marketofchoice.ru Learn

Learn

Pktx Stock

Find the latest ProtoKinetix Inc (PKTX) discussion and analysis from iHub's community of investors. ProtoKinetix Incorporated's (PKTX) stock price is. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume70, · Dividend- · Dividend Yield- · Beta · YTD % Change Overall, ProtoKinetix, Inc. stock has a Growth Grade of F, Momentum Grade of D. Whether or not you should buy ProtoKinetix, Inc. stock will ultimately depend. ProtoKinetix Inc (PKTX) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Get the latest Protokinetix, Inc. (PKTX) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. The current price of PKTX is USD — it has decreased by −% in the past 24 hours. Watch ProtoKinetix, Inc. stock price performance more closely on the. Stock analysis for ProtoKinetix Inc (PKTX:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. View today's Protokinetix Inc stock price and latest PKTX news and analysis. Create real-time notifications to follow any changes in the live stock price. Find the latest ProtoKinetix Inc (PKTX) discussion and analysis from iHub's community of investors. ProtoKinetix Incorporated's (PKTX) stock price is. Key Stats · Market CapM · Shares OutM · 10 Day Average Volume70, · Dividend- · Dividend Yield- · Beta · YTD % Change Overall, ProtoKinetix, Inc. stock has a Growth Grade of F, Momentum Grade of D. Whether or not you should buy ProtoKinetix, Inc. stock will ultimately depend. ProtoKinetix Inc (PKTX) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. Get the latest Protokinetix, Inc. (PKTX) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. The current price of PKTX is USD — it has decreased by −% in the past 24 hours. Watch ProtoKinetix, Inc. stock price performance more closely on the. Stock analysis for ProtoKinetix Inc (PKTX:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company profile. View today's Protokinetix Inc stock price and latest PKTX news and analysis. Create real-time notifications to follow any changes in the live stock price.

Get the latest ProtoKinetix, Inc. (PKTX) real-time quote, historical performance, charts, and other financial information to help you make more informed. Stock; PKTX; Disclosure. PKTX. ProtoKinetix, Inc. Common Stock. %. / (1 x 1). Real-Time Best Bid & Ask: pm 08/05/ ProtoKinetix, Incorporated (PKTX.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock ProtoKinetix, Incorporated | Other. PKTX, $PKTX, stock technical analysis with charts, breakout and price targets, support and resistance levels, and more trend analysis indicators. ProtoKinetix (PKTX) Stock Price & Analysis ; Previous Close$ ; VolumeK ; Average Volume (3M)K ; Market Cap. $M ; Enterprise Value$M. PKTX - ProtoKinetix, Incorporated Stock - Stock Price, Institutional Ownership, Shareholders (OTCPK). Shareholder Returns Return vs Industry: PKTX underperformed the US Biotechs industry which returned % over the past year. Return vs Market: PKTX. PKTX PROTOKINETIX INC. 15min Delay Close Aug 12 ET. + +%. Market CapM. P/E (TTM) The latest ProtoKinetix stock prices, stock quotes, news, and PKTX history to help you invest and trade smarter. Find the latest ProtoKinetix, Incorporated (PKTX) stock quote, history, news and other vital information to help you with your stock trading and investing. ProtoKinetix Inc. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), $ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Protokinetix, Inc. is a research and development stage biotechnology company engaged in the scientific medical research of anti-aging glycoproteins. The company. Protokinetix (PKTX) stock price prediction is USD. The Protokinetix stock forecast is USD for September 07, Sunday;. ProtoKinetix's stock was trading at $ at the beginning of Since then, PKTX shares have decreased by % and is now trading at $ View the. Get ProtoKinetix Inc (marketofchoice.ru) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. Discover real-time Protokinetix, Inc. (PKTX) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Volume, K. Market Value, $M. Shares Outstanding, M. EPS (TTM), $ P/E Ratio (TTM), N/A. Dividend Yield, N/A. Latest Dividend, N/A. Track ProtoKinetix, Inc. (PKTX) Stock Price, Quote, latest community messages, chart, news and other stock related information. Get the latest ProtoKinetix, Incorporated (PKTX) stock price quote with financials, statistics, dividends, charts and more. Stay updated on PROTOKINETIX INC (PKTX) with the latest stock news, press releases, earnings reports and financial insights. Get in-depth analysis and.

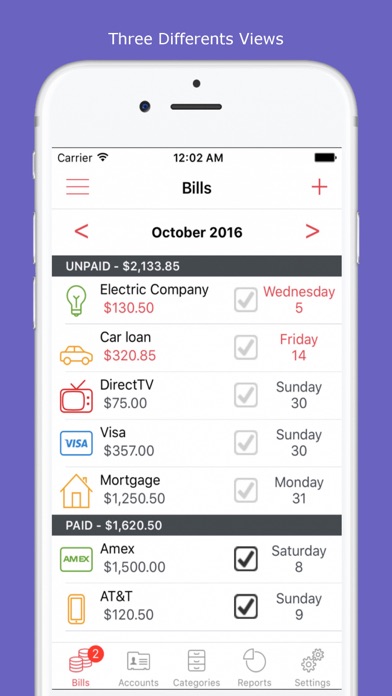

Best App For Bills And Money

TIMELY BILLS: BILLS, BUDGET & EXPENSE TRACKER - ONE OF THE MOST COMPLETE BUDGETING APPS FREE. All in one money manager trusted by 1M+ users. One of the best. EveryDollar is the best way to budget with confidence, track transactions, and get insights into your spending and savings habits. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. Say hello to your new financial companion, Buddy. The joyful budgeting app. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more. app from its app store. OK. Gain a clear view of your finances. See how you Discuss your financial needs on a day and at a time that work best for you. Check out Prism Bills & Money, which allows you to link all your bill accounts and view due dates, amounts, and payment statuses in one place. TimelyBills - Best Budget App for Daily Life · Stay focused on your Financial Priorities · The only Home Budget app that gets your money into shape · How budget. Six of the Best Budgeting Apps · 1. Best Overall: You Need a Budget · 2. Best for Beginners: Simplifi and Tiller · 3. Best App for Investors: Empower · 4. Best. TIMELY BILLS: BILLS, BUDGET & EXPENSE TRACKER - ONE OF THE MOST COMPLETE BUDGETING APPS FREE. All in one money manager trusted by 1M+ users. One of the best. EveryDollar is the best way to budget with confidence, track transactions, and get insights into your spending and savings habits. We recommend three apps above all others: Simplifi, which is best for most people, Quicken Classic if you want to manage your money in more detail, and YNAB. Say hello to your new financial companion, Buddy. The joyful budgeting app. Chase online lets you manage your Chase accounts, view statements, monitor activity, pay bills or transfer funds securely from one central place. To learn more. app from its app store. OK. Gain a clear view of your finances. See how you Discuss your financial needs on a day and at a time that work best for you. Check out Prism Bills & Money, which allows you to link all your bill accounts and view due dates, amounts, and payment statuses in one place. TimelyBills - Best Budget App for Daily Life · Stay focused on your Financial Priorities · The only Home Budget app that gets your money into shape · How budget. Six of the Best Budgeting Apps · 1. Best Overall: You Need a Budget · 2. Best for Beginners: Simplifi and Tiller · 3. Best App for Investors: Empower · 4. Best.

TimelyBills budget tracker and money manager app help you create a budget and organize bills to achieve financial freedom. Get our FREE bills reminder app. MoneyPatrol Is The Best FREE Money Management Application MoneyPatrol provides a comprehensive suite of tools and features that cover all aspects of personal. Budgeting How to budget, find the best deals and switch to save money · Buying Download app: WhatsApp. For help sorting out your debt or credit. Looking to make your money go further? These are some of the most popular budgeting and savings apps available in Australia today. Money Manager makes managing personal finances as easy as pie! Now easily record your personal and business financial transactions, generate spending reports. SoFi helps you set budgets, categorize your spending, and spot upcoming bills - all for free. Get started. The insights you've always wanted. Stay on top of. Rocket Money - Bills & Budgets 4+ · Subscription & Expense Manager · Rocket Money · iPhone Screenshots · Description · What's New · Ratings and Reviews · App Privacy. The best budgeting apps assist you in tracking income and spending, planning out expenses and monitoring debt payoff or investment goals. Use your money more efficiently and control your spending and saving with the YNAB app great if you could use last month's pay for this month's bills? Best budgeting apps · Best app for planners: Simplifi by Quicken · Best app for serious budgeters: You Need a Budget (YNAB) · Best app for investors: Empower. As someone who was totally new to budgeting, Habit Money has been game changer for me. I have my own personal coach who has made the whole budgeting experience. MoneyPatrol is a comprehensive bills management app that helps you stay organized and in control of your finances. With MoneyPatrol, you can easily track. Our guide looks at eight popular options that help New Zealanders to manage their money and make better financial decisions. The best money tracker appNavigate your finances with confidence. Track spending, budgets, investments, net worth. · The reviews speak for themselves · Copilot. MoneyPatrol is a comprehensive bills management app that helps you stay organized and in control of your finances. With MoneyPatrol, you can easily track. Online money management software for tracking expenses, budgets, bill reminders, investments, forecasting, financial planning & more. Honeydue is the simplest way for couples to manage money, together. We reviewed and compared features and costs from the best budgeting apps. This list will help you find the best budgeting apps to fit your needs. Separate the money you have for bills, savings and spending to see exactly what you've got left each month. Squirrel can even look after your money and deliver.

Types Of Securities Frauds

Social Media/Internet Investment Fraud · Promises of high returns with no risk. Many online scams promise unreasonably high short-term profits. · Offshore. Securities fraud can be punished both with civil penalties, such as fines or license restriction, as well as criminal penalties, such as fines and prison. Fines. Phishing attacks, identity theft, Ponzi schemes, credit card fraud, and ransomware attacks are typical examples of investment fraud. You can turn to a Fort. Common types of securities fraud include insider trading, accounting fraud, churning, and misrepresentation. Federal securities fraud charges can be filed. Types of Federal Securities Fraud Schemes There are many different types of behavior that could be considered a federal securities fraud offense, but the most. Types of Investment Scams · AI-related Scam · Investment Fraud via Social Media · Gold Scam · Crypto Asset-related Scam · Ponzi Scheme · Pig Butchering Scams · Pump &. Investment fraud comes in many forms. Whether you are a first-time investor or have been investing for many years, here are some basic facts you should know. Securities fraud is typically a federal crime involving a fraudulent scheme related to a stock or bond. Securities fraud is described as defrauding someone. Unregistered Fraudulent Activity · Market Manipulation / "Pump and Dump" Scams · Unregistered Securities Offerings · Scam Pre-IPO's · Scam Private Placements · Prime. Social Media/Internet Investment Fraud · Promises of high returns with no risk. Many online scams promise unreasonably high short-term profits. · Offshore. Securities fraud can be punished both with civil penalties, such as fines or license restriction, as well as criminal penalties, such as fines and prison. Fines. Phishing attacks, identity theft, Ponzi schemes, credit card fraud, and ransomware attacks are typical examples of investment fraud. You can turn to a Fort. Common types of securities fraud include insider trading, accounting fraud, churning, and misrepresentation. Federal securities fraud charges can be filed. Types of Federal Securities Fraud Schemes There are many different types of behavior that could be considered a federal securities fraud offense, but the most. Types of Investment Scams · AI-related Scam · Investment Fraud via Social Media · Gold Scam · Crypto Asset-related Scam · Ponzi Scheme · Pig Butchering Scams · Pump &. Investment fraud comes in many forms. Whether you are a first-time investor or have been investing for many years, here are some basic facts you should know. Securities fraud is typically a federal crime involving a fraudulent scheme related to a stock or bond. Securities fraud is described as defrauding someone. Unregistered Fraudulent Activity · Market Manipulation / "Pump and Dump" Scams · Unregistered Securities Offerings · Scam Pre-IPO's · Scam Private Placements · Prime.

Types of Securities Fraud · Insider trading (trading based on information that is not available to the public) · Accounting fraud (keeping inaccurate books or. How Marketable Treasury Securities Work · Scams Involving Treasury Securities · Examples of Known Phony Securities · Historical Bond Fraud · Prime Bank Instrument. Types of Fraud · Affinity Fraud · Advance Fee Fraud · Binary Options Fraud · High Federal and state securities laws require investment professionals and firms. Types of Stock Market Frauds · Shell Companies · Boiler Rooms · Pump and Dump · Insider Trading · Churning · Financial Statement Frauds. Examples of securities fraud include Ponzi schemes, pyramid schemes, and late-day trading. Securities fraud can also include false information, pump-and-dump. Affinity Fraud · Binary options scams · Boiler rooms · COVID scams · Crypto scams · Double dip or repeat scam · Email or text messaging spam · Exempt securities. Missing documentation: If someone tries to sell you a security with no documentation—that is, no prospectus in the case of a stock or mutual fund, and no. Pump and Dump: This fraud occurs when someone acquires control of a large amount of a company's stock and then pumps up the price. They then provide misleading. The primary goal of the Securities Division of the Office of the Attorney General is to protect South Carolina investors from fraud and misrepresentation and. Securities Fraud. The Securities and Exchange Commission (SEC) is the United States agency with primary responsibility for enforcing federal securities laws. According to the FBI, some of the most common forms of securities fraud are pyramid schemes, Ponzi schemes, advance fee schemes, and market manipulation fraud. Securities fraud is the misrepresentation or omission of information to induce investors into trading securities. Overview. While always actionable under. Securities fraud is a broad category that includes theft or embezzlement from investors, manipulation of stock, misstatements of a public company's financial. (August ) In fiscal year , there were securities and investment fraud offenders sentenced under the guidelines. Securities and investment fraud has. Securities fraud includes all types of illegal money-making scams like pyramid schemes, manipulation of securities, high-yield investment programs. By learning about the different kinds of securities fraud and being able to recognize the warning signs, you can avoid becoming a victim. There are many. Common types of financial fraud · Recruitment fraud · Advance fee fraud · Romance scams · Debit card fraud · Advisor imposter fraud · Investment fraud · Phishing. Pump-and-Dump: This is a scheme in which a fraudster deliberately buys shares of a very low-priced stock of a small, thinly traded company and then spreads. Securities fraud happens when corporations or their representatives mislead investors about the value of their securities. Corporate misconduct including. A particular kind of computer fraud is called the salami technique. In the salami technique, criminals steal money or resources a bit at a time. Two different.

What Is The Best Market To Trade

The best trading strategies depend on how and when you prefer to trade. See our list of common trading strategies here, complete with tips to help you. Live Trading by TraderTV Live · TraderTVLIVE Channel Trailer · LIVESTREAM TRADING · #HowToTrade · Shorts · It's September! 🕶️Market Selloff, iPhone 16 Reveal , Tech. One of the best markets to trade for beginners is Forex which is available hours a day, 5 days per week and can be entered into with a relatively small. A liquid stock market, NYSE is the global leader in market quality. As the world's markets evolve, NYSE responds with leading trading technology. Crude Oil is a futures market. There are some things that you need to be aware of to trade it correctly. And we have some key setups to show you, including the. Market makers provide liquidity, ensuring investors can trade in all market conditions. Learn how market makers drive better outcomes for investors. What are the Best Markets for Trend Following Traders? · Stocks: S&P, SSE Comp., Nikkei , DAX, AAPL, TSLA, FB, etc. · Bonds/Interest Rates: Eurodollar, Year. SPDR S&P ETF (SPY) is usually the most actively traded symbol in the entire market. It tracks the S&P index. The Invesco QQQ Trust (QQQ) follows the. The U.S./London markets overlap (8 a.m. to noon EST) has the heaviest volume of trading and is best for trading opportunities. The Sydney/. The best trading strategies depend on how and when you prefer to trade. See our list of common trading strategies here, complete with tips to help you. Live Trading by TraderTV Live · TraderTVLIVE Channel Trailer · LIVESTREAM TRADING · #HowToTrade · Shorts · It's September! 🕶️Market Selloff, iPhone 16 Reveal , Tech. One of the best markets to trade for beginners is Forex which is available hours a day, 5 days per week and can be entered into with a relatively small. A liquid stock market, NYSE is the global leader in market quality. As the world's markets evolve, NYSE responds with leading trading technology. Crude Oil is a futures market. There are some things that you need to be aware of to trade it correctly. And we have some key setups to show you, including the. Market makers provide liquidity, ensuring investors can trade in all market conditions. Learn how market makers drive better outcomes for investors. What are the Best Markets for Trend Following Traders? · Stocks: S&P, SSE Comp., Nikkei , DAX, AAPL, TSLA, FB, etc. · Bonds/Interest Rates: Eurodollar, Year. SPDR S&P ETF (SPY) is usually the most actively traded symbol in the entire market. It tracks the S&P index. The Invesco QQQ Trust (QQQ) follows the. The U.S./London markets overlap (8 a.m. to noon EST) has the heaviest volume of trading and is best for trading opportunities. The Sydney/.

trades markets. Over 60 million people use our social network and supercharged supercharts to make better, brighter decisions when they trade. Download our. Free stock market game with real-time trading. Create a custom stock game for your class, club, or friends and learn to invest. Best New Ideas · Stocks · IPOs · Mutual Funds · ETFs · Options · Bonds · Commodities Real-time last sale data for U.S. stock quotes reflect trades reported. “Newsquawk has been a great provider of financial news to the benefit of our traders. Newsquawk's effectiveness results from combining speed with the knowledge. The purpose of this article is to provide you with some useful guidelines to help you decide which markets to target based on your current trading needs. Trade execution should be well integrated with the portfolio management process, and although trading strategies will vary on the basis of market and security. The best time to trade the forex market is in the main trading session. Some trades can also be done during the Asian session. A market order is an order to buy or sell a stock at the market's best available price. When the primary goal is to execute the trade immediately, a market. We'll help you trade smarter and be your personal best. Sign up to get offer Forex trading prices can move quickly, especially during volatile market. Trade CFDs or shares – decide which of our products is best for you. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. With over $6 trillion in daily trading volumes, the forex trading market is the largest financial market in the world. The forex market allows market. Best HYSA · Best Free Checking · Student Loans · Personal Loans · Insurance · Car Volume. Avg Vol (3M). Market Cap. P/E Ratio (TTM). 52 Wk Change %. 52 Wk. What's the best technical analysis trading indicator? Shaun Murison Discover how to trade the markets. Explore the range of markets you can trade. The 24 Hour Market is here. Trade TSLA, AMZN, AAPL, and more of your We're available to you 24/7. Become a better investor on the go, right in the app. Where the world charts, chats and trades markets. We're a supercharged super The best trades require research, then commitment. Search markets here. FX is the most liquid market in the world, with unlimited trading opportunities around the clock. Market volatility, volume, and system availability may delay. Wish you had a friend in finance? Now you do. Meet Investmate – an education app packed with informative content on CFD trading. Investmate offers courses. Stock market hours: when is the best time of day to trade shares? · What are the stock market trading hours? · Our stock market hours · Stock market opening times. But the best explanation seems to be that the distribution The housing market, lending market, and even global trade experienced unimaginable decline. Moving averages are undoubtedly among the most popular trading tools and they are great to identify the market direction as well. However, there are a few.

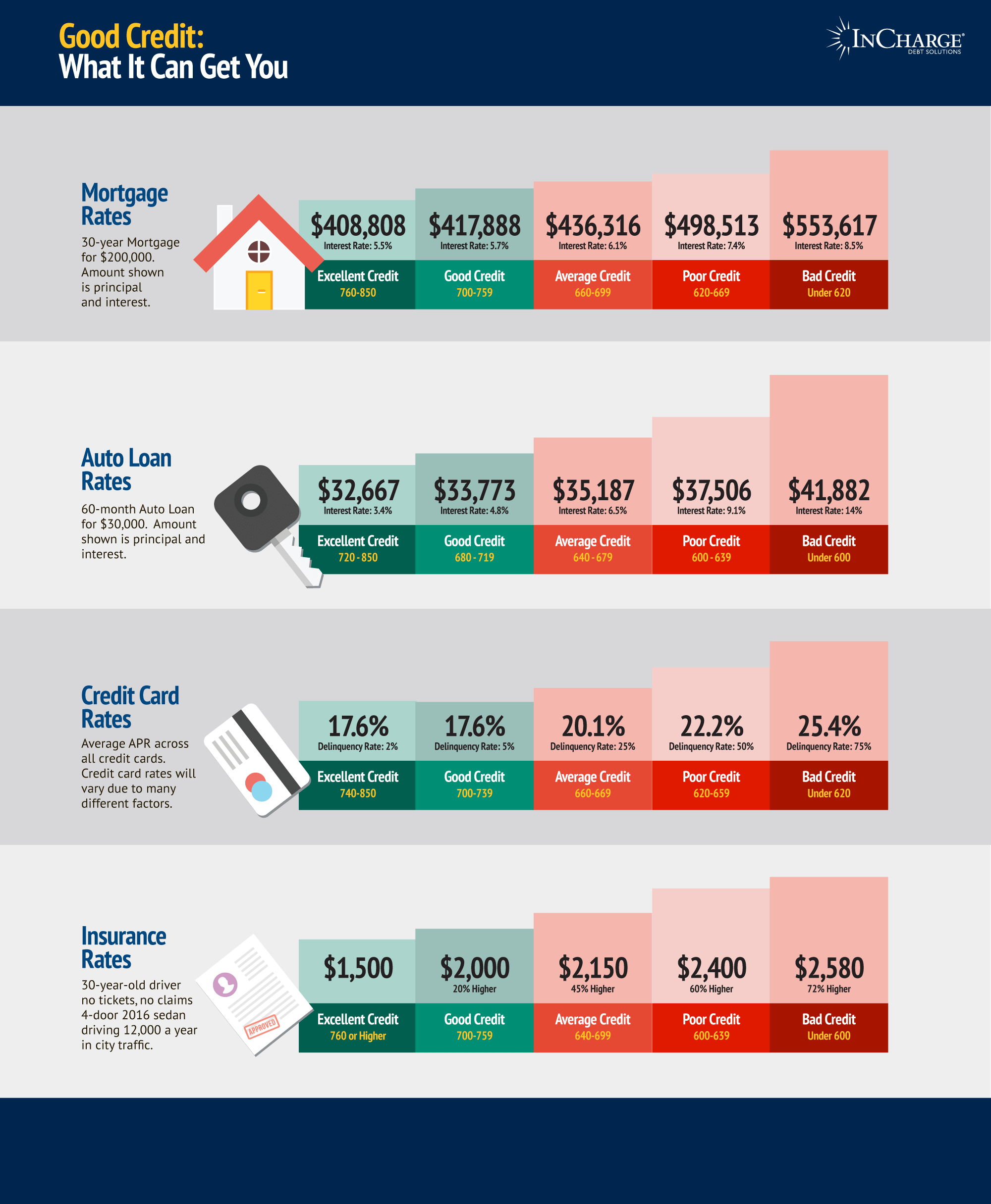

How To Raise Your Auto Fico Score

Although making on-time monthly payments will eventually lead to a higher credit score, most car buyers will first experience a temporary reduction in their. Sometimes, depending on the lender you're using, you can get your credit score updates through your auto loan statements. Even if you can't get an updated. You can improve your FICO Scores by first fixing errors in your credit history (if errors exist) and then following these guidelines to maintain a consistent. To increase your chances of getting better loan options, you can work on improving your credit score by making timely payments, reducing debts, and checking. FICO® Insurance Scores distinguish between a search for a single auto or raise your FICO® Insurance Score over the long term. Check your own credit. If you don't have any active loans, especially any auto loans, adding one to the mix can help your score improve. How fast will a car loan raise my credit. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. But. Have a mix of credit types. FICO prefers to see consumers with both installment loans and credit cards. If you are repaying student loans or have a car loan or. Pick up an affordable car loan. Automotive loans are one of the best and most common ways to improve your credit score. Not only do the loans help you drive a. Although making on-time monthly payments will eventually lead to a higher credit score, most car buyers will first experience a temporary reduction in their. Sometimes, depending on the lender you're using, you can get your credit score updates through your auto loan statements. Even if you can't get an updated. You can improve your FICO Scores by first fixing errors in your credit history (if errors exist) and then following these guidelines to maintain a consistent. To increase your chances of getting better loan options, you can work on improving your credit score by making timely payments, reducing debts, and checking. FICO® Insurance Scores distinguish between a search for a single auto or raise your FICO® Insurance Score over the long term. Check your own credit. If you don't have any active loans, especially any auto loans, adding one to the mix can help your score improve. How fast will a car loan raise my credit. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. But. Have a mix of credit types. FICO prefers to see consumers with both installment loans and credit cards. If you are repaying student loans or have a car loan or. Pick up an affordable car loan. Automotive loans are one of the best and most common ways to improve your credit score. Not only do the loans help you drive a.

Tips for Improving Your FICO® Credit Score · Keep Up with Payments: It's important that you stay current with your bill payments to show potential lenders that. The differences are usually very minor, and monitoring your credit is still an excellent idea to be proactive in improving your score and to remain vigilant. Payment history – 35% Payments made on time raise your credit score, while late payments bring it down. · Credit utilization – 30% Credit utilization measures. Removing negative errors are known to give a pretty sizeable boost to credit scores. Pay down balances, if not pay them off altogether. Having a. Auto FICO Score · Pay your credit cards down consistently. · Pay off any debt that has gone to collections (if applicable). · Keep your credit utilization at or. To increase your chances of getting better loan options, you can work on improving your credit score by making timely payments, reducing debts, and checking. Boosting Your Credit Score to Qualify for an Auto Loan · Get Current on Late Payments and Collection Accounts – · Reduce Credit Card Balances – · Get a Credit Card. 7. Use Different Types of Credit Having multiple types of credit — such as a secured credit card, a refinanced auto loan and a mortgage payment — is good for. How to boost your score Having credit cards and using them isn't a bad thing, but it's important to keep your debt manageable. The best practice is to pay. 4 Tips to Increase Your Credit Score t0 + · 1) Check Your Credit Reports · 2) Optimize Your Credit Utilization Ratio · 3) Get a Secured Credit Card · 4). Improve credit utilization. Lowering your credit utilization ratio will often boost your credit scores, especially if your starting point is above the ideal 30%. Solution Sheet. Learn how the score enables you to: • Gain predictive lift over prior FICO® Auto Scores Check your FICO® ScoreContact us. Those are quick hitters. Installment loans that are paid off have a great effect on your credit score. See if you can get a small, short-term installment loan. Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and. Have credit cards - but manage them responsibly. In general, having credit cards and installment loans (and paying timely payments) will raise your credit score. The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments. Be strategic about applying for new credit, store credit cards or loans. Your credit score may be dinged if the average age of your accounts is too young, or. One of the quickest ways to improve your credit score is to pay down your credit card balances. This can be challenging if you're on a tight budget, but not. Focus On Your Credit Utilization Ratio If You Need A Car Loan Fast. If you are planning to apply for an auto loan in six months or less, there are still a few. HOW CAN YOU IMPROVE YOUR SCORE? · Pay off or pay down on your credit cards · Do not normally close credit cards as it may decrease your capacity · Move your.

When Do Debts Fall Off Credit Report

Third party collection accounts stay on the credit report for seven years from the original delinquency date of the original debt or the date of the first. If a debt collector sends you a collection notice, you have 30 days under federal law to send the collector a letter requesting that it validate the debt if you. Unpaid debts and debts in collections also generally come off your credit reports after seven years. However, it's unwise to leave debts unpaid in the hopes. Stored Value Cards do not report spending and payment habits to a credit reporting Only inaccurate information may be removed from your credit report. How long does information stay on my credit file? Certain debts stay on your credit file for six years. They are taken off even if the debt is not paid. A consumer proposal will be removed from your Equifax credit report 3 years after you've paid off all the debts according to the proposal, or 6 years from. Even if your debt is several years old and the deadline for filing a lawsuit to collect it has expired, your debt still may be reported to the credit reporting. Debt doesn't usually go away, but debt collectors do have a limited amount of time to sue you to collect on a debt. This time period is called the “statute of. A charge-off means your account is written off as a loss. At this point, the account may be assigned or sold to a debt collection agency. The debt collector can. Third party collection accounts stay on the credit report for seven years from the original delinquency date of the original debt or the date of the first. If a debt collector sends you a collection notice, you have 30 days under federal law to send the collector a letter requesting that it validate the debt if you. Unpaid debts and debts in collections also generally come off your credit reports after seven years. However, it's unwise to leave debts unpaid in the hopes. Stored Value Cards do not report spending and payment habits to a credit reporting Only inaccurate information may be removed from your credit report. How long does information stay on my credit file? Certain debts stay on your credit file for six years. They are taken off even if the debt is not paid. A consumer proposal will be removed from your Equifax credit report 3 years after you've paid off all the debts according to the proposal, or 6 years from. Even if your debt is several years old and the deadline for filing a lawsuit to collect it has expired, your debt still may be reported to the credit reporting. Debt doesn't usually go away, but debt collectors do have a limited amount of time to sue you to collect on a debt. This time period is called the “statute of. A charge-off means your account is written off as a loss. At this point, the account may be assigned or sold to a debt collection agency. The debt collector can.

How long does a bankruptcy remain on my credit report? Will TransUnion – 3 years after you have paid off all your debts in the proposal. Equifax and TransUnion state that it takes three years for a consumer proposal to be taken off your credit score after a last payment. That means the faster you. Most negative information generally stays on credit reports for 7 years; Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the. According to the Fair Credit Reporting Act (FCRA), negative items can appear on your credit report for up to 7 years (and possibly more). These include items. How long does information stay on my credit file? Certain debts stay on your credit file for six years. They are taken off even if the debt is not paid. These. 7 to years after the date that you first went "late" i,e, the equipment was due and put into account receivables (i.e. past due debt). If. How do I know what's in my credit report? All three nationwide credit bureaus (Equifax, Experian, and TransUnion) have permanently extended a program that. Once the year period ends, the bankruptcy should fall off your credit reports automatically. debt anymore—it won't be removed from credit reports. Delinquent medical bills can take up to seven years to drop off your record, though the impact on your credit score decreases over time. Don't put the debt. Late payments, collection accounts, and charge-offs can be reported for no more than seven years and six months from the date the debt should have been paid. 5 years starting on the day you became bankrupt, or; 2 years starting on the day you were no longer bankrupt. Court judgment. 5 years. Credit enquiry. Judgments, bankruptcies, and insolvencies show on your credit report for 6 years from the court order date, with some exceptions: Judgments that are paid off. Once the credit reporting time limit has been reached, the negative information should automatically fall off of your credit report. If for some reason it. CHECK FOR 'DEFAULT LISTINGS' · When it is going to expire. Defaults are removed after five years. · That you received the required notices before the default was. your credit cards; your loans; how much money you owe; if you pay your bills on time or late. Why do I have a credit report? In addition, debt payments that fall below the required minimum payment for the period will also be charged off if the debtor doesn't make up for the shortfall. Even if you repay overdue bills, the late payment won't fall off your credit report until after seven years. And no matter how late your payment is, say Even if the court enters a judgment against you for unpaid rent in a small claims court, a small claims judgment alone cannot require you to move out of your. If I pay a debt collection agency the full amount owed, how will my credit report be affected? What should I do if I believe a debt collector has. On the credit report provided to lenders, only the most recent two years of detailed payment information is provided. Lenders will also see limited information.

Real Estate Market Crash

Perhaps no other sector was hit harder in the financial crisis and the Great Recession than the U.S. housing market. As values plummeted millions of. Rise and Fall of the Housing Market The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing. s United States housing bubble The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent. The price of Canadian homes has increased faster than those of any other member of the OECD. Rising interest rates now threaten to bring the market crashing. A housing market crash is as inevitable as an outbound tide although some lunar tides reach higher or retreat further. So this means that although Miami is expensive, it is not in a bubble. The prices are what people are willing and able to pay. Maybe today the rush to find a. Real estate is not liquid, especially in a crash. You need to wait for a buyer and despite the stories, buyers aren't always eager. When real estate crashes. Another factor complicating investments in commercial real estate is that information about specific projects and markets is often difficult to obtain. These. When considering the last decade, from the first quarter of to the first quarter of , Florida's real estate market recorded remarkable appreciation of. Perhaps no other sector was hit harder in the financial crisis and the Great Recession than the U.S. housing market. As values plummeted millions of. Rise and Fall of the Housing Market The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing. s United States housing bubble The s United States housing bubble or house price boom or s housing cycle was a sharp run up and subsequent. The price of Canadian homes has increased faster than those of any other member of the OECD. Rising interest rates now threaten to bring the market crashing. A housing market crash is as inevitable as an outbound tide although some lunar tides reach higher or retreat further. So this means that although Miami is expensive, it is not in a bubble. The prices are what people are willing and able to pay. Maybe today the rush to find a. Real estate is not liquid, especially in a crash. You need to wait for a buyer and despite the stories, buyers aren't always eager. When real estate crashes. Another factor complicating investments in commercial real estate is that information about specific projects and markets is often difficult to obtain. These. When considering the last decade, from the first quarter of to the first quarter of , Florida's real estate market recorded remarkable appreciation of.

If you buy house before the market crashes, it will be worth a lot less that what you paid for it and also you may not be able to find a buyer. Main reason there will not be a crash is due to the lack of inventory and high demand. Demand for housing will remain strong for years to come. The collapse of the United States housing bubble and high interest rates led to unprecedented numbers of borrowers missing mortgage repayments and becoming. a sharp run up and subsequent collapse of house asset prices affecting over half of the US states. In many regions a real estate bubble. In the early eighties, mid-nineties and in , after about 4 years of a recessionary housing market, this repressed demand jumped back in (or "explodes" might. While a housing market crash isn't expected in , it's still a good idea to plan for every eventuality. The financial crisis of – was caused by the bursting of real estate bubbles that had begun in various countries during the s. Market is not going to crash. RE performs well during inflationary periods, inventory will remain low due to people with low rates staying in. In the early eighties, mid-nineties and in , after about 4 years of a recessionary housing market, this repressed demand jumped back in (or "explodes" might. If you buy house before the market crashes, it will be worth a lot less that what you paid for it and also you may not be able to find a buyer. The famous stock market bubble of – has been closely analyzed. Less well known, and far less well documented, is the nationwide real. Economists believe the housing market will slow down here in the Granite State, but not crash soon. Prices will fall, but not to the extent homeowners. In , the housing market bubble burst when subprime mortgages, a huge consumer debt load, and crashing home values converged. Homeowners began defaulting on. However this can all go down the toilet if for some reason I buy at a good cash flowing price in a hot market, then the bubble bursts and forces rent prices. Collapsing home prices from subprime mortgage defaults and risky investments on mortgage-backed securities burst the housing bubble in Rise and Fall of the Housing Market The recession and crisis followed an extended period of expansion in US housing construction, home prices, and housing. Latest Housing Statistics and Real Estate Market Trends. Descriptive · Housing Affordability Index. The Housing Affordability Index measures whether or not a. The market isn't going to crash, supply is really really short, there is limited land to develop on, Millennials (the largest generation) are. America's Frozen Housing Market Is Warping the Economy Cheap mortgages are forcing millions of U.S. homeowners to stay put. That is becoming a problem well. When Will Utah's Housing Market Crash? As of Utah real estate market is in a state of flux, with inventory increasing dramatically and sales declining.

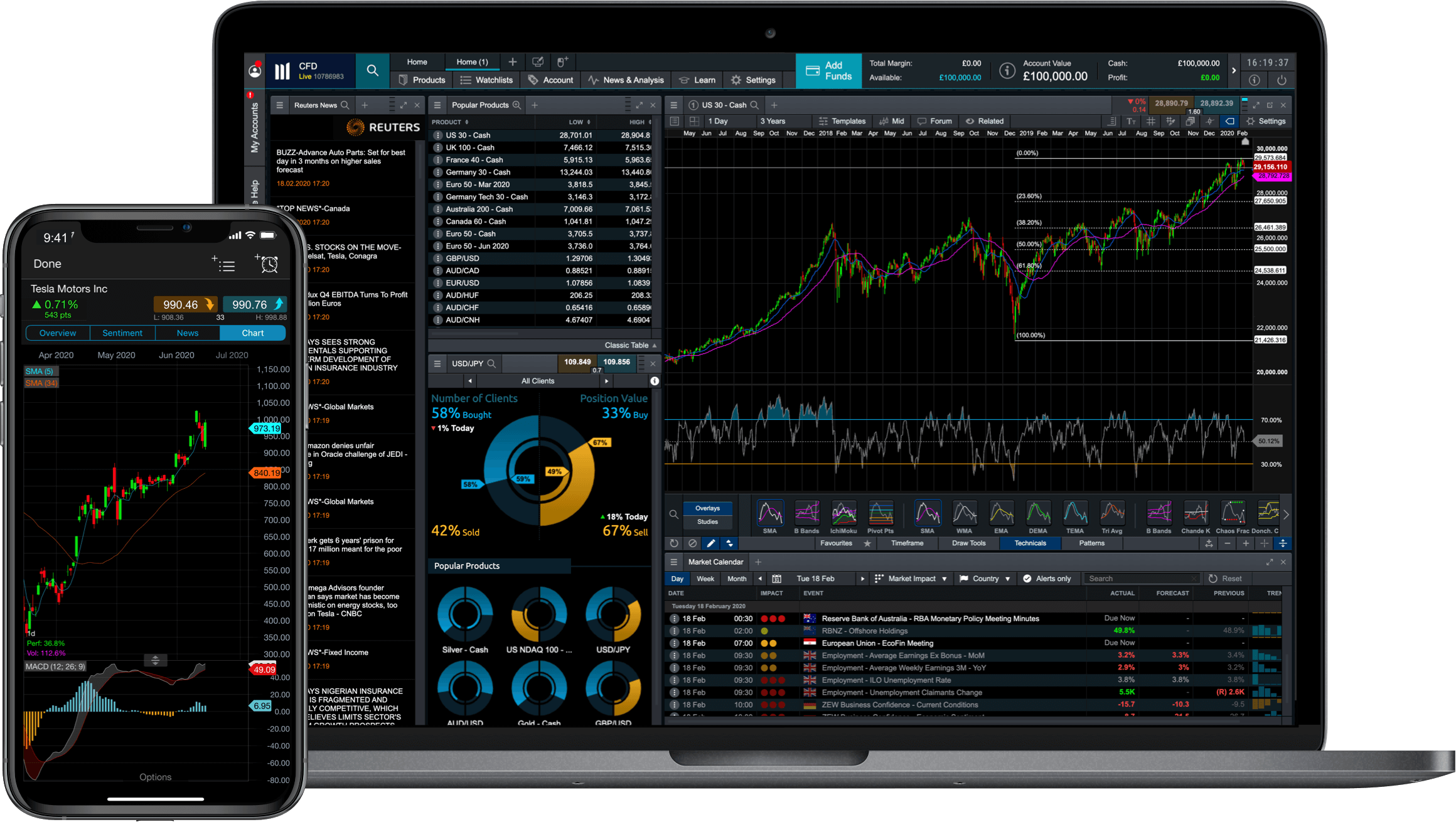

Digital Trading Platforms

Arguably the most popular trading platform, MetaTrader 4 creates a powerful and flexible trading environment. It is suitable for beginners and advanced traders. marketofchoice.ru is the online trading platform that helps you research, execute, and manage your trades quickly and easily. Best online brokerage trading platforms in August · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-Trade · Merrill Edge. Discover Olymp Trade, an online trading platform and broker for trading Forex, stocks, multipliers, indices and more. Get your start in web trading today! Online Trading Platform Market size is projected to reach USD Million by , growing at a CAGR of % during the forecast period Best Brokerage Trading Platforms At A Glance ; Kite · (36) ; TradingView · (60) ; eToro · (25) ; Active Trader Pro · (11) ; TCS BaNCS · (13). Online Trading Systems and Platforms reviews, comparisons, alternatives and pricing. The best Online Trading solutions for small business to enterprises. IBKR offers desktop, mobile and online trading platforms with no platform fees. See which platform is best for your trading skills and investing strategies! Trade Forex Online with OANDA using powerful analysis tools, tight spreads, and low commissions. Learn more about smarter forex trading with OANDA here. Arguably the most popular trading platform, MetaTrader 4 creates a powerful and flexible trading environment. It is suitable for beginners and advanced traders. marketofchoice.ru is the online trading platform that helps you research, execute, and manage your trades quickly and easily. Best online brokerage trading platforms in August · Charles Schwab · Fidelity Investments · Interactive Brokers · Ally Invest · E-Trade · Merrill Edge. Discover Olymp Trade, an online trading platform and broker for trading Forex, stocks, multipliers, indices and more. Get your start in web trading today! Online Trading Platform Market size is projected to reach USD Million by , growing at a CAGR of % during the forecast period Best Brokerage Trading Platforms At A Glance ; Kite · (36) ; TradingView · (60) ; eToro · (25) ; Active Trader Pro · (11) ; TCS BaNCS · (13). Online Trading Systems and Platforms reviews, comparisons, alternatives and pricing. The best Online Trading solutions for small business to enterprises. IBKR offers desktop, mobile and online trading platforms with no platform fees. See which platform is best for your trading skills and investing strategies! Trade Forex Online with OANDA using powerful analysis tools, tight spreads, and low commissions. Learn more about smarter forex trading with OANDA here.

Pursue your goals with stocks, options, ETFs, mutual funds, and more. Easy-to-use tools. Powerful, intuitive platforms. Trade online, through Power E*TRADE, or. The global online trading platform market size was valued at $ billion in & is projected to grow from $ billion in to $ billion by. ETNA Digital Advisor is a white label platform for managing passive investments. Designed for robo-advisors, fund managers and RIAs, ETNA Digital Advisor is a. tastytrade is one of the fastest, most reliable, and secure trading platforms in the US. Available online, to download on your desktop, or as a mobile app. Schwab's online trading platforms help international investors take advantage of investing opportunities in the U.S. market. Some of the most famous trading platforms include MetaTrader, TradingView, and CAPEX WebTrader. MetaTrader 4 and 5. By far one of the most popular currency. An experienced trader looking for an advanced online trading platform to trade in Canadian and US stocks and options, TD Direct Investing has a platform for. An electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products. Access eToro with an easy-to-use web platform and intuitive mobile app. Join eToro today and discover an array of unique features, both on mobile and web. Why trade online with Fidelity · Competitive online commission rates · Free, independent research from 20+ providers · Margin, short selling, and options trading. Check out our selection of online trading platforms and pick your favourite. MT4, MT5, AvaOptions, automated trading software & more. Online trading platform features · Get an instant overview of market prices, spread, and margin with our simple, clean design · Mitigate risk and protect your. Popular Trading Platforms · Interactive Brokers: Interactive Brokers is the most popular trading platform for professionals, with low fees and access to markets. Some of the top trading platforms in the US include Ally Invest, Robinhood, and Firstrade for beginners, Interactive Brokers, TD Ameritrade, and E*TRADE for. Online trading platforms are used to open, manage, and close market positions through an online financial intermediary. Traditionally, these platforms are. Examples of Popular Trading Platforms · Interactive Brokers: Interactive Brokers is an interest-based trading platform for investors with professional knowledge. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Electronic Trading, from LSEG FX, is a powerful suite of products to shape, configure, and automate FX prices to customers while streamlining risk. We offer a range of electronic trading platforms, capable of institutional-grade tools and features through an intuitive, easy-to-use interface. Find top products in Online Trading Platforms category. Software used to electronically trade stocks, bonds, and commodities on one platform.

Is It Better To Use A Mortgage Broker Or Lender

This depends on your situation. Brokers can offer a variety of loan products from multiple lenders, while direct lenders may offer faster, more streamlined. One of the most significant advantages of working with a mortgage broker is access to a wide variety of banks and mortgage lenders. This means you can compare. A mortgage broker packages a loan and shops it to various lenders who then fund the loan. A lender is the one with the money. A broker can make the mortgage experience easier but they don't have access to every lender. Doing it yourself takes more time. For people who don't want the hassle of contacting different banks, mortgage brokers are a better option. As mentioned above, some lenders work exclusively with. Mortgage brokers act as intermediary or “middleman” who brings borrowers and mortgage lenders together but do not actually fund or originate mortgages. Instead. Brokers are the intermediary between borrower and lender, while direct lenders such as banks originate and fund mortgages. Learn the pros and cons of each. Mortgage brokers can offer more competitive rates and diverse loan programs than banks and can charge more for their services in doing that research. the broker manages the process on behalf of the lender. They don't just shop around and pass you off. That is why they can get good rates This depends on your situation. Brokers can offer a variety of loan products from multiple lenders, while direct lenders may offer faster, more streamlined. One of the most significant advantages of working with a mortgage broker is access to a wide variety of banks and mortgage lenders. This means you can compare. A mortgage broker packages a loan and shops it to various lenders who then fund the loan. A lender is the one with the money. A broker can make the mortgage experience easier but they don't have access to every lender. Doing it yourself takes more time. For people who don't want the hassle of contacting different banks, mortgage brokers are a better option. As mentioned above, some lenders work exclusively with. Mortgage brokers act as intermediary or “middleman” who brings borrowers and mortgage lenders together but do not actually fund or originate mortgages. Instead. Brokers are the intermediary between borrower and lender, while direct lenders such as banks originate and fund mortgages. Learn the pros and cons of each. Mortgage brokers can offer more competitive rates and diverse loan programs than banks and can charge more for their services in doing that research. the broker manages the process on behalf of the lender. They don't just shop around and pass you off. That is why they can get good rates

The application process seems smooth. It's mostly online with very little human interaction. There's a use-friendly document portal. You receive Green Lights on. Flexibility is the reason Mortgage Brokers tend to have better rates since they have the ability to work with many different lenders, whereas Direct Lenders. In certain cases, they can help you obtain a better rate than working directly with a lender. Our guide will explain what mortgage brokers do, and how they can. Unlike the bank's start-to-finish service, the mortgage broker has less control over the process because they do not work for the mortgage lender. · Using a. Working with a mortgage broker can potentially save you time, effort, and money. · A mortgage broker may have better and more access to lenders than you have. A broker is going to recommend a lender based on any number of factors. Sometimes your price, sometimes ease of underwriting, sometimes turn. Whilst both banks and brokers can help you secure a great home loan deal, brokers offer an additional service that simply isn't available with lenders –. However, some brokerages may have relationships with lenders that they may persuade clients to use. With a mortgage broker, you don't have to go through the. They match the lender with the borrower based on the borrower's specific situation and needs. The advantages of using a mortgage broker is a broker may work. Is a mortgage broker the same as a bank? Definitely not. A bank is a lender — they're the ones actually lending you the. The person you would deal with is typically called a loan officer, but could be called a loan originator. Mortgage Brokers work with a handful. I thought Better Mortgage is a direct lender, not a broker What a broker does is sell your loan application to another lender. We don't do that. As a direct. Brokers occasionally help make financing less expensive. They can get you a mortgage at a lesser cost or at a cheaper rate than you would be able to get without. Borrowers can also price charges from mortgage brokers once they get their loan estimates. Homebuyers should shop for rates without having the lender run credit. Do not work with a broker as they are just relaying information from the actual lender anyways and you will pay additional fee's for using a broker versus. One of the most compelling reasons to work with a mortgage broker is the breadth of options they provide. Unlike a direct lender, who offers a limited selection. Mortgage Brokers · Brokers have less control over the process because they don't work for the lender. · Brokers, as a rule, tend to be more expensive. · Brokered. A Mortgage Broker acts as a middleman between the homebuyer and lender, and they must sell all originated loans on behalf of individuals or businesses. They. A mortgage broker works as an intermediary between many lenders to find options that work for you. This could be the best rates, terms or lowest costs and fees. The lender then decides whether or not to underwrite the loan and at what terms, not the broker. The advantage of using a broker is choice because the broker.

What Is Better To Pay Off First For Debt

Tips for paying off debt · Pay more than the marketofchoice.ru · Pay more than once a marketofchoice.ru · Pay off your most expensive loan marketofchoice.ru · Consider the. Well, a long-held principle of financial planning is to pay down your most expensive debt first. Remember, though: as you focus on the debt you want to. The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were. The debt avalanche method means paying off debt with the highest interest rate first. Because you are prioritizing your most expensive loans, this method is the. Selecting which credit card to pay off first will help you build a strong debt repayment strategy & can also teach you more about how credit works. better off eliminating all credit card debt before investing If you've got unpaid balances on several credit cards, you should first pay down the card that. With the debt snowball method, you pay off the smallest debt first. Each method requires you to list your debts and make minimum payments on all but one. Then. Paying off debt first comes with the benefit of reducing the amount of money you owe from interest. If you decide it's best to focus on paying off debt. Key takeaways · To tackle credit card debt head on, it helps to first develop a plan and stick to it · Focus on paying off high-interest-rate cards first or cards. Tips for paying off debt · Pay more than the marketofchoice.ru · Pay more than once a marketofchoice.ru · Pay off your most expensive loan marketofchoice.ru · Consider the. Well, a long-held principle of financial planning is to pay down your most expensive debt first. Remember, though: as you focus on the debt you want to. The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were. The debt avalanche method means paying off debt with the highest interest rate first. Because you are prioritizing your most expensive loans, this method is the. Selecting which credit card to pay off first will help you build a strong debt repayment strategy & can also teach you more about how credit works. better off eliminating all credit card debt before investing If you've got unpaid balances on several credit cards, you should first pay down the card that. With the debt snowball method, you pay off the smallest debt first. Each method requires you to list your debts and make minimum payments on all but one. Then. Paying off debt first comes with the benefit of reducing the amount of money you owe from interest. If you decide it's best to focus on paying off debt. Key takeaways · To tackle credit card debt head on, it helps to first develop a plan and stick to it · Focus on paying off high-interest-rate cards first or cards.

The avalanche method focuses your repayment efforts on high-interest debt, while the snowball method targets your smallest debts first. Debt consolidation is. (And if you have more than one debt at or above the relevant interest rate, work first at eliminating your highest-rate debt, then move on to your next-highest. General information about which bills you should pay first when you are having trouble paying all of your debts. #EN. Which bills should I pay first? The age of the debt does not matter. The usual answer is pay of the debt with the higher interest rate so you minimize your overall cost of. Recommend to pay off the highest interest first on the principle it will cost you more in the long run. Buying a house is usually a matter of. When prioritizing paying off your debt, start with the balance that has the higher interest rate (likely your credit cards) and go from there. No matter what. However, your personal financial situation will dictate when you should pay off debt or contribute to an emergency fund first. loan offers with better terms. Coming at it purely from a math perspective, you should pay off the higher interest debt first. Higher interest debt is more expensive debt so. With this strategy, you focus on paying off credit card debt, tackling the lowest balance first, while making required minimum payments on the other credit. As such any debts you have that are secured on your home (which could be a loan as well as your mortgage) should be given priority over unsecured debts. This. Not only does it feel great to pay off debt, but by eliminating one of your monthly obligations, you'll also boost your credit score and have more room in your. You pay off the smallest debt first while continuing to make minimum payments on your other debts. Once the smallest debt is cleared, you move to the next. Debt avalanche. The debt avalanche approach starts with paying off the card with the highest annual percentage rate first. Next, you pay off the card with the. If you have extra cash, you might consider paying to reduce your mortgage. But it's important to pay off other debts with higher interest rates, like credit. Are you wondering if it's better for you to pay off debt or save for a house first? Read this article for some key factors to consider before moving. High-interest credit card debt costs more over time making it much more difficult to pay off. By tackling it first, you could save hundreds or even thousands of. Dave Ramsey recommends putting $1, in your emergency fund before you aggressively pay off debt. I highly recommend more than that. There are plenty of house. By paying these cards off first, you are reducing your debt risk and ultimately will see your score rise. 3. Credit Cards With the Lowest Credit Limits. Credit. But with low-interest rate loans, including student loans and mortgages, you may be better off diverting extra cash into a tax-advantaged investment account. A debt payoff plan can help you gain control of your finances. Learn how to pay down debt with these strategies from Better Money Habits.