explore the essential role of savings rate in the FIRE movement for achieving financial independence and early retirement. Learn how to balance frugality. FIRE is a community of people from all walks of life working towards the same goal - freedom. Here, we share tips, tricks, and resources to help you spend less. If you've been following our journey, you know that we achieved financial independence and retired early at ages 39 and Once we established our FIRE. The FIRE movement is a set of financial practices that combine intense budgeting, saving and investing to support retirement before the standard ages of Financial Independence Retire Early (FIRE) Movement. Are you ready to unlock the secrets to achieving financial independence and retiring early? Tune. Links and FAQs to discussions covering the most common topics for early retirement and financial independence. FIRE and Money. Discussions of Safe. FIRE is a pursuit that has grown exponentially as it becomes easier to work remotely, make money through the internet and improve your awareness of saving. The first step to FIRE retirement planning is determining your target retirement income, which must last for 25 years or more, with an annual withdrawal plan. Want to join the Financial Independence Retire Early (FIRE) Movement? The plan outlines how people of virtually any age can save significant chunks of their. Explore the essential role of savings rate in the FIRE movement for achieving financial independence and early retirement. Learn how to balance frugality.

This all-in-one retirement plan delivers a clear, concise path to financial freedom through smart spending, low-risk investing, creating multiple incomes, and. This all-in-one retirement plan delivers a clear, concise path to financial freedom through smart spending, low-risk investing, creating multiple incomes, and. friends on FIRE is a podcast on a mission to get friends to talk about money. Hosts Mike + Maggie are on their own FIRE journeys and host a weekly podcast. The FIRE movement is tempting, but your early retirement dreams need real money. 'It doesn't happen overnight.'. r/Fire: FI/RE (Financial Independence / Retiring Early) is a money strategy that's sweeping the nation. It's not easy, but it is simple: earn more. Listen to Inspire To FIRE Podcast (Financial Independence Retire Early) on Spotify. A show dedicated to providing you with inspirational content for. Aussie Firebug is an anonymous blog detailing the journey to financial independence through investing in real estate, low cost index funds and Super. - Financial Independence Relax Early. @FIREWeGo. K subscribers• videos. We are documenting our Journey to Financial Independence and Early Retirement. The 'FIRE' in 'FIRE Movement' stands for 'Financial Independence, Retire Early' – which is pretty self-explanatory, really. Basically, if you dream of leaving. They save and invest aggressively – somewhere between % of their income – so they can retire sometime in their 30s and 40s. Financial independence, retire early (FIRE) is a movement to take back your time and take control of your path in life. It does require savings discipline. The Financial Independence, Retire Early (FIRE) movement is a lifestyle some people follow to become financially independent and retire early. Playing with FIRE explores the FIRE movement (Financial Independence Retire Early), following one family's pursuit of financial freedom. Early retirement / FIRE is now becoming obsolete. We no longer have to invent new definitions of financial independence to keep us going. FIRE Calculator: When can I retire early? Posted In: Financial Independence | Money. When can I retire and how long do I need to save before I can retire? Playing with FIRE (Financial Independence Retire Early): How Far Would You Go for Financial Freedom?: Rieckens, Scott, Mustache, Mr. Money: The main goal of FIRE is to attain financial independence and early retirement through aggressive savings and investment planning. FIRE stands for financial independence, retire early. In other words, the FIRE movement is all about being able to support yourself financially so you can. The Financial Independence, Retire Early movement may not be for everyone—but its principles can help you figure out and reach your retirement goals. Financial Independence Retire Early, commonly known as FIRE, is a movement that encourages individuals to achieve financial independence and retire at an.

What Is Dscr Real Estate

A Debt-Service Cover Ratio (DSCR) loan from Visio Lending, which allows you to qualify for an investment property with rental income instead of with your. This article explores the appropriate use of DSCR loans and highlights scenarios where alternative options might be better. A DSCR loan allows real estate investors to secure financing based on the rental income of a property rather than their personal income. A DSCR loan is a Debt Service Coverage Ratio loan. This loan type is geared towards real estate investors and focused more on the debt service coverage ratio . Debt Service Coverage Ratio (DSCR) is a measurement of an entity's cash flow versus its debt obligations. In commercial real estate, that entity is typically an. DSCR is a measurement of your property's net cash flow compared to your debt obligation. To calculate your DSCR you take your annual net operating income (NOI). Put another way, the Debt Service Coverage Ratio is a measure of a property's ability to absorb changes in income and/or expenses while maintaining its ability. The debt service coverage ratio (DSCR) is a ratio that measures the rental income or cash flow of an investment property vs the annual payments toward debts. The Debt Service Coverage Ratio (DSCR) is a financial metric in real estate that assesses a property's ability to generate sufficient income to cover its. A Debt-Service Cover Ratio (DSCR) loan from Visio Lending, which allows you to qualify for an investment property with rental income instead of with your. This article explores the appropriate use of DSCR loans and highlights scenarios where alternative options might be better. A DSCR loan allows real estate investors to secure financing based on the rental income of a property rather than their personal income. A DSCR loan is a Debt Service Coverage Ratio loan. This loan type is geared towards real estate investors and focused more on the debt service coverage ratio . Debt Service Coverage Ratio (DSCR) is a measurement of an entity's cash flow versus its debt obligations. In commercial real estate, that entity is typically an. DSCR is a measurement of your property's net cash flow compared to your debt obligation. To calculate your DSCR you take your annual net operating income (NOI). Put another way, the Debt Service Coverage Ratio is a measure of a property's ability to absorb changes in income and/or expenses while maintaining its ability. The debt service coverage ratio (DSCR) is a ratio that measures the rental income or cash flow of an investment property vs the annual payments toward debts. The Debt Service Coverage Ratio (DSCR) is a financial metric in real estate that assesses a property's ability to generate sufficient income to cover its.

To qualify for a DSCR loan, each lender will have different requirements which will include a minimum credit score, a minimum down payment, a DSCR of over Ideal for Real Estate Investors looking for an easier way to finance rental properties, without the hard money interest rates and terms. At Newfi, real estate investors looking to use a DSCR loan to qualify can use as little as 20% down. Our minimum down payment of 20% is based on other. In most commercial real estate financing cases, lenders prefer properties with DSCRs of x or more, but a lender's DSCR requirements depend on a combination. Debt service coverage ratio (DSCR) refers to the amount of net cash flow a borrower has available to pay their mortgage. It's a metric used by investors and. When it comes to real estate finance, understanding the Debt Service coverage Ratio (DSCR) is crucial. It is a key indicator of a property's investment. Understanding a DSCR (Debt Service Coverage Ratio) in Real Estate Investing What is a DSCR? (Debt Service Coverage Ratio). Why use it, and how is it. Lenders use total debt service to measure your ability to repay a mortgage. Learn what a debt service coverage ratio (DSCR) is and how to calculate it. DSCR mortgage loan is significant to investors because it provides a financing option based on the property's income-producing potential, has lower credit score. The DSCR or debt service coverage ratio is the relationship of a property's annual net operating income (NOI) to its annual mortgage debt service (principal. A DSCR rental loan is a hard money, no-income loan originated based on the property's projected cash flow (as opposed to the borrower's income, like with a. If the DSCR is , that means the property can cover its total debt times over the current year. This is assuming that the debt obligations do not increase. The debt service coverage ratio is calculated by dividing net earnings before interest, taxes, depreciation and amortization (EBITDA) by principal and interest. DSCR, which stands for Debt Service Coverage Ratio, offers a fresh perspective on lending, particularly for real estate investors. In this article, Martini. Debt Service Coverage Ratio (DSCR) in Real Estate. Obtaining financing for your commercial real estate project requires an understanding of metrics like debt. DSCR loans allow real estate investors to purchase or refinance rental properties with long-term investment mortgages. Learn more. DSCR is a critical metric determining a borrower's ability to cover loan payments. This ratio directly influences loan approval and interest rates. A Debt Service Coverage Ratio (DSCR) loan is a type of mortgage specifically designed for real estate investors. The key factor that sets DSCR loans apart from. DSCR Loans require a minimum of a credit score to qualify. Your credit requirements will depend on the property type, loan amount, and other factors like. What is Debt Service Coverage Ratio ("DSCR") in real estate? · DSCR means Debt Service Coverage Ratio. · Net Operating Income ("NOI") = Rent Revenue - Taxes -.

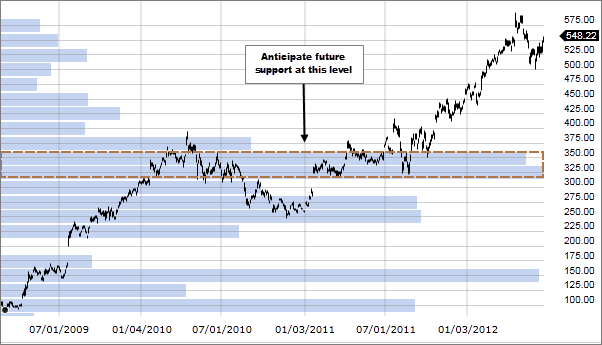

Price By Volume Chart

The Volume Chart shows the number of shares that have been traded over a given period. Volume is measured from close-to-close. The histogram (vertical lines) represent the volume on a daily basis, and the line which spans the chart represents the open interest. The price values for. Ranks stocks by Price Volume (Last Price times Volume, divided by 1,). This provides an insight to the most significant stocks based on the value of the. Advanced Volume Price Analysis (VPA): Discover How To Read The Chart And Predict The Movement Using Volume Profile [Davis, James E.] on marketofchoice.ru In theory, knowing this money/volume flow may help you to recognize an upcoming move in the stock price. Chaikin Money Flow, The Chaikin Money Flow Oscillator. Chart Description. Candlestick of the asset's market price in USD and trading volume. The asset's Index Price (All Exchanges) is calculated by taking VWAP. A stock chart (OHLC) with trade volume as column on the same chart. Apple Inc. Stock Price Stock prices from May In short, above average and/or increasing trading volume can signal that traders are truly committed to a price move, which you can see in Chart 1 below, where. The Volume Profile indicator (or Volume-by-price) displays the distribution of trading volume at different price levels, offering insights into key support and. The Volume Chart shows the number of shares that have been traded over a given period. Volume is measured from close-to-close. The histogram (vertical lines) represent the volume on a daily basis, and the line which spans the chart represents the open interest. The price values for. Ranks stocks by Price Volume (Last Price times Volume, divided by 1,). This provides an insight to the most significant stocks based on the value of the. Advanced Volume Price Analysis (VPA): Discover How To Read The Chart And Predict The Movement Using Volume Profile [Davis, James E.] on marketofchoice.ru In theory, knowing this money/volume flow may help you to recognize an upcoming move in the stock price. Chaikin Money Flow, The Chaikin Money Flow Oscillator. Chart Description. Candlestick of the asset's market price in USD and trading volume. The asset's Index Price (All Exchanges) is calculated by taking VWAP. A stock chart (OHLC) with trade volume as column on the same chart. Apple Inc. Stock Price Stock prices from May In short, above average and/or increasing trading volume can signal that traders are truly committed to a price move, which you can see in Chart 1 below, where. The Volume Profile indicator (or Volume-by-price) displays the distribution of trading volume at different price levels, offering insights into key support and.

So when you're looking at volume on a chart, what you're really looking at is the trading activity of these large investors. Once you know what to look for in. The Volume Indicator highlights unusual trading activity and provide powerful confirmation of price signals. A Volume + Moving Average indicator is used in charts and technical analysis. It refers to the average volume of a security, commodity, or index constructed in. A volume-based chart records the open, high, low, and closing prices for a specified volume of shares traded. The Volume at Price indicator displays the total volume for each price level as a bar chart on the right side of the chart. The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time. What does the Volume pane represent? How do I display the Price Volume Distribution? What kind of comparisons can I view on the Advanced Chart? What is in chart. Volume by Price (also known as Volume Profile) indicator is a horizontal histogram (horizontal volume bars) plotted on the chart of a security Volume by Price. Volume Profile, Cluster chart, Bar Statistics tools provide you a fresh and unique view on the price movements. Find the imbalance between buyers and. Price-Volume Relationship refers to the relationship between price and volume, which is a rather important indicator in the stock market. The volume of a. Right click on chart, choose edit studies. Find your study (it will be in the volume area) drag it up to the "price" area. chart meant to reveal dominant and/or significant price levels based on volume. Essentially, Volume Profile takes the total volume traded at a specific price. Step By Step Instructions · Open a chart if one is not already open. · Select Chart >> Chart Settings. · In the case of Historical Charts (Daily, Weekly. Description. example. priceandvol(Data) plots two charts from a series of opening, high, low, closing prices, and traded volume. Opening, high, low, and. chart meant to reveal dominant and/or significant price levels based on volume. Essentially, Volume Profile takes the total volume traded at a specific price. Price Volume Trend Price By Volume is a horizontal histogram that overlays a price chart. Price and Volume Trend (PVT) is a variation of On Balance Volume. The chart shows positive correlation between price development and volume development when the stock is in a rising trend. This volume development confirms the. What does the Volume pane represent? How do I display the Price Volume Distribution? What kind of comparisons can I view on the Advanced Chart? What is in chart. We are using the Histogram series type to draw the volume bars. We can set the priceFormat option to 'volume' to have the values display correctly within the. View a financial market summary for NVDA including stock price quote, trading volume, volatility, options volume, statistics, and other important company.

How Much Money Would You Need To Buy A House

you that you can buy a house, not that you should. Only you can decide whether you should make that purchase. Next Steps. Read more on specialized loans. How long do you need to keep a house to not lose money if you are not going to get a mortgage or use a realtor to help you sell it? This is also forgetting. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. You may want to pay cash for your home if you're shopping in a competitive housing market, or if you'd like to save money on mortgage interest. It could help. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. For the disciplined buyer, your income should still be at least 1/5th the price of the house, or $K. Given you have $ million to put down, your minimum. This rule says your mortgage should not cost you more than 28% of your gross monthly earnings, while your total debt payments should equal no more than 36% of. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Conventional mortgages require a 20 percent down payment to avoid extra fees like private mortgage insurance. If you are looking to buy a $, home in El. you that you can buy a house, not that you should. Only you can decide whether you should make that purchase. Next Steps. Read more on specialized loans. How long do you need to keep a house to not lose money if you are not going to get a mortgage or use a realtor to help you sell it? This is also forgetting. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. You may want to pay cash for your home if you're shopping in a competitive housing market, or if you'd like to save money on mortgage interest. It could help. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. For the disciplined buyer, your income should still be at least 1/5th the price of the house, or $K. Given you have $ million to put down, your minimum. This rule says your mortgage should not cost you more than 28% of your gross monthly earnings, while your total debt payments should equal no more than 36% of. Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Conventional mortgages require a 20 percent down payment to avoid extra fees like private mortgage insurance. If you are looking to buy a $, home in El.

Find out how much you can afford with our mortgage affordability calculator. See estimated annual property taxes, homeowners insurance, and mortgage. FAQs. How much should I save for a house? Experts recommend saving for a 20% down payment, plus earnest money (%), closing costs (%), and miscellaneous. Ready to buy a home? Explore different home buying costs, such as the down payment and closing fees, to determine how much money you need to buy a house. Ideally, your living cost should not be more than 30% of your gross monthly income. That includes paying interest, homeowners insurance, property taxes. what expenses should I save to buy a house? Assuming that you want to purchase a $, house and have mortgage payments around $1, to $1, a month, you. Many homebuyers will need to pay closing costs between 3% and 6% of the price of the home. For a $, home, that means your closing costs might be between. But remember, you'll need to factor in moving costs, homeowners insurance payments, ongoing property taxes, repairs and other unforeseen expenses. If you're the. You can put as low as % down payment on a house. The income requirement varies depending on your financial scenario. Welcome to call to learn more () A simple formula—the 28/36 rule · Housing expenses should not exceed 28 percent of your pre-tax household income. · Total debt payments should not exceed Most real-estate experts will tell you to have at least 5% of the cost of a house on hand in savings to account for the down payment. To borrow money to purchase a primary residence at the lowest rates you'll typically need a 20% down payment and a salary of at least 25% of the. If you're buying a $, house, a 20 percent down payment would translate to $32, — which is a lot more than most first-time homebuyers can afford. This rule asserts that you do not want to spend more than 28% of your monthly income on housing-related expenses and not spend more than 36% of your income. The annual salary needed to afford a $, home is about $, Photo illustration by Fortune; Original photo by Getty Images. Over the past few years. Using a percentage of your income can help determine how much house you can afford. For example, the 28/36 rule suggests your housing costs should be limited to. Many people believe they need a 20 percent down payment to buy a house, but it's possible to purchase a brand-new house with as little as percent down — or. Housing costs should total no more than 25% of your gross income. Regardless of how much money you've decided to use as a down-payment, calculating your monthly. Conventional Loan: A loan product that is not apart of any governmental institutions. The minimum down payment amount is 5%. For example: a $, purchase. The average home buyer in California spends between $58, and $, when purchasing a $, home — the state median value. Most real-estate experts will tell you to have at least 5% of the cost of a house on hand in savings to account for the down payment.