marketofchoice.ru Learn

Learn

Stock Yield Definition

Yield is used to describe the annual return on your investments as a percentage of your original investment. A yield is the return on an investment, either in terms of dividends for shares or interest payments. It is expressed as a percentage of the cost of the. Yield tells investors how much income they will earn each year relative to the market value or initial cost of their investment. The average yield of stocks on. YIELD ON STOCK Definition YIELD ON STOCK is the percentage of the annual dividend to the current price of the stock, e.g., a $30 stock with a dividend of. Yield is a measure of the profit that an investor will be paid for investing in a stock or a bond. It is usually computed on an annual basis. Dividend yield is a financial metric that measures the income from dividends relative to the value of an investment. It shows how much a company, fund, or. Dividend yield is a stock's annual dividend payments to shareholders expressed as a percentage of the stock's current price. YIELD to calculate bond yield This article describes the formula syntax and usage of the YIELD function in Microsoft Excel. In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment. Yield is used to describe the annual return on your investments as a percentage of your original investment. A yield is the return on an investment, either in terms of dividends for shares or interest payments. It is expressed as a percentage of the cost of the. Yield tells investors how much income they will earn each year relative to the market value or initial cost of their investment. The average yield of stocks on. YIELD ON STOCK Definition YIELD ON STOCK is the percentage of the annual dividend to the current price of the stock, e.g., a $30 stock with a dividend of. Yield is a measure of the profit that an investor will be paid for investing in a stock or a bond. It is usually computed on an annual basis. Dividend yield is a financial metric that measures the income from dividends relative to the value of an investment. It shows how much a company, fund, or. Dividend yield is a stock's annual dividend payments to shareholders expressed as a percentage of the stock's current price. YIELD to calculate bond yield This article describes the formula syntax and usage of the YIELD function in Microsoft Excel. In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment.

Capital - The funds invested in a company on a long-term basis and obtained by issuing preferred or common stock, by retaining a portion of the company's. It is the Fund's total income net of expenses, divided by the total number of outstanding shares. The yield may differ slightly from the actual distribution. This ratio lets you know the amount of dividends you could expect to receive each year for every dollar invested in a stock. The formula for calculating the. For stocks, it represents the annual dividend income as a percentage of the stock's current market price. In the context of bonds, it signifies the annual. Dividend yield is a stock's annual dividend payments to shareholders expressed as a percentage of the stock's current price. Yield is the income returned on an investment, such as the interest from holding a security. The yield is usually expressed as an annual percentage rate based. The dividend yield formula is used to determine the cash flows attributed to an investor from owning stocks or shares in a company. Therefore, the ratio shows. Investors may purchase securities such as bonds or stocks to generate income. They may wish to know the income potential, or yield, of this investment. Dividend yield: This is a financial ratio that highlights how much a company pays out in dividends each year, relative to its stock price. It shows the return. An investment's yield measures the amount of income generated by a bond (in the form of an interest payment) or stock (in the form of a dividend payment) as a. A yield measures any income from an investment over a set period of time, such as dividends from shares or interest from bonds. For companies that pay dividends, the Dividend Yield can give you an idea how a company's dividend payments relate to its stock price. Yield investors typically focus on buying companies with indicated dividend yields that are comfortably above the S&P average and that are perceived to. A financial market of a group of securities in which prices are rising or are expected to rise. The term "bull market" is most often used to refer to the stock. Income stocks pay dividends consistently. Dividends are a portion of the company's earnings paid to shareholders. Investors buy them for the income they. Yield to call is the yield calculated to the next call date, instead of to maturity, using the same formula. Yield to worst is the worst yield you may. definitions that are important to understand when talking about yield as it relates to bonds: coupon yield, current yield, yield-to-maturity, yield-to-call. Dividend yield is the ratio of the dividends paid by a company to its shareholders relative to its current stock price. When a company announces a dividend, it's agreeing to pay a certain amount per share of stock at a certain point in time. Hence the meaning of the phrase “. PRO. This is the measure of the return on an investment and is shown as a percentage. A stock yield is calculated by dividing the annual dividend by the stock's.

Shorting The Euro

The Euro STOXX 50® Short Index aims to reflect the performance of the following market: 1x Short exposure to Eurozone blue chip companies listed in EUR in. Goldman Sachs Euro Short Duration Bond Plus Portfolio Class R Shares (Acc AT A GLANCE Asset Class Short Duration Sub Asset Class Multi Sector. The euro short-term rate (€STR) is published on each TARGET2 business day based on transactions conducted and settled on the previous TARGET2 business day. The new Fund, is now available to investors and offers a portfolio of high-quality euro-denominated short-term debt instruments. Release: Euro Short Term Rate, 7 economic data series, FRED: Download, graph, and track economic data. The euro short-term rate (€STR) reflects the wholesale euro unsecured overnight borrowing costs of banks located in the euro area. The ECB publishes on its. The STOXX Daily Short indices are innovative investment tools that replicate a short investment strategy on the relevant underlying STOXX Index. In the euro was born: it first appeared on payslips, bills and invoices. On. 1 January , euro banknotes and coins entered European bank tills, cash. 69% of client accounts are short on this market. The percentage of IG client accounts with positions in this market that are currently long or short. The Euro STOXX 50® Short Index aims to reflect the performance of the following market: 1x Short exposure to Eurozone blue chip companies listed in EUR in. Goldman Sachs Euro Short Duration Bond Plus Portfolio Class R Shares (Acc AT A GLANCE Asset Class Short Duration Sub Asset Class Multi Sector. The euro short-term rate (€STR) is published on each TARGET2 business day based on transactions conducted and settled on the previous TARGET2 business day. The new Fund, is now available to investors and offers a portfolio of high-quality euro-denominated short-term debt instruments. Release: Euro Short Term Rate, 7 economic data series, FRED: Download, graph, and track economic data. The euro short-term rate (€STR) reflects the wholesale euro unsecured overnight borrowing costs of banks located in the euro area. The ECB publishes on its. The STOXX Daily Short indices are innovative investment tools that replicate a short investment strategy on the relevant underlying STOXX Index. In the euro was born: it first appeared on payslips, bills and invoices. On. 1 January , euro banknotes and coins entered European bank tills, cash. 69% of client accounts are short on this market. The percentage of IG client accounts with positions in this market that are currently long or short.

WisdomTree Long EUR Short USD 3x Daily (LEU3) is designed to provide investors with a 'leveraged long' exposure to Euro ("EUR") relative to US Dollars. Euro Short Term Rate In the Euro Area remained unchanged at percent on Wednesday September This page includes a chart with historical data for Euro. PIMCO Euro Short-Term High Yield Corporate Bond Index UCITS ETF - IE00BD8D5G25 The investment objective of the Fund is to seek to maximise total return. An actively managed portfolio of Euro short-term bonds, with opportunistic allocations to attractive Euro bond strategies. Find the latest ProShares Short Euro (EUFX) stock quote, history, news and other vital information to help you with your stock trading and investing. Morningstar Rating. - ; FundAMUNDI EURO LIQUIDITY SHORT TERM GOVIES - I (C) (% over the period) ; Characteristics. General data. Inception date. 05/05/ WisdomTree Long EUR Short USD 3x Daily (LEU3) is designed to provide investors with a 'leveraged long' exposure to Euro ("EUR") relative to US Dollars. - Interest Rate Risk: The weighted average maturity (WAM) of the portfolio is established at 4 days at the end of the period. - Credit Risk: Short-term spreads. Short Maturity Euro Corporate Bond Fund. Fund Description. The fund's objective is to provide income whilst maximising total returns in the Euro-denominated short term fixed income market by investing. PIMCO Euro Short-Term High Yield Corporate Bond Index UCITS ETF - IE00BD8D5G25 The investment objective of the Fund is to seek to maximise total return. The Euro Short Term Rate, or €STR, is the primary overnight money-market benchmark rate in the Euro area and reflects the wholesale euro unsecured overnight. Between December and December , the euro traded below the US dollar, but has since traded near parity with or above the US dollar, peaking at US$ Find latest pricing, performance, portfolio and fund documents for Franklin Euro Short Maturity UCITS ETF - IE00BFWXDY Investing involves risk, including the possible loss of principal. Short ProShares ETFs are non-diversified and entail certain risks, including risk associated. Fund Description. The fund's objective is to provide income whilst maximising total returns in the Euro-denominated short term fixed income market by investing. Euro Area Macro Monitor - PMIs continue to weaken - is this a goodbye to growth? The good start of the year continued into Q2, with euro area GDP growing % q. - Interest Rate Risk: The weighted average maturity (WAM) of the portfolio is established at 4 days at the end of the period. - Credit Risk: Short-term spreads. Development of euro-zone money- and short-term bond markets. Possible material risks of funds in this risk class. The fund is designed for safety-oriented.

What Is A Limit Sale

For sell limit orders, you're setting a price floor — i.e. the lowest amount you'd be willing to accept per share. If a trader places a limit order to sell, the. Limit order (limit sell) can be seen by the market that you are willing to buy or sell at a set price. A stop order can't be seen by the market. A limit order is a tool used by traders to make a purchase or sale at a specific price or better. A stop order executes a market order. Limit orders allow you to set the price you want to buy or sell shares for. A limit order is a buy or sell order that executes at the minimum price you set or better. Limit orders also feature enhanced order options like expiration and. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. A sell limit order is a limit order that an investor can use to sell stock at a specified price or above the specified price. Opposite of a buy limit order, a. A limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a. For sell limit orders, you're setting a price floor — i.e. the lowest amount you'd be willing to accept per share. If a trader places a limit order to sell, the. Limit order (limit sell) can be seen by the market that you are willing to buy or sell at a set price. A stop order can't be seen by the market. A limit order is a tool used by traders to make a purchase or sale at a specific price or better. A stop order executes a market order. Limit orders allow you to set the price you want to buy or sell shares for. A limit order is a buy or sell order that executes at the minimum price you set or better. Limit orders also feature enhanced order options like expiration and. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. A limit order is an instruction for a broker to buy a stock or other security at or below a set price, or to sell a stock at or above the indicated price. A sell limit order is a limit order that an investor can use to sell stock at a specified price or above the specified price. Opposite of a buy limit order, a. A limit order is an order to buy or sell a security at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a.

A Sell Limit Order is an order placed above the current market price. Limit orders similarly allow you to set a desired price range for the sale of shares you own. If the stock never reaches that price range while your order. A limit order allows you to buy or sell a security or cryptocurrency at a specific limit price or better. A limit order is a tool which gives investors more control about their trades. You can use it to purchase or sell stocks or other securities at a specific. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower. A condition on a Good 'til Canceled Limit order to buy or a stop order to sell a security. This condition prevents the order limit or stop price from being. A limit order is an order made with a brokerage firm or bank for the sale or purchase of a certain financial instrument at a designated price or better. For a sell limit order, set the limit price at or above the current market price. Examples. Stop-limit orders allow you to automatically place a limit order to buy or sell when an asset's price reaches a specified value, known as the stop price. This. A limit order is an instruction you give to buy or sell an asset at a specific price. . The instruction is usually given to a broker that will automatically. A limit order allows investors to buy or sell securities at a price they specify or better, providing some price protection on trades. Limit Order. This is an order to buy or sell a security at or better than a specified price (a "limit price"). Limit orders are for investors. When the price of the stock achieves the set stop price, a limit order is triggered, instructing the market maker to buy or sell the stock at the limit price. A limit order can only be executed at your specific limit price or better. Investors often use limit orders to have more control over execution prices. A limit order allows investors to purchase or sell a stock at a specified price or better. In case of buy limit orders, the order will only get executed below. A Limit order is an order to buy or sell at a specified price or better. The Limit order ensures that if the order fills, it will not fill at a price less. A limit order is an order that instructs the broker to buy or sell a specific security at a specific price. That means the order will only be executed if the. A market/limit order is an order to buy or sell a single security that you send immediately to the market, rather than placing a window trade. A limit order in financial markets is an instruction to buy or sell a stock or other security at a specified price. Precision and control: Stop-limit orders enable investors to execute trades with precision. By specifying the exact price at which you want to buy or sell a.

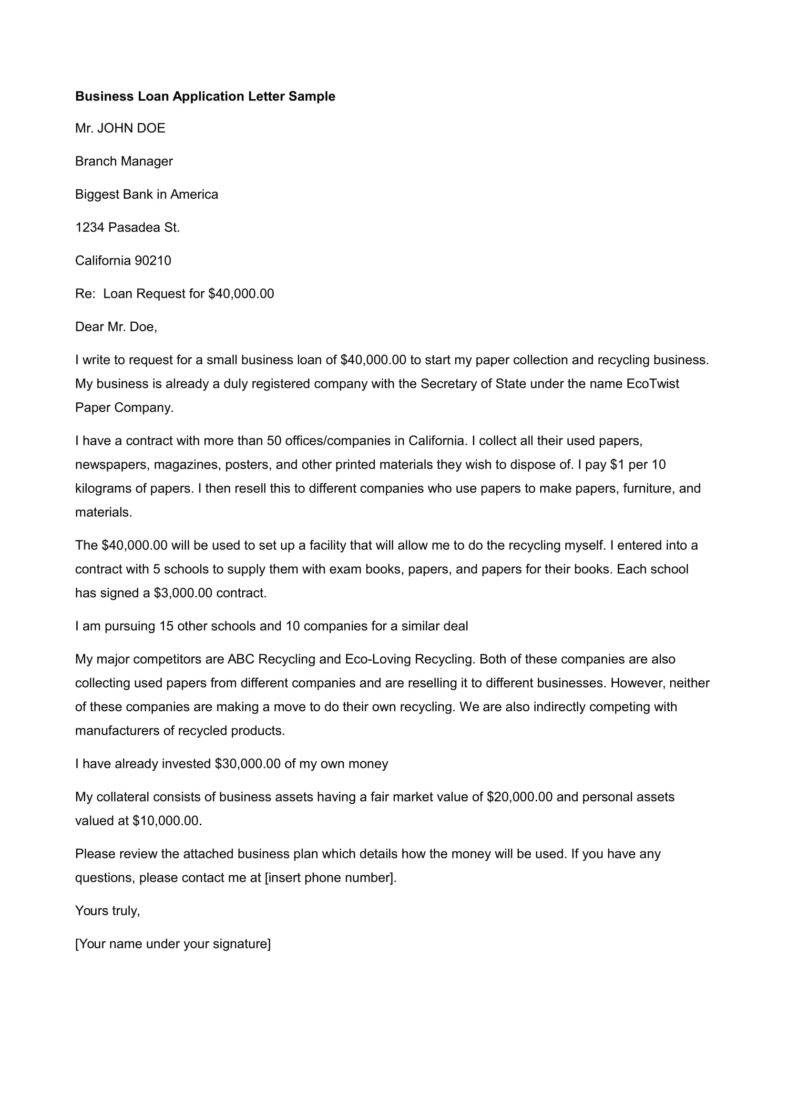

How To Ask For A Small Business Loan

Bank of America meets all SBA Preferred Lender Program eligibility criteria, including proficiency in processing and servicing SBA-guaranteed loans. Talk to a. Small Business Loans · Find a Business Loan up to $K · Funding Through Partnership · How Accion Opportunity Fund2 Works · What Our Members Say. 1. Decide Why You Need Financing · 2. Check Your Eligibility · 3. Compare Business Lending Options · 4. Gather the Required Documents · 5. Submit Your Application. What is required for a small business loan? · Number of years in business: Some lenders may have tenure requirements to meet before you can apply or be approved. What We Look for When Evaluating a Loan: · 1. Experience. What experience do you have in the industry related to your business. · 2. Creditworthiness. Do you and. Get help to grow your small business or startup · Apply for a Boost Fund Loan · CTNext - a community ecosystem for CT startups! · Help and support for CT's. You can apply for a Business Advantage Auto Loan online · If you use Small Business Online Banking, you can apply for an unsecured business loan or unsecured. Besides the type of loan you apply for, consider the details of the loan. Each loan comes with its own interest rate and loan term, among other points of. How to apply for small business loans · Step 1: Write a history and overview of your business · Step 2: Include the required financial statements · Step 3: List. Bank of America meets all SBA Preferred Lender Program eligibility criteria, including proficiency in processing and servicing SBA-guaranteed loans. Talk to a. Small Business Loans · Find a Business Loan up to $K · Funding Through Partnership · How Accion Opportunity Fund2 Works · What Our Members Say. 1. Decide Why You Need Financing · 2. Check Your Eligibility · 3. Compare Business Lending Options · 4. Gather the Required Documents · 5. Submit Your Application. What is required for a small business loan? · Number of years in business: Some lenders may have tenure requirements to meet before you can apply or be approved. What We Look for When Evaluating a Loan: · 1. Experience. What experience do you have in the industry related to your business. · 2. Creditworthiness. Do you and. Get help to grow your small business or startup · Apply for a Boost Fund Loan · CTNext - a community ecosystem for CT startups! · Help and support for CT's. You can apply for a Business Advantage Auto Loan online · If you use Small Business Online Banking, you can apply for an unsecured business loan or unsecured. Besides the type of loan you apply for, consider the details of the loan. Each loan comes with its own interest rate and loan term, among other points of. How to apply for small business loans · Step 1: Write a history and overview of your business · Step 2: Include the required financial statements · Step 3: List.

“To apply for a conventional small business loan, you'll first need to share all of your financial details, including your personal financial information, your. Best for businesses that want an unsecured term loan, with a simplified application and decisioning process. The do's and don'ts of your first small business loan · 1. Do create a real budget. · 2. Do have budget references. · 3. Don't overestimate your income. · 4. Don't. Before applying for an SBA disaster loan, you must register with FEMA. Check to confirm that you are eligible, then apply with FEMA online. The U.S. Small Business Administration (SBA) has several programs to help finance small business loans. Many SBA loan programs combine business coaching and. small business lending data collections that use loan size to define a small business loan, such as the Call Report. In this survey, a small business loan. Get fast, affordable business loans online through Funding Circle. SBA 7A, PPP, Term Loans & more - we'll help you find the right loan for your small. SBA loans. The Small Business Administration offers a limited number of business loans directly, typically through government-backed emergency loan programs. While you may be able to get a small business loan without having to offer collateral, that doesn't mean the lender won't ask for other conditions. Does the trade credit exclusion apply to a loan or other credit arrangement from a bank, credit union, or financing company if the proceeds are used to purchase. Six Questions a Lender Will Ask Small Business Owners · 1. How much money do you need? · 2. What does your credit profile look like? · 3. How will you use the. APR takes into account all fees and interest rates so you have a standard measure of the cost of credit across different type loan products. Ask the lender to. Qualifying for a small business loan often means you need good credit, especially if your business is young or does not have a lot of employees. Pay attention. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit Apply today – it's fast and easy! IBank's Small Business Finance Center features a loan guarantee program designed to assist small businesses that experience capital access barriers. How much money do you need? · What do you need the money for? · How will you pay it back? · Do you have enough cash flow to service the loan? · What does your. SBA loans and traditional bank loans require excellent to good personal credit scores to qualify for small business loans. But online lenders can be more. Call us. Talk to a Small Business specialist at , opens in new tab. Unsecured loan amount, not to exceed two (2) months gross revenue or one (1). It was a long process; I started by running some numbers and then asking my bank what they could offer as an interest rate individually just so. Some of these loans may be applied for through the U.S. Small Business Administration (SBA), however, you can also apply for small business loans through.

Falling In Love Online Without Meeting

If you feel embarrassed about meeting with an in-person counselor or prefer a casual type of therapy, consider reaching out to an online therapist. Online. I've lost interest in seeing anyone else, Katie, because I'm falling in love with you! P.S. I hope we can get together Friday evening. I'll call you. Letter. It's possible for someone to develop feelings for someone they haven't met in person, especially with the rise of online connections. “I don't know what to do, I think I'm falling for you.” “Here's my number, so call me maybe.” “All I can say is, it was enchanting to meet you.”. Can you fall in love with someone online without meeting him? How was it when you both met? Did your relationship work out? Robert and Lisa Firestone, have listed common psychological reasons that love scares us without us being fully aware: Love arouses anxiety and makes us feel. Do you want to meet her in person? If you don't want your interactions to stay online, it's obvious she's captured your heart. You want to see. In fact, on one of our walks a random guy driving a truck, slowed down, rolled his window down, just to say "I love seeing happy couples". We're not even dating. We are now on a month's solid break without communication, until I start figuring this out. It has been helpful to have the space. I have started seeing a. If you feel embarrassed about meeting with an in-person counselor or prefer a casual type of therapy, consider reaching out to an online therapist. Online. I've lost interest in seeing anyone else, Katie, because I'm falling in love with you! P.S. I hope we can get together Friday evening. I'll call you. Letter. It's possible for someone to develop feelings for someone they haven't met in person, especially with the rise of online connections. “I don't know what to do, I think I'm falling for you.” “Here's my number, so call me maybe.” “All I can say is, it was enchanting to meet you.”. Can you fall in love with someone online without meeting him? How was it when you both met? Did your relationship work out? Robert and Lisa Firestone, have listed common psychological reasons that love scares us without us being fully aware: Love arouses anxiety and makes us feel. Do you want to meet her in person? If you don't want your interactions to stay online, it's obvious she's captured your heart. You want to see. In fact, on one of our walks a random guy driving a truck, slowed down, rolled his window down, just to say "I love seeing happy couples". We're not even dating. We are now on a month's solid break without communication, until I start figuring this out. It has been helpful to have the space. I have started seeing a.

Without serotonin to keep an eye on proceedings, we experience the dopamine Meeting Boston singles: Boston Dating with EliteSingles · Dating in Miami. Should I travel to meet a guy I met online? (or girl). Falling in love with someone online from another country has many hurdles to overcome. There's no simple. We publish articles around emotional education: calm, fulfilment, perspective and self-awareness. | Falling in Love with a Stranger — Read now. online. Don't get me wrong, online dating can be totally fun when done right, but in my many years of using apps to meet people this way, it. Relationships forming over the Internet, in chat rooms, via emails, on message boards, on social media, and even through online gaming are common nowadays. It may start out the same way, whether it be meeting online or in person, each relationship veers off on its own path that's % unique to each. You fell in love with them because of who they were, not because they were a without seeing me. I told him if he leaves without seeing me next year. Here's a piece of expert advice from dating coach Evan Marc Katz on how to slow things down. guy falling in love with a sleeping beautiful woman How to Master. Experience has taught us that the majority of our relationships will fail. We'll try time and time again to meet that perfect partner. We'll put our hope and. If someone you meet online needs your bank account information to deposit money, they are most likely using your account to carry out other theft and fraud. I love my partner, but I can't stop thinking about this other man. I think Online. 24 hours / 7 days a week. Email us. Get a reply in 24 hours. love you until you love yourself. I don't think there's anything inherently wrong with online dating and studies have shown that more and more people are. After two marriages and two divorces and at 55, I found the love of my life online. I just can't imagine living the rest of my days without Brian. He inspires. Looking for love online? Protect Yourself Against Romance Scams. Protect I wish I knew this before I ever started going online to meet someone. I. Guys can fall in love with any girl who allows them to be themselves without judging and just being open to the ideas they formulate— no matter how silly they. They both want to feel the intense, obsessive, “I can't live without you” craving of early-stage romantic love. ” This “falling in love” feeling is really. Stream the best dating shows and reality competitions available on Netflix, including Love Is Blind, The Ultimatum, Love on the Spectrum, and Love Island. You meet someone special on a dating website or app. Do your friends or family say they're concerned about your new love interest? Search online for the type. But those hormones don't just kick in when you meet a potential love interest. You have to get to know them first. Psychologist Arthur Aron devised a set of. This is why the people we fall in love with almost always resemble I have entire online courses that deal with meeting and connecting with new people.

Can You Get Loans From Multiple Banks

LendingTree helps you get the best deal possible on your loans. By providing multiple offers from several lenders, we show your options, you score the win. There can indeed be advantages to holding multiple checking accounts or savings accounts, but having more than one or two will definitely require more of your. Banks syndicate loans because it allows them to lessen the risk associated with lending to a borrower. That's because one bank (usually) doesn't take the full. If you need extra cash fast, we've got you covered. With multiple personal loan options, we have what you need to apply easily, get a fast approval response. Code Section 72(p)(2)(A) sets forth limits on participant loans from a qualified retirement plan. A plan may permit a participant to take multiple loans. If you find yourself in a situation where you need a second personal loan, try to apply with the same lender. Applying for multiple loans with different lenders. A loan syndication usually occurs when multiple banks lend money to a borrower all at the same time and for the same purpose. That is to say. There is no hard limit to how many loans you can have at once. As mentioned previously, lenders typically like to see a debt-to-income (DTI) ratio under 30% or. It is possible to have at least two loans at the same time. This usually happens when the loans were approved at different times and even years apart. While. LendingTree helps you get the best deal possible on your loans. By providing multiple offers from several lenders, we show your options, you score the win. There can indeed be advantages to holding multiple checking accounts or savings accounts, but having more than one or two will definitely require more of your. Banks syndicate loans because it allows them to lessen the risk associated with lending to a borrower. That's because one bank (usually) doesn't take the full. If you need extra cash fast, we've got you covered. With multiple personal loan options, we have what you need to apply easily, get a fast approval response. Code Section 72(p)(2)(A) sets forth limits on participant loans from a qualified retirement plan. A plan may permit a participant to take multiple loans. If you find yourself in a situation where you need a second personal loan, try to apply with the same lender. Applying for multiple loans with different lenders. A loan syndication usually occurs when multiple banks lend money to a borrower all at the same time and for the same purpose. That is to say. There is no hard limit to how many loans you can have at once. As mentioned previously, lenders typically like to see a debt-to-income (DTI) ratio under 30% or. It is possible to have at least two loans at the same time. This usually happens when the loans were approved at different times and even years apart. While.

Meeting challenges. Taking that next step forward. Whatever your goals, Merrill and Bank of America offer a wide range of solutions to help you get there. Get your personalized loan options. Check your options with no impact to your credit score. Like what you see? Choose one and continue to apply. You can also. With the ability to choose a loan amount of up to $40,, LendingClub offers fixed rates and a monthly repayment plan to fit within your budget. We understand. You may have multiple loans at one time. You can have a first and second loan or multiple loans if you have an existing loan. If you're considering multiple. Once you've chosen a home, it's time to request Loan Estimates from multiple lenders. Getting multiple Loan Estimates can help you save money and get a. Debt consolidation loans allow consumers to transfer the account balances from multiple credit cards or installment loans into a single loan and to make a. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come. Combine all your debt into one monthly payment with a loan that has a lower interest rate. No Collateral Required. Credit Card Consolidation. ALLIANCE Credit Union in TX is always ready to serve our members. Explore our personal and businesses banking services and learn how to become a member. The simple answer is yes – it is possible to have multiple loans at the same time. However, there are certain problems that may arise if you wish to do this. Adding a bank account or two can help you be ready for whatever life throws at you. With multiple bank accounts, you can dedicate specific ones to certain. It's also important to mention that certain lenders might not approve you for two loans. Many will, and you could be approved for two personal loans through. that exist to serve their members. Like banks, credit unions accept deposits, make loans and provide a wide array of other financial services. A Carter Bank Personal Loan can provide you with funds to pay off credit cards, cover medical bills or make a special purchase. We know everyone's needs are. Short answer: Yes, you can. Long answer: It's better to speak with a mortgage agent/broker in order to find the most suitable option for you. Additionally, because debt consolidation loans combine multiple loans into one loan, they can also reduce the number of bills a borrower has to manage each. Central Bank offers personal loans options to help you get your finances on track. See how our solutions can help you and apply today. loan. Loans for exporters. Most U.S. banks view loans for exporters as risky. This can make it harder for you to get loans for things like day-to-day. If you're looking for more favorable lending terms but lack a strong credit history, you might consider signing jointly as a secondary borrower on a cosign loan.

Qualified Residence Trust

A Qualified Personal Residence Trust (QPRT) is a residential property that is transferred into an irrevocable trust for a specified number of years. At the end. Qualified personal residence trusts (QPRTs) can help homeowners facilitate a low-tax lifetime transfer of property from themselves to their heirs. Qualified personal residence trust (QPRT) refers to a type of trust used to minimize estate and gift taxes by moving personal residences into a trust. The regulations under Code section allow two types of qualified trusts: personal residence trusts and qualified personal residence trusts ("QPRTs"). Of the. A qualified personal residence trust is an estate planning technique that can reduce your estate taxes by removing the value of your home from your estate. Qualified Personal Residence Trusts (QPRTs). A Qualified Personal Residence Trust (QPRT) is an irrevocable living trust designed to provide estate and gift tax. Funding of the Qualified Personal Residence Trust (“QPRT”). (1) Residence. The Transferor transfers and assigns to the Trustee all of the. Transferor's. From the Estate Planning and Probate Group What is a Qualified Personal Residence Trust? A Qualified Personal Residence Trust (“QPRT”) is Trust which allows. A QPRT allows someone to transfer ownership of a primary residence or vacation home out of their taxable estate to family members at a discounted value for gift. A Qualified Personal Residence Trust (QPRT) is a residential property that is transferred into an irrevocable trust for a specified number of years. At the end. Qualified personal residence trusts (QPRTs) can help homeowners facilitate a low-tax lifetime transfer of property from themselves to their heirs. Qualified personal residence trust (QPRT) refers to a type of trust used to minimize estate and gift taxes by moving personal residences into a trust. The regulations under Code section allow two types of qualified trusts: personal residence trusts and qualified personal residence trusts ("QPRTs"). Of the. A qualified personal residence trust is an estate planning technique that can reduce your estate taxes by removing the value of your home from your estate. Qualified Personal Residence Trusts (QPRTs). A Qualified Personal Residence Trust (QPRT) is an irrevocable living trust designed to provide estate and gift tax. Funding of the Qualified Personal Residence Trust (“QPRT”). (1) Residence. The Transferor transfers and assigns to the Trustee all of the. Transferor's. From the Estate Planning and Probate Group What is a Qualified Personal Residence Trust? A Qualified Personal Residence Trust (“QPRT”) is Trust which allows. A QPRT allows someone to transfer ownership of a primary residence or vacation home out of their taxable estate to family members at a discounted value for gift.

A Qualified Personal Residence Trust (QPRT) is a specialized type of irrevocable trust designed to decrease the amount of gift and estate taxes. By: Elliott Stapleton A Qualified Personal Residence Trust (QPRT) A Qualified Personal Residence Trust (also known as a QPRT), allows the transfer of your. A Qualified Personal Residence Trust (QPRT). Boiled down to its essentials, you transfer a residence to a trust, while retaining the right to live in it for a. If you own an estate, you can establish a Qualified Personal Residence Trust. You can do this by transferring the title of your property to the trust. As the. A QPRT allows the homeowner to remain in the residence with “retained interest” until a specified date. After this date, the remaining interest and thus the. Can a qualified personal residence trust help you decrease your estate taxes? Learn what it is and how it could help. Qualified Personal Residence Trusts and Their Potential Use In Meeting Estate Planning Objectives · An individual may give his or her residence (or vacation. A Qualified Personal Residence Trust is an irrevocable trust that is funded by the transfer of a personal residence. How does a QPRT work? The way a QPRT works is you deed the title to the residence to the trustee of your irrevocable QPRT. The trust allows you to live in the. A Qualified Personal Residence Trust (QPRT) is a specialized type of irrevocable trust designed to decrease the amount of gift and estate taxes. A QPRT is a type of trust. A QPRT allows the homeowner to retain an interest in the property for a period of time and live there until the end of the trust. A Personal Residence Trust (PRT) offers many benefits such as asset protection, estate tax savings, income tax savings and flexibility in terms of when. A trust of which the term holder is the grantor that otherwise meets the requirements of a personal residence trust (or a qualified personal residence trust) is. Our skilled Florida estate planning attorneys at Verras Law are well-versed in tools like Qualified Personal Residence Trusts and can help you understand if. Personal Residence Trust & Qualified Personal Residence Trust. A Personal Residence Trust (PRT) is a term we apply to a trust intended to hold property and. A QPRT may not hold assets other than the residence, proceeds from the sale of the residence, insurance proceeds, and cash necessary to pay expenses of the. Taking advantage of the benefit of a QPRT requires the transfer of your residence to the trustee during your lifetime. The transfer of the residence to the. A Qualified Personal Residence Trust (“QPRT”) is a technique that enables a donor to remove a residence from the donor's estate at a reduced transfer tax. A QPRT is an irrevocable trust into which you transfer your home while retaining the right to live there rent free for a specified number (term) of years. A personal residence must fund the Qualified Personal Residence Trust, as its name implies. This means commercial homes or vacation homes cannot be transferred.