marketofchoice.ru Community

Community

How Much Is Silver Trading At Today

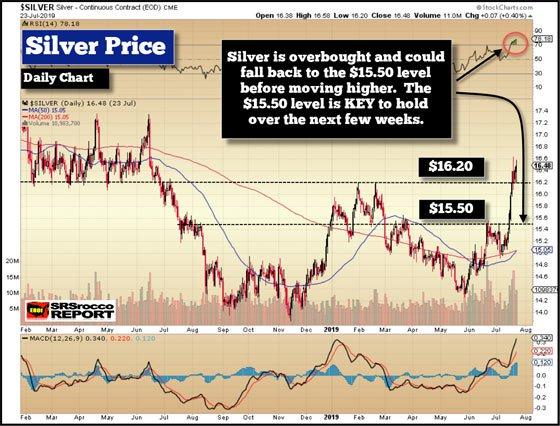

The current price of silver is $ per troy ounce. Silver's price is down % from the previous trading day. Historical data below. View the silver price per ounce in USD ($) via our fast loading silver chart. The price of silver per ounce chart displays the prices for the last 7 days in. The price of silver today, as of am ET, was $30 per ounce. That's up % from yesterday's silver price of $ Compared to last week, the price of. Updating current precious metal market values Gold: Silver: Platinum Gold, Silver, Platinum, Palladium, Copper, and Bitcoin Live Prices. Welcome. Instant access to 24/7 live gold and silver prices from Monex, one of America's trusted, high-volume precious metals dealers for 50+ years. Silver Price is at a current level of , down from last month and up from one year ago. This is a change of % from last month and. The silver traded on the stock exchange is worth around 17 million US dollars in total. Popular Articles. Business Insider 09/11/ Here's why the stock. $ | % · Learn More About Silver Pricing Below. The price of silver is trading at $, up 79 cents. Gold prices reached a record high of $2, per ounce this week, driven by growing expectations that. The current price of silver is $ per troy ounce. Silver's price is down % from the previous trading day. Historical data below. View the silver price per ounce in USD ($) via our fast loading silver chart. The price of silver per ounce chart displays the prices for the last 7 days in. The price of silver today, as of am ET, was $30 per ounce. That's up % from yesterday's silver price of $ Compared to last week, the price of. Updating current precious metal market values Gold: Silver: Platinum Gold, Silver, Platinum, Palladium, Copper, and Bitcoin Live Prices. Welcome. Instant access to 24/7 live gold and silver prices from Monex, one of America's trusted, high-volume precious metals dealers for 50+ years. Silver Price is at a current level of , down from last month and up from one year ago. This is a change of % from last month and. The silver traded on the stock exchange is worth around 17 million US dollars in total. Popular Articles. Business Insider 09/11/ Here's why the stock. $ | % · Learn More About Silver Pricing Below. The price of silver is trading at $, up 79 cents. Gold prices reached a record high of $2, per ounce this week, driven by growing expectations that.

Live Silver Spot Price Today ; $ · $ · $ · +$ (%).

An example: The current price of silver is $ per troy ounce (as of March 5, ). 1 gram of silver is equal to troy ounces. Therefore, the metal. Presently, the spot price of silver per troy ounce stands at USD To view silver prices in other denominations, simply scroll down this page. Moreover. Silver Futures - Dec 24 (SIZ4) ; Prev. Close: ; Open: ; Day's Range: ; 52 wk Range: ; 1-Year Change: %. Take advantage of the live spot prices by shopping our Top Sellers categories for Gold, Silver, Platinum and Palladium today. Spot Price Charts. Precious Metal. For example, a one ounce Sunshine Mint silver bar may sell for $ while a 10 ounce Sunshine Mint silver bar may sell for $ If you do the math, you'll. View real-time and historical charts of all precious metals prices. Check the live precious metals prices today and over time on historical price charts. The series is deflated using the headline Consumer Price Index (CPI) with the most recent month as the base. The current month is updated on an hourly basis. Live Silver Charts and Silver Spot Price from International Silver Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco. Live Silver Prices ; SILVER USD/Oz, , , , ; SILVER GBP/Oz, , , , Silver Price Charts · Silver in US Dollar · How is the Price of Silver Determined? · Spot Trading vs. Futures Trading · Silver Trading Hours. Money Metals Exchange Live Silver Spot Prices ; Silver Price per Ounce, $ ; Silver Price per Gram, $ ; Silver price per kilo, $ This is the constantly changing price at which silver is traded on the global markets. Spot silver prices represent the value of a unit of raw silver for. Get the latest Silver price (SI:CMX) as well as the latest futures prices and other commodity market news at Nasdaq. Silver prices: silver prices current, plus spot silver prices posted after COMEX silver market closes. Silver prices - spot price of silver - change daily. Explore gold and silver's price history and discover previous per prices. Current Precious Metals Prices. Commodity / Ratio, Spot Price, Change. Gold. Silver is expected to trade at USD/t. oz by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Looking. LIVE SILVER SPOT PRICE CHART ; Silver spots. Prices. Change ; Silver Per Oz. $ $ ; Silver Per Gram. $ $ ; Silver Per Kilo. $ $ Check the live price of silver today in all major currencies These two trading venues for silver have far higher trading volumes than other trading. What is the price of silver today per ounce, gram and kilogram? Track the current price of silver with a live hour Silver Price Spot Chart from ICMC! Spot Silver. Updated: Price per ounce: $ Price per Kilo: $ Price per Gram: $

How Can Buy Cryptocurrency

Binance offers many options where you can easily buy several cryptocurrencies including Bitcoin, with the lowest fees and highest security. Bitcoin futures track the price movements of Bitcoin5, and these Bitcoin ETFs hold Bitcoin futures contracts to mimic Bitcoin's return. Note that the ETF doesn'. Buy crypto fast, easily and securely with BitPay. Pay with a credit card, debit card, Apple Pay or Google Pay. Enter your wallet address and use your crypto. 1. Get Revolut. If you don't have it already, download the Revolut app for free and sign up to start buying Bitcoin and other crypto tokens. · 2. Top up your. In this article, we'll give you step-by-step instructions on how to buy crypto. We'll walk you through everything you need to know about making your first. KuCoin lets you buy cryptocurrency using your debit or credit card. Select the desired cryptocurrency, enter the amount, and then input your Visa or Mastercard. The World's Premier Crypto Trading Platform. Buy Bitcoin, Ethereum, and + cryptocurrencies. Trade with 20+ fiat currencies and Apple/Google Pay. Buying bitcoin from the marketofchoice.ru website · Visit our Buy Bitcoin page. · Select Bitcoin (BTC). · Choose whether you want to pay in USD or another local. The World's Premier Crypto Trading Platform. Buy Bitcoin, Ethereum, and + cryptocurrencies. Trade with 20+ fiat currencies and Apple/Google Pay. Binance offers many options where you can easily buy several cryptocurrencies including Bitcoin, with the lowest fees and highest security. Bitcoin futures track the price movements of Bitcoin5, and these Bitcoin ETFs hold Bitcoin futures contracts to mimic Bitcoin's return. Note that the ETF doesn'. Buy crypto fast, easily and securely with BitPay. Pay with a credit card, debit card, Apple Pay or Google Pay. Enter your wallet address and use your crypto. 1. Get Revolut. If you don't have it already, download the Revolut app for free and sign up to start buying Bitcoin and other crypto tokens. · 2. Top up your. In this article, we'll give you step-by-step instructions on how to buy crypto. We'll walk you through everything you need to know about making your first. KuCoin lets you buy cryptocurrency using your debit or credit card. Select the desired cryptocurrency, enter the amount, and then input your Visa or Mastercard. The World's Premier Crypto Trading Platform. Buy Bitcoin, Ethereum, and + cryptocurrencies. Trade with 20+ fiat currencies and Apple/Google Pay. Buying bitcoin from the marketofchoice.ru website · Visit our Buy Bitcoin page. · Select Bitcoin (BTC). · Choose whether you want to pay in USD or another local. The World's Premier Crypto Trading Platform. Buy Bitcoin, Ethereum, and + cryptocurrencies. Trade with 20+ fiat currencies and Apple/Google Pay.

Retail investors looking to enter the market can now choose between buying crypto outright or buying a crypto-related asset. How to buy crypto with MetaMask. Onboard to crypto with MetaMask. Just click on the “Buy” button on the MetaMask browser extension or mobile app to get started. Unique to the crypto exchange space, we promote, encourage and mandate you, as our valued customer, to send your purchased Bitcoin and Ether to an external. How to buy crypto with MetaMask. Onboard to crypto with MetaMask. Just click on the “Buy” button on the MetaMask browser extension or mobile app to get started. How do I buy cryptocurrencies? You can purchase crypto in the PayPal app or through other major platforms including web3 wallets. How do I pay with crypto? Cryptocurrencies and digital assets can be bought in a few different ways, such as Centralized Crypto Exchanges, Decentralized Exchanges and Crypto Brokers. marketofchoice.ru is not just a crypto exchange but an ecosystem of various crypto services. The simple navigation on the website allows everyone to find what they need. In United States, you can buy Bitcoin on Coinbase's centralized exchange. Coinbase is the most trusted place for people and businesses to buy, sell, and manage. How can I trade Bitcoin? · Download Revolut for iOS or Android, then sign up. · Go to Crypto on your home screen and tap Get started. · Read and accept our risk. You can buy crypto on Kraken's crypto trading platform. Create your free account and connect a funding method to buy over cryptocurrencies. Kraken makes it. Desktop · In Exodus Desktop, click the Buy & Sell icon. · On the Buy Crypto tab: a) Select the fiat currency you want to pay with. b) Select the crypto you want. Coinbase is our pick for best crypto exchange for beginners because it offers a large number of supported cryptocurrencies, strong security, and advanced. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. PayPal now supports cryptocurrency for Personal account holders, with options to buy, sell, hold and transfer digital currencies securely starting from $1. marketofchoice.ru is not just a crypto exchange but an ecosystem of various crypto services. The simple navigation on the website allows everyone to find what they need. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. Instead, you can use Bitcoin to buy these other cryptocurrencies. Ethereum has become a popular cryptocurrency to exchange for DeFi tokens, an emerging trend in. You can purchase cryptocurrencies through centralized and decentralized cryptocurrency exchanges or brokers, or if you don't want direct exposure to. It's easy to buy crypto, just pick a crypto exchange, verify and fund your account and pick a crypto to buy. The vast majority of crypto exchanges now allow you. Here are the different payment methods you can choose to buy BTC on Uphold. How to buy BTC with a credit or debit card The quickest way for new users to get.

What Does It Mean To Be An S Corporation

An S corporation (or S Corp), for United States federal income tax, is a closely held corporation that makes a valid election to be taxed under Subchapter S. As a result, most S corporations, even if they only have one shareholder/employee, need a reliable means of running payroll. How do S corporations run payroll? An S corporation is a type of corporate business entity that allows for pass-through taxation. Instead of paying corporate taxes. An S Corporation (S Corp) is a filing election with the IRS. They run similarly to an LLC (a pass-through entity) but with the added benefits of a corporation. WHAT IS AN S CORPORATION? S corporations (also referred to as “S Corps”) are corporations or limited liability companies (“LLCs”) whose founders have filed. An S Corporation is a corporation that reports corporate income, losses, and deductions through its shareholders. Typically, the shareholder and/or owner. S corps have directors and officers. The board of directors oversees corporate affairs and handles major decisions but not daily operations. Instead, directors. It is like any other corporation, except for this difference: It is like any other partnership for federal income tax purposes. The S corporation files an ". An S corp is any business that chooses to pass corporate income, losses, deductions, and credits through shareholders for federal tax purposes. An S corporation (or S Corp), for United States federal income tax, is a closely held corporation that makes a valid election to be taxed under Subchapter S. As a result, most S corporations, even if they only have one shareholder/employee, need a reliable means of running payroll. How do S corporations run payroll? An S corporation is a type of corporate business entity that allows for pass-through taxation. Instead of paying corporate taxes. An S Corporation (S Corp) is a filing election with the IRS. They run similarly to an LLC (a pass-through entity) but with the added benefits of a corporation. WHAT IS AN S CORPORATION? S corporations (also referred to as “S Corps”) are corporations or limited liability companies (“LLCs”) whose founders have filed. An S Corporation is a corporation that reports corporate income, losses, and deductions through its shareholders. Typically, the shareholder and/or owner. S corps have directors and officers. The board of directors oversees corporate affairs and handles major decisions but not daily operations. Instead, directors. It is like any other corporation, except for this difference: It is like any other partnership for federal income tax purposes. The S corporation files an ". An S corp is any business that chooses to pass corporate income, losses, deductions, and credits through shareholders for federal tax purposes.

An S corporation (S corp) isn't a business entity type. It's a tax classification, one with the potential to save a lot of money for both LLCs and corporations. An S corporation is a distinct type of corporation. It is specifically designed to eliminate the problem of double taxation present in standard corporations. An S-corp is a tax designation granted by the IRS that can be advantageous for some businesses. If you elect to be an S-corp, your company will be taxed . A corporation (or LLC that has elected to be taxed as a corporation) may elect to be taxed as a pass-through entity for US federal and certain state income tax. S corporations are corporations that are taxed on a "flow -through" basis. This means that tax liabilities from income (or deductions from losses) are passed. S corporations allow the sale of shares of stock, which is essential for attracting potential investors and entrepreneurs for funding your business. Avoid ". With S-Corp treatment, the corporation has the option of paying its shareholder(s) a salary. (An LLC that has not elected S-Chapter treatment cannot pay a. The impact of the election is that the S corporation's items of income, loss, deductions and credits flow to the shareholder and are taxed on the shareholder's. An S Corporation (S Corp) is a closely held corporation (Limited Liability Company (LLC), partnership, or C Corporation) that is treated as a pass-through. On the other hand, S Corporations (“S Corps”)—corporations taxed under Subchapter S of the Internal Revenue Code—and limited liability companies (“LLCs”) are. An S corporation protects the personal assets of its shareholders. Absent an express personal guarantee, a shareholder is not personally responsible for the. For purposes of this title, the term "S corporation" means, with respect to any taxable year, a small business corporation for which an election under section. But, unlike a c corp, s corps only have to file taxes yearly and they are not subject to double taxation. Read on if this sounds enticing for your business. S. The definition of an S corporation is either a general corporation or a close corporation that has elected to be taxed pursuant to Subchapter S of the IRS code. WHAT IS AN S CORPORATION? S Corporations, more commonly referred to as S Corps, are a tax designation under subchapter S of the Internal Revenue Code. Whereas. S Corporations begin as limited liability companies (LLCs) or C Corporations, then are filed for S Corp status with the IRS. That S Corp election tells the. An S corporation is a type of business structure that provides some of the benefits of being a corporation while potentially lowering the tax burden for its. An S corporation is a corporation that's treated as a 'pass-through entity' for federal tax purposes. The “S” in 'S-Corp' refers to Subchapter S in Chapter 1 of. An S corporation is a business entity which elects to pass business income and losses through to its shareholders. The S corp tax designation allows corporations to avoid double taxation. S corps are pass-through tax entities. This means that the corporation itself is not.

Revolving Loan Definition

Revolving credit facilities are a type of working capital finance. As with overdrafts, you can access pre-approved funds as required, and interest is usually. A Banking arrangement which allows for the loan amount to be withdrawn, repaid, and redrawn again in any manner and any number of times, until the arrangement. A revolving loan fund (RLF) is a gap financing measure primarily used for development and expansion of small businesses. It is a self-replenishing pool of money. Revolving credit is a type of loan that's automatically renewed as debt is paid. It helps to give cardmembers access to money up to a preset amount, also known. (a)Each Revolving Loan shall be made as part of a Borrowing consisting of Revolving Loans made by the Lenders ratably in accordance with their respective. Revolving Phase means that stage of the RLF's business lending activities that commences immediately after all Grant funds have been disbursed to the RLF. Also known as a revolving credit facility, revolving credit loan and revolver. A committed loan facility allowing a borrower to borrow (up to a limit). Where a borrowing party takes up a credit to a particular limit, and then pays back the borrowed money overtime, he has obtained a revolving credit. Paying up. It is an arrangement which allows for the loan amount to be withdrawn, repaid, and redrawn again in any manner and any number of times, until the arrangement. Revolving credit facilities are a type of working capital finance. As with overdrafts, you can access pre-approved funds as required, and interest is usually. A Banking arrangement which allows for the loan amount to be withdrawn, repaid, and redrawn again in any manner and any number of times, until the arrangement. A revolving loan fund (RLF) is a gap financing measure primarily used for development and expansion of small businesses. It is a self-replenishing pool of money. Revolving credit is a type of loan that's automatically renewed as debt is paid. It helps to give cardmembers access to money up to a preset amount, also known. (a)Each Revolving Loan shall be made as part of a Borrowing consisting of Revolving Loans made by the Lenders ratably in accordance with their respective. Revolving Phase means that stage of the RLF's business lending activities that commences immediately after all Grant funds have been disbursed to the RLF. Also known as a revolving credit facility, revolving credit loan and revolver. A committed loan facility allowing a borrower to borrow (up to a limit). Where a borrowing party takes up a credit to a particular limit, and then pays back the borrowed money overtime, he has obtained a revolving credit. Paying up. It is an arrangement which allows for the loan amount to be withdrawn, repaid, and redrawn again in any manner and any number of times, until the arrangement.

A revolving loan is a type of loan that can be renewed at maturity. This means that the borrower can continue to borrow money as long as they pay back what. Define Revolving Loan Facility. means the credit facility or portion thereof established by Lender in favor of Borrower for the purpose of providing working. The objective of the revolving loan fund is to fill the financing gap between project costs and private debt financing and private equity by making direct low-. Revolving-loan definition: A type of loan that is secured against a property and allows the owner to borrow and repay money at his or her leisure. Revolving credit facilities are a type of committed credit facility which allow the borrower to borrow on an ongoing basis while repaying the balance in. A revolving credit agreement, or revolving line of credit agreement, is a financing agreement made between a lending institution and a borrower. (b) A revolving loan account is a revolving credit account under which a customer may obtain a loan from a creditor. (c) A revolving triparty account is a. Like overdrafts and credit cards, revolving credit is a flexible funding option that enables businesses to withdraw credit when required to pay for business. ABR Revolving Loan means any Revolving Loan bearing interest at a rate determined by reference to the Alternate Base Rate in accordance with the provisions of. Here's the difference, a revolving line of credit allows the credit line to remain open regardless of when you spend or pay off your debt, while a non-revolving. A revolving credit facility is a line of credit that is arranged between a bank and a business. It comes with an established maximum amount, and the business. The buyerspayments were pooled in a local revolving loan fund from which their neighbors could borrow to buy their own solar power gear. From. Wikipedia. This. Revolving loan funds (RLFs) are pools of capital from which loans can be made for clean energy projects—as loans are repaid, the capital is then reloaned. A Revolving Credit Facility (RCF) is a form of pre-approved funding provided by a bank or another lender. Unlike a term loan which has a fixed repayment. Revolving credit is a credit facility made available to a customer to borrow and use funds as and when required. In this type of loan facility, the credit limit. Credit cards and lines of credit are both examples of revolving credit. Instalment loans are non-revolving, because you must pay off the loan over a specific. While you're ultimately required to pay back the money owed, revolving debt isn't repaid based on a fixed monthly schedule. The most well-known type of. Creating marketing materials that are easily accessible to the community and clearly define the requirements of the RLF program will help make certain that. A Revolving Loan Fund (RLF) is a source of money from which loans are made for multiple small business development projects. Revolving loan funds share many. A revolving line of credit is a type of loan that allows you to borrow money when you need it and pay interest only on what you borrow.

Green Energy Stocks To Invest In

Here are the top 8 renewable energy stocks - ranked by the number of holdings in US-traded ETFs in August Investing primarily in companies engaged in business activities related to alternative and renewable energy, energy efficiency, pollution control, water. Find the best renewable energy stocks for investing in the sustainable future of energy. Research and compare the performance. GE. GE Aerospace. $ $ (%). After. % ; BEP. Brookfield Renewable Partners. $ $0. (0%). After. % ; NPIFF. Northland Power. $ Norfund invests in conventional renewable energy sources, such as solar, wind, hydropower, biomass and geothermal. We chose the 10 best green energy stocks from four-high potential green energy sectors: solar, wind, hydro, EVs, and hydrogen. Quick Look at the Best Renewable Energy Stocks: · Brookfield Renewable · Sunrun, Inc. · Clearway Energy Inc · Enphase Energy Inc · Atlantica Online · SolarEdge. Clean energy stocks and exchange traded funds have rebounded this spring, raising hopes that the sector's two-year slump is coming to an end. Renewable energy stocks are a lucrative investment with the immense potential to generate rewarding returns both financially and personally. Here are the top 8 renewable energy stocks - ranked by the number of holdings in US-traded ETFs in August Investing primarily in companies engaged in business activities related to alternative and renewable energy, energy efficiency, pollution control, water. Find the best renewable energy stocks for investing in the sustainable future of energy. Research and compare the performance. GE. GE Aerospace. $ $ (%). After. % ; BEP. Brookfield Renewable Partners. $ $0. (0%). After. % ; NPIFF. Northland Power. $ Norfund invests in conventional renewable energy sources, such as solar, wind, hydropower, biomass and geothermal. We chose the 10 best green energy stocks from four-high potential green energy sectors: solar, wind, hydro, EVs, and hydrogen. Quick Look at the Best Renewable Energy Stocks: · Brookfield Renewable · Sunrun, Inc. · Clearway Energy Inc · Enphase Energy Inc · Atlantica Online · SolarEdge. Clean energy stocks and exchange traded funds have rebounded this spring, raising hopes that the sector's two-year slump is coming to an end. Renewable energy stocks are a lucrative investment with the immense potential to generate rewarding returns both financially and personally.

1- KP Energy Limited · 2- KPI Green Energy Ltd · 3- Advait Infratech Ltd · 4- Waaree Renewables Technologies Ltd · 5- Insolation Energy Ltd. Top 5 renewable energy stocks: RENIXX-World stocks · Tesla · Verbund · Ørsted A/S · Nextracker Inc · Iberdrola. Bloomberg NEF has been tracking clean energy investment globally for more markets investment in climate-tech companies, and for the first time this. Although this may not fit everyone's definition of green energy, clean energy funds offer a convenient way to invest in a broad portfolio of energy companies. If you want to play it safe and invest in a been-around-the-block stock, Nasdaq says GE and Siemens Energy could be two good options. Both are leaders in gas. Enbridge Inc (ENB). Enbridge is actually one of the largest renewable energy partners in Canada. They started investing in renewable energy production in This blog will help by highlighting top options for investors looking to benefit from the shift to clean energy technology stocks. List of Green or Renewable Energy Stocks to Invest ; img Suzlon Energy Ltd Partly Paidup. ₹ SMALL CAP ; img Orient Green Power Company Ltd. ₹ SMALL. Green Energy Stocks Update Within the Green Energy sector, the top gainers were IOC (up %) and RELIANCE IND. (up %). On the other hand, INSOLATION. As a specialist in solar panels and battery storage solutions, Sunrun is incredibly relevant to the broader storyline of green energy stocks. However, the. ENPH,SEDG,FSLR - best renewable energy stocks with strong balance sheets, consistent cash flow, and high returns on invested capital. How do I invest in clean energy stocks? The consumption of fossil fuels contributes to climate change. Emissions from the use of fossil fuels such as oil. Alternative Energy Stocks ; VST VISTRA · ; NTOIF NESTE OYJ · ; ORA ORMAT TECHNOLOGIES · ; MEOH METHANEX · ; GPRE GREEN PLAINS · For example, NextEra Energy is the largest renewable energy generator in the United States, while First Solar is a leading manufacturer of solar panels. In this comprehensive guide, we'll explore the world of renewable energy stocks, the best investment opportunities, and key factors to consider when building. ENPH,SEDG,FSLR - best renewable energy stocks with strong balance sheets, consistent cash flow, and high returns on invested capital. How We Chose These Stocks · NextEra Energy (NYSE: NEE) · ITM Power (LON: ITM) · First Solar (NASDAQ: FSLR) · Brookfield Renewable Partners (NYSE: BEP) · Uranium. U.S. policymakers enacted several key initiatives regarding renewable energy, sustainability and decarbonization. Learn more about them from our experts. Read. Invest in the future you believe in. We discuss stocks Any thoughts on other potential Chapter 11 green energy stocks? I think Fuel. r/greeninvestor: Invest in the future you believe in. We discuss stocks in renewable energy, electric vehicles, plant-based meat, and any other.

How To Get Money For Donating Plasma

When you donate, you'll receive compensation on a BioLife Debit Card that works wherever Debit Mastercard is accepted. Buddy Bonus. You can also receive extra. When you make a plasma donation, you donate approximately two to three times the amount of plasma than can be obtained from a whole blood donation. A patient. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive up to. Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. Funds can be withdrawn. Earn up to $60 for each donation. All payments are digital transactions – no need to keep track of a physical card. When you donate, you'll receive compensation on a BioLife Debit Card that works wherever Debit Mastercard is accepted. Buddy Bonus. You can also receive extra. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive up to. Each plasma collection facility sets its own compensation rates. Find a Donor Center. Plasma donors save lives everyday! When you donate, you'll receive compensation on a BioLife Debit Card that works wherever Debit Mastercard is accepted. Buddy Bonus. You can also receive extra. When you make a plasma donation, you donate approximately two to three times the amount of plasma than can be obtained from a whole blood donation. A patient. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive up to. Donors are paid via a “cash card.” After each donation, you will receive funds to an electronic account associated with the card. Funds can be withdrawn. Earn up to $60 for each donation. All payments are digital transactions – no need to keep track of a physical card. When you donate, you'll receive compensation on a BioLife Debit Card that works wherever Debit Mastercard is accepted. Buddy Bonus. You can also receive extra. After each donation, your compensation will be sent to you. A qualified donor can donate plasma twice in every 7 days period at the most. You will receive up to. Each plasma collection facility sets its own compensation rates. Find a Donor Center. Plasma donors save lives everyday!

Yes. Plasma donors are compensated for the commitment and efforts involved in being an important, regular plasma donor. Donors receive compensationon a pre-paid. Some confusion exists about plasma donations being used for profit. We do not sell your plasma or pay people to donate, and the donation process is not. How do you get paid? · You'll receive a prepaid debit card after your first successful plasma donation. · Simply walk in, donate plasma, and your card will be. Depending on the frequency of donations, individuals can expect to earn more than $ a month when donating plasma at the Miami Plasma Donor Center. This. I went to Octapharma and getting started was super easy. Just go in with your SSN, proof of address, and ID and they'll set you up with all of. Why donate blood plasma? Plasma increases blood volume in emergencies and can be used to make products that fight disease and infection. Learn more. When it comes to reporting income from plasma donation on your tax return, this income should be reported on Schedule 1 (Form ), specifically on line 8. Top 10 Best Paid Blood Plasma Donation Centers Near New York, New York. Plasma donors can earn between $$50 as their donation payment. On top of this, you can boost your earnings on each donation through monthly donation. Make a difference by donating plasma at ABO Plasma Glassboro, NJ. Schedule your appointment today to become a plasma donor. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the. Bloodworks Northwest is a volunteer donor supported organization and does not pay for blood or plasma donations. For information on plasma donation eligibility, please call To make an appointment in one of our PLASMAVIE (with the exception of Trois-Rivières). plasma donation, but the red cells and plasma are returned to the donor. These blood donations have the same risks as regular blood donations. Products. You can continue to donate blood, platelets or plasma if you are in the Specialized Donor Program. have taken money, drugs or other payment for sex in the. Donate Source Plasma and Earn Over $ in Two Months Your Source Plasma donation pay potential increases the more you donate. Eligible Source Plasma donors. General blood donor eligibility guidelines apply to plasma donors. A Vitalant professional is happy to answer any questions you may have about plasma donation. The NYBC Donor Advantage Program rewards frequent blood, platelet and plasma donors. Earn points with each donation and redeem them for gifts or gift cards. FDA regulations prevent individuals from donating more than twice per week. Plasma donors cannot earn enough money from selling plasma in one week to, for. 5.

Depreciation

Free depreciation calculator using the straight line, declining balance, or sum of the year's digits methods with the option of partial year depreciation. You can use depreciation to help balance your books and plan how much of your revenues you should set aside for replacing machinery, technology, and other. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. On your business taxes, depreciation (also called capitalization, cost recovery, or amortization) lets you deduct the "used up" portion of an asset's cost. OMB's estimates of depreciation are intended to measure the reduction in value of the federally financed capital stock due to aging, wear and tear, accidental. Depreciation is the method for allocating the cost of fixed assets to periods benefitting from asset use. Depreciation is a measurement of the “useful life” of a business asset to determine the period over which the cost can be deducted from taxable income. There's no pre-determined rate at which a vehicle will depreciate. Within the first year, many cars will lose up to 20% of their value. After that, they may. Depreciation is an accounting method that determines a fixed asset's value is reduced over its useful life. Free depreciation calculator using the straight line, declining balance, or sum of the year's digits methods with the option of partial year depreciation. You can use depreciation to help balance your books and plan how much of your revenues you should set aside for replacing machinery, technology, and other. The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. On your business taxes, depreciation (also called capitalization, cost recovery, or amortization) lets you deduct the "used up" portion of an asset's cost. OMB's estimates of depreciation are intended to measure the reduction in value of the federally financed capital stock due to aging, wear and tear, accidental. Depreciation is the method for allocating the cost of fixed assets to periods benefitting from asset use. Depreciation is a measurement of the “useful life” of a business asset to determine the period over which the cost can be deducted from taxable income. There's no pre-determined rate at which a vehicle will depreciate. Within the first year, many cars will lose up to 20% of their value. After that, they may. Depreciation is an accounting method that determines a fixed asset's value is reduced over its useful life.

Under each method, be careful to not depreciate below the salvage value originally specified. Straight Line Method. To calculate depreciation under the straight. As a forest owner, you may depreciate most property used on your woodland if you hold your woodland as either a business or as an investment. Depreciation refers to the decrease in value of an asset as it ages. Depreciation can be an accounting method of allocating the cost of a tangible asset. The purpose of depreciation is to give a rough estimate of an asset's current value and to spread its cost over the useful lifespan of the asset. Depreciation is the recovery of the cost of the property over a number of years. You deduct a part of the cost every year until you fully recover its cost. Depreciation should be reasonable, not excessive. Depreciation is subjective. The IRS publishes depreciation guides; United Policyholders publishes a. What does depreciation mean? Depreciation is what happens when assets lose value over time until the value of the asset becomes zero, or negligible. Calculating Rental Property Depreciation · You'll depreciate % for the first year, or $1, ($99, x %). · Every year after that, you'll. DEPRECIATION definition: 1. the process of losing value 2. the process of losing value 3. the amount by which something. Learn more. The meaning of DEPRECIATION is any decrease in the value of property (as machinery) for the purpose of taxation that cannot be offset by current repairs and. Depreciation refers to the reduced value of something over time due to wear and tear. Many items, from appliances to major construction machinery. Depreciation is the amount charged against an organization's earnings to recognize the cost of an asset over its estimated useful life. Depreciation is an accounting method used to calculate the decrease in value of a fixed asset while it's used in a company's revenue-generating operations. The first step in determining your depreciation deduction is to determine the depreciable basis of the asset. Different rules apply depending upon how you. Commercial property can be depreciated over a year straight line, while residential property can be depreciated over a year straight line. If the roof is 10 years old at the time of your loss and it requires replacement, we would subtract 40% depreciation (10 years x 4% a year) from your. Depreciation is often misunderstood as a term for something simply losing value, or as a calculation performed for tax purposes. Depreciation definition: decrease in value due to wear and tear, decay, decline in price, etc.. See examples of DEPRECIATION used in a sentence. Under each method, be careful to not depreciate below the salvage value originally specified. Straight Line Method. To calculate depreciation under the straight. The same amount of depreciation is taken each year of the asset's useful life. In order to identify the annual depreciation expense for an asset using straight-.

Day Trading Chart Patterns Pdf

Chart patterns app is packed with features that can help you to identify Profitable Chart patterns, candlestick pattern chart, and chart patterns analysis. Day Trading Chart Patterns: Price Action Patterns + Candlestick patterns Deepak S. PDF? This is definitely going to save you time and cash in. The most popular chart patterns that are respected by day traders around the world. These are the patterns we look for. But remember, this patterns only. Candlestick patterns are one of the most powerful trading concepts, they are Later in the day sellers overwhelmed the market pushing the price back down. Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. When you analyze trading charts. • On a daily futures chart, the body of the Flag seldom lasts more than five trading sessions before a resumption of the trend occurs. • Risk is small. If you're not a big reader and you just want a trading book to get straight to the point, this is for you. Save this book on your desktop or even print this. This book Contain Day Trading Chart Patterns & Candlestick Patterns with detail explanation and live examples on real candlestick charts. Also Included. I have covered about 65 of the most unique, frequent and important patterns that are presented in day-to-day trading. I have provided credits for the original. Chart patterns app is packed with features that can help you to identify Profitable Chart patterns, candlestick pattern chart, and chart patterns analysis. Day Trading Chart Patterns: Price Action Patterns + Candlestick patterns Deepak S. PDF? This is definitely going to save you time and cash in. The most popular chart patterns that are respected by day traders around the world. These are the patterns we look for. But remember, this patterns only. Candlestick patterns are one of the most powerful trading concepts, they are Later in the day sellers overwhelmed the market pushing the price back down. Explore the top 11 trading chart patterns every trader needs to know and learn how to use them to enter and exit trades. When you analyze trading charts. • On a daily futures chart, the body of the Flag seldom lasts more than five trading sessions before a resumption of the trend occurs. • Risk is small. If you're not a big reader and you just want a trading book to get straight to the point, this is for you. Save this book on your desktop or even print this. This book Contain Day Trading Chart Patterns & Candlestick Patterns with detail explanation and live examples on real candlestick charts. Also Included. I have covered about 65 of the most unique, frequent and important patterns that are presented in day-to-day trading. I have provided credits for the original.

I read that a chartist becomes world class after viewing a million chart patterns. If you analyze one pattern per chart on stocks each trading day, it'll. This book Contain Day Trading Chart Patterns & Candlestick Patterns with detail explanation and live examples on real candlestick charts. patterns in the market. With this is mind, some of them may not be Downloaded to my day trading Drive folder for reference. Thanks. These chart patterns are formed within these technical charts and Volume reflects a running total throughout the trading day, and open interest is. Market analysis is broadly categorized into two main methods, the first one is fundamental analysis and the second one is technical analysis. Forex traders constantly use candlestick chart patterns for day trading to foretell potential price moves on the chart. Forex candlesticks help them guess. Trading Chart Pattern Book PDF - Free download as PDF File .pdf) or read DAY TRADER DOSEN'T MEANS YOU HAVE TO TRADE EVERY DAY, IF THERE IS NO. + Power of Trading Chart Patterns: A Quick Guide to Technical Analysis Charts in PDF & PNG for Stock Market, Forex, and Crypto Traders. marketofchoice.ru: Day Trading Chart Patterns: Price Action Patterns + Candlestick Patterns eBook: Mote, Deepak: Kindle Store. Get This Printable High-Resolution PDF Cheatsheet With 24 Chart Patterns In Technical Analysis. Used by Forex, Stock, Gold, and Pop Firm Traders. The best chart patterns for day trading include the triangle, flag, pennant, wedge, and bullish hammer chart patterns. This document provides a cheat sheet of common chart patterns in technical analysis. It lists reversal patterns like double tops and head and shoulders that. Chart Patterns Cheat Sheet | PDF. Chart Patterns Cheat Sheet - Free Chart Patterns. Chart Patterns. Day trading chart patterns. Enhanced. Poster Day Charts in PDF & PNG for Stock Market, Forex, and Crypto Traders. If it's a red day, watch your Nvidia but don't mess with trading. I have one I bought shares and it got me and it's a dead duck stuck on $2. Profitable Chart Patterns Trading Guide - Free download as PDF File .pdf), Text File day trading to longer term trading. It is best to focus on mastering one. Traders tend to behave mostly in a similar pattern in identical situations. Since charts are a result of the actions of traders, the trading charts reflect. Ed Downs has spent the last 32 years developing successful trading techniques using chart pattern analysis. This book provides step by step instructions on how. DAY TRADES. Intraday trading patterns (for day trading).. INTRADAY CHART EXAMPLES. 1 to 3 daily. Trading with such information is just downright hard—especially when the market isn't going up. Since the day I first started trading some 20 years ago, I've.

Best 9 Month Cd Rates

% APY*. Get one of the highest rates available anywhere with as little as a $5 deposit. rate of return on the money. Personal CDs. Compare Our Rates. Term. APY1. Open 3-month CD. %. Open Account · Open 6-month CD. %. Open Account · Open Many banks and credit unions are offering high-yield CDs paying rates around % to % APY or more for 9-month terms. “. Interest Rate, APY. 3 Month CD, %, %. 6 Month CD, %, %. 9 Month CD, %, %. 12 Month CD, %, %. 18 Month CD, %, %. 24 Month. CD rates), to find the best offer available. Then, the investor contacts the financial institution (either online or in person), and opens the cd account. As of September 9, , the bank or credit union with the highest CD rate The Best 3-Month CD Rates. The following banks and credit unions have the. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Shoreham Bank. 9 Month, %, %, $1,, $1, 12 Month, %, %, $1,, $1, 24 CD terms less than 24 months. For those longer (month term or more). Best 9-month CD rates. The highest 9-month CD rate today is % from CIBC USA. Best 1-year CD rates. The highest 1-year CD rate today is % from. % APY*. Get one of the highest rates available anywhere with as little as a $5 deposit. rate of return on the money. Personal CDs. Compare Our Rates. Term. APY1. Open 3-month CD. %. Open Account · Open 6-month CD. %. Open Account · Open Many banks and credit unions are offering high-yield CDs paying rates around % to % APY or more for 9-month terms. “. Interest Rate, APY. 3 Month CD, %, %. 6 Month CD, %, %. 9 Month CD, %, %. 12 Month CD, %, %. 18 Month CD, %, %. 24 Month. CD rates), to find the best offer available. Then, the investor contacts the financial institution (either online or in person), and opens the cd account. As of September 9, , the bank or credit union with the highest CD rate The Best 3-Month CD Rates. The following banks and credit unions have the. The highest certificates of deposit (CDs) rates today are offered by Merchants Bank of Indiana (%), First Federal of Lakewood (%), Shoreham Bank. 9 Month, %, %, $1,, $1, 12 Month, %, %, $1,, $1, 24 CD terms less than 24 months. For those longer (month term or more). Best 9-month CD rates. The highest 9-month CD rate today is % from CIBC USA. Best 1-year CD rates. The highest 1-year CD rate today is % from.

9 month CD: up to % APY*; 13 month CD: up to % APY*; 36 month CD: up to % APY*. Open an account online. The interest rate for the 9-Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the initial term and does not. Some of the best CD rates in NY ; Day CD. ; 9-Month CD. ; Month CD. ; Month CD. View All CD Rates. We also offer CDs with other terms, as well as IRA CDs, so you can choose what works best for your financial needs. 9 Month CD and Elevate your savings with EagleBank's 9-month CD rates. Enjoy competitive interest, FDIC insurance, and flexible terms. Secure your financial future today. Today's CD Special Rates ; 4 month · % · % · % · % ; 7 month · % · % · % · % ; 11 month · % · % · % · %. First National Bank of America offers an APY of % for its year certificate. That makes it the best CD for this term length. Current 6-month CD rates. Quontic Bank — % APY; America First Credit Union — % APY; Bank5 Connect — % APY ; Current 1-year CD rates. CIBC Bank USA —. The 9-month Promo CD will renew as a Regular month CD after the first No Monthly Maintenance Fees. With our CDs, there are no surprises. Zero. Best CD rates of September (Up to %) · America First Credit Union — 3 months - 5 years, % – % APY, $ minimum deposit · Barclays Bank — 6. Bankrate's picks for the best 6-month CD rates · America First Credit Union · Quontic Bank · Bank5 Connect · Bask Bank · LendingClub Bank · Salem Five Direct · Ally. Deposit (CD). Save more, do more with a great CD rate. 9 Months. % APY*. No minimum balance. START SAVING NOW. Bump-Up CD 24 Months. %. APY*. No. Check out our special 9-Month Promo CD with a limited-time rate of % APY. LEARN MORE ABOUT THis GREAT RATE. And be sure to explore all the other options. % APY* 9-Month Certificate Special Offer Available! · Leave your funds in the certificate for the specified term and you'll be rewarded with your original. Would that CD rate beat treasuries after taxes? Some people is a good rate. Like others have said as long as you live in an. Marcus by Goldman Sachs · % ; Sallie Mae Bank 14 Month CD · % ; Live Oak Bank 1-Year Personal CD · % ; Western Alliance Bank High Yield CD · %. Month. $1, min deposit. %. APY*. Member FDIC. Bankwell 9 Mo Special. marketofchoice.ru $50, marketofchoice.ru: No Limit. Open Now. Lock in a great rate and peace of mind ; 9 month, % ; 1 year, % ; year, % ; 2 year, %. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make.

Catastrophic Illness Insurance

A catastrophic illness is any illness or condition, acute or chronic, for which expenses are incurred that are not covered by insurance, state, federal. Critical illness insurance pays a full benefit in case of new diagnoses of serious conditions like invasive cancer, heart attack, coronary bypass surgery. Catastrophic illness insurance covers expenses for major health conditions such as heart attack, stroke, or cancer, but does not cover routine care. Catastrophic insurance is primarily designed to protect you from high medical expenses in the event of a major illness or injury. It does not provide coverage. Canada · ROP - Return of premium. · ROPD - Return of premium on Death. · Term CI - Similar to term life insurance, this critical illness insurance increases in. What Is Critical Illness Insurance? Pay for out-of-pocket expenses, without breaking the bank, if you or a family member are diagnosed with a covered serious. If you're diagnosed with a critical illness or condition, our critical illness coverage will provide a lump-sum payment that you can use as you see fit. What is covered by Critical Illness insurance? It's simple. You choose 1 of 5 Maximum Lifetime Benefit amounts: $10,, $20,, $30,, $40, or $50, Critical illness insurance is the plan that protects you in the event of a future major illness diagnosis. This type of plan supplements existing health. A catastrophic illness is any illness or condition, acute or chronic, for which expenses are incurred that are not covered by insurance, state, federal. Critical illness insurance pays a full benefit in case of new diagnoses of serious conditions like invasive cancer, heart attack, coronary bypass surgery. Catastrophic illness insurance covers expenses for major health conditions such as heart attack, stroke, or cancer, but does not cover routine care. Catastrophic insurance is primarily designed to protect you from high medical expenses in the event of a major illness or injury. It does not provide coverage. Canada · ROP - Return of premium. · ROPD - Return of premium on Death. · Term CI - Similar to term life insurance, this critical illness insurance increases in. What Is Critical Illness Insurance? Pay for out-of-pocket expenses, without breaking the bank, if you or a family member are diagnosed with a covered serious. If you're diagnosed with a critical illness or condition, our critical illness coverage will provide a lump-sum payment that you can use as you see fit. What is covered by Critical Illness insurance? It's simple. You choose 1 of 5 Maximum Lifetime Benefit amounts: $10,, $20,, $30,, $40, or $50, Critical illness insurance is the plan that protects you in the event of a future major illness diagnosis. This type of plan supplements existing health.

Unum Critical Illness Insurance can help protect your finances during life-changing events, so you can focus on healing. Lessen your financial burden with Bankers Life's critical illness insurance, which provides a lump-sum payment directly to you, if diagnosed for a covered. Critical Illness Insurance is a health cover protecting you from medical expenses involved in treating severe illnesses like cancer, stroke, paralysis, and. Critical Illness Insurance can provide you with a benefit that can help you pay for unexpected costs, such as those that your existing medical insurance may not. If you have a critical illness, out-of-pocket expenses can add up. A critical illness insurance plan can help cover costs as you recover. Get a quote today! Catastrophic coverage protects you from the costs of worst-case scenarios, providing coverage for hospitalization or serious illnesses. Woman Shops For A. Critical illness insurance. Pays a lump-sum benefit if you are diagnosed with certain critical illnesses, such as cancer, heart attack, stroke and more. Critical illness insurance typically provides a lump sum payment when you have a verified diagnosis of a covered illness. Group critical illness insurance helps your employees financially prepare for the unexpected. Learn more about Securian's customized group insurance. Critical illness insurance is a type of supplemental insurance that pays cash benefits to a policyholder if they're diagnosed with a medical condition. Catastrophic illness insurance is a type of accelerated death benefit rider offered on most life insurance policies, including term life, whole life, and. Critical Illness Insurance provides benefits when a covered person is diagnosed with an eligible condition like heart attack, stroke, major organ transplant. Accident and critical illness coverage protects you and your family from costs resulting from emergencies and unexpected illnesses. These plans act as an. Group critical illness insurance helps your employees financially prepare for the unexpected. Learn more about Securian's customized group insurance. Critical Illness insurance pays employees directly. While health insurance covers most medical costs, there are many expenses it doesn't cover. Colonial Life critical illness insurance coverage can offset costs if an unexpected illness strikes. Learn more about how critical illness insurance works. Benefits. What are the Critical Illness Benefit amounts? Benefit amounts range from $10, to $30, and are payable in $10, increments. Children are. Learn more about the basics of Critical Illness Insurance from Mutual of Omaha. Determine what options are right for you. Covers common, serious illnesses. If you're faced with invasive cancer, heart attack, stroke or advanced Alzheimer's Disease, you'll receive the full benefit. Critical illness insurance provides a benefit if you experience one or more of the following medical emergencies.